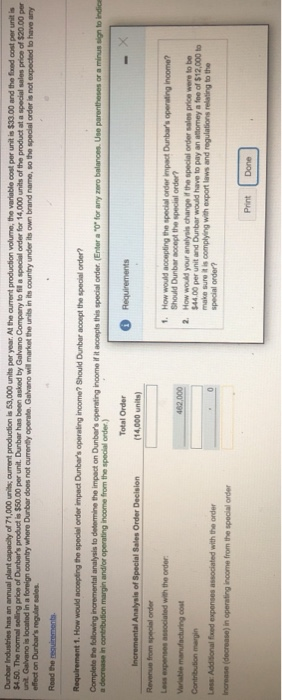

Dunbar Industries has an annual plant capacity of 71,000 units current production is 53,000 units per year. Al the current production volume, the variable cost per unit is $33.00 and the fixed cost per unit is $4.50. The normal selling price of Dunbar's product is $50.00 per unit. Dunbar has been asked by Galvano Company to fill a special order for 14,000 units of the product at a special sales price of $20.00 per unit. Galvano is located in a foreign country where Dunbar does not currently operate Galvano will market the units in its country under its own brand name, so the special order is not expected to have any effect on Dunbar's regular sales Read the resuirements Requirement 1. How would accepting the special order impact Dunbar's operating income? Should Dunbar accept the special order? Complete the following incremental analysis to determine the impact on Dunbar's operating income if it accepts this special order. Enter a "O" for any zero balances. Use parentheses or a minus sign to indice a decrease in contribution margin and/or operating income from the special order) Total Order (14.000 units) Requirements Incremental Analysis of Special Sales Order Decision Revenue from special order Los expenses associated with the order: Variable manufacturing cost Contribution main Lass Additional food expenses associated with the order Increase (decrease in operating income from the special order 1. How would accepting the special order impact Dunbar's operating income? Should Dunbar cept the special order? 2. How would your analysis charge of the special order sales price were to be $44.00 per unit and Dunbar would have to pay an attomey a fee of $12,000 to make sure it is complying with export laws and regulations relating to the special order? Print Done Dunbar Industries has an annual plant capacity of 71,000 units current production is 53,000 units per year. Al the current production volume, the variable cost per unit is $33.00 and the fixed cost per unit is $4.50. The normal selling price of Dunbar's product is $50.00 per unit. Dunbar has been asked by Galvano Company to fill a special order for 14,000 units of the product at a special sales price of $20.00 per unit. Galvano is located in a foreign country where Dunbar does not currently operate Galvano will market the units in its country under its own brand name, so the special order is not expected to have any effect on Dunbar's regular sales Read the resuirements Requirement 1. How would accepting the special order impact Dunbar's operating income? Should Dunbar accept the special order? Complete the following incremental analysis to determine the impact on Dunbar's operating income if it accepts this special order. Enter a "O" for any zero balances. Use parentheses or a minus sign to indice a decrease in contribution margin and/or operating income from the special order) Total Order (14.000 units) Requirements Incremental Analysis of Special Sales Order Decision Revenue from special order Los expenses associated with the order: Variable manufacturing cost Contribution main Lass Additional food expenses associated with the order Increase (decrease in operating income from the special order 1. How would accepting the special order impact Dunbar's operating income? Should Dunbar cept the special order? 2. How would your analysis charge of the special order sales price were to be $44.00 per unit and Dunbar would have to pay an attomey a fee of $12,000 to make sure it is complying with export laws and regulations relating to the special order? Print Done