Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Duncan's Diamond Bit Drilling Corporation (Duncan) purchased the following assets in 2023. Assume its taxable income was $60,000 for purposes of computing the $179

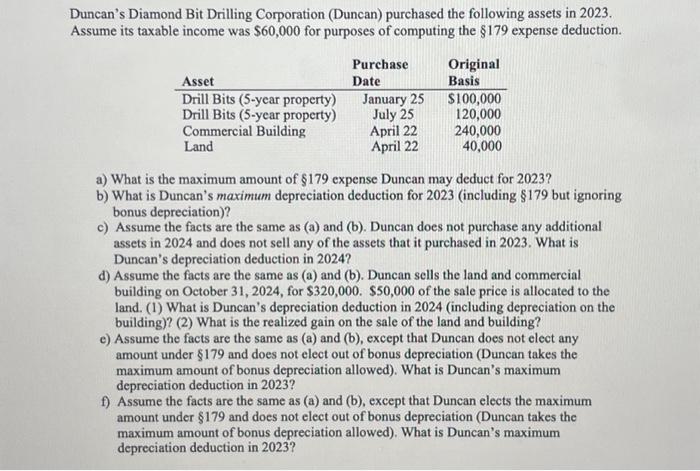

Duncan's Diamond Bit Drilling Corporation (Duncan) purchased the following assets in 2023. Assume its taxable income was $60,000 for purposes of computing the $179 expense deduction. Asset Drill Bits (5-year property) Purchase Date Original Basis January 25 $100,000 Drill Bits (5-year property) July 25 120,000 Commercial Building April 22 240,000 Land April 22 40,000 a) What is the maximum amount of $179 expense Duncan may deduct for 2023? b) What is Duncan's maximum depreciation deduction for 2023 (including $179 but ignoring bonus depreciation)? c) Assume the facts are the same as (a) and (b). Duncan does not purchase any additional assets in 2024 and does not sell any of the assets that it purchased in 2023. What is Duncan's depreciation deduction in 2024? d) Assume the facts are the same as (a) and (b). Duncan sells the land and commercial building on October 31, 2024, for $320,000. $50,000 of the sale price is allocated to the land. (1) What is Duncan's depreciation deduction in 2024 (including depreciation on the building)? (2) What is the realized gain on the sale of the land and building? e) Assume the facts are the same as (a) and (b), except that Duncan does not elect any amount under $179 and does not elect out of bonus depreciation (Duncan takes the maximum amount of bonus depreciation allowed). What is Duncan's maximum depreciation deduction in 2023? f) Assume the facts are the same as (a) and (b), except that Duncan elects the maximum amount under $179 and does not elect out of bonus depreciation (Duncan takes the maximum amount of bonus depreciation allowed). What is Duncan's maximum depreciation deduction in 2023?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a The maximum amount of 179 expense Duncan may deduct for 2023 is 179000 This deduction allow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started