Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dunne and Jones Ltd (DJ) are a robotics company situated in the middle of England. They have developed a new home help robot that can

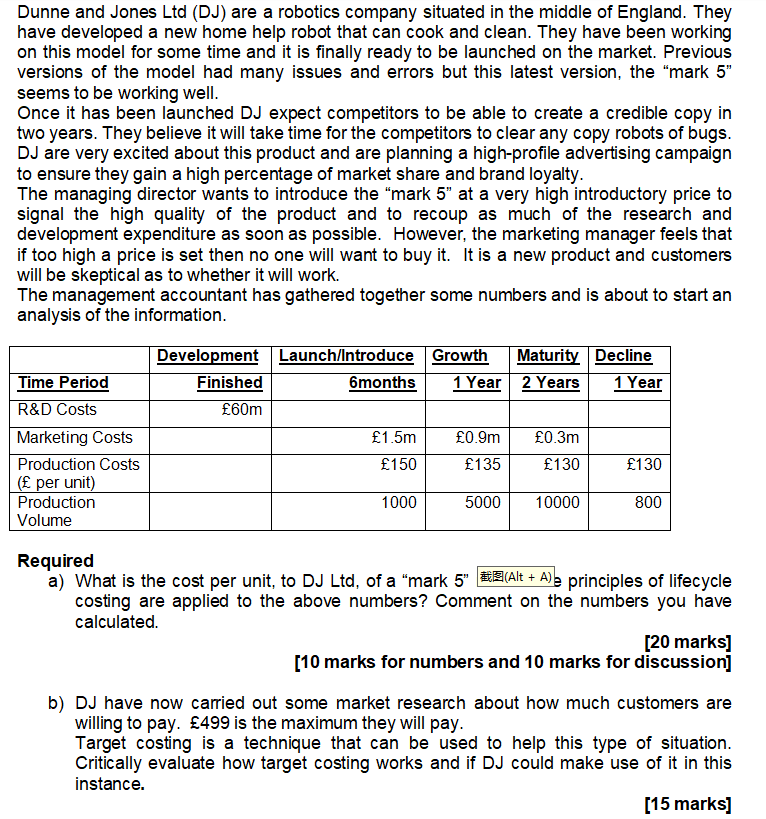

Dunne and Jones Ltd (DJ) are a robotics company situated in the middle of England. They have developed a new home help robot that can cook and clean. They have been working on this model for some time and it is finally ready to be launched on the market. Previous versions of the model had many issues and errors but this latest version, the "mark 5" seems to be working well. Once it has been launched DJ expect competitors to be able to create a credible copy in two years. They believe it will take time for the competitors to clear any copy robots of bugs. DJ are very excited about this product and are planning a high-profile advertising campaign to ensure they gain a high percentage of market share and brand loyalty. The managing director wants to introduce the "mark 5" at a very high introductory price to signal the high quality of the product and to recoup as much of the research and development expenditure as soon as possible. However, the marketing manager feels that if too high a price is set then no one will want to buy it. It is a new product and customers will be skeptical as to whether it will work. The management accountant has gathered together some numbers and is about to start an analysis of the information. Required a) What is the cost per unit, to DJ Ltd, of a "mark 5" (Alt + A)e principles of lifecycle costing are applied to the above numbers? Comment on the numbers you have calculated. [20 marks] [10 marks for numbers and 10 marks for discussion] b) DJ have now carried out some market research about how much customers are willing to pay. 499 is the maximum they will pay. Target costing is a technique that can be used to help this type of situation. Critically evaluate how target costing works and if DJ could make use of it in this instance. [15 marks] Dunne and Jones Ltd (DJ) are a robotics company situated in the middle of England. They have developed a new home help robot that can cook and clean. They have been working on this model for some time and it is finally ready to be launched on the market. Previous versions of the model had many issues and errors but this latest version, the "mark 5" seems to be working well. Once it has been launched DJ expect competitors to be able to create a credible copy in two years. They believe it will take time for the competitors to clear any copy robots of bugs. DJ are very excited about this product and are planning a high-profile advertising campaign to ensure they gain a high percentage of market share and brand loyalty. The managing director wants to introduce the "mark 5" at a very high introductory price to signal the high quality of the product and to recoup as much of the research and development expenditure as soon as possible. However, the marketing manager feels that if too high a price is set then no one will want to buy it. It is a new product and customers will be skeptical as to whether it will work. The management accountant has gathered together some numbers and is about to start an analysis of the information. Required a) What is the cost per unit, to DJ Ltd, of a "mark 5" (Alt + A)e principles of lifecycle costing are applied to the above numbers? Comment on the numbers you have calculated. [20 marks] [10 marks for numbers and 10 marks for discussion] b) DJ have now carried out some market research about how much customers are willing to pay. 499 is the maximum they will pay. Target costing is a technique that can be used to help this type of situation. Critically evaluate how target costing works and if DJ could make use of it in this instance. [15 marks]

Dunne and Jones Ltd (DJ) are a robotics company situated in the middle of England. They have developed a new home help robot that can cook and clean. They have been working on this model for some time and it is finally ready to be launched on the market. Previous versions of the model had many issues and errors but this latest version, the "mark 5" seems to be working well. Once it has been launched DJ expect competitors to be able to create a credible copy in two years. They believe it will take time for the competitors to clear any copy robots of bugs. DJ are very excited about this product and are planning a high-profile advertising campaign to ensure they gain a high percentage of market share and brand loyalty. The managing director wants to introduce the "mark 5" at a very high introductory price to signal the high quality of the product and to recoup as much of the research and development expenditure as soon as possible. However, the marketing manager feels that if too high a price is set then no one will want to buy it. It is a new product and customers will be skeptical as to whether it will work. The management accountant has gathered together some numbers and is about to start an analysis of the information. Required a) What is the cost per unit, to DJ Ltd, of a "mark 5" (Alt + A)e principles of lifecycle costing are applied to the above numbers? Comment on the numbers you have calculated. [20 marks] [10 marks for numbers and 10 marks for discussion] b) DJ have now carried out some market research about how much customers are willing to pay. 499 is the maximum they will pay. Target costing is a technique that can be used to help this type of situation. Critically evaluate how target costing works and if DJ could make use of it in this instance. [15 marks] Dunne and Jones Ltd (DJ) are a robotics company situated in the middle of England. They have developed a new home help robot that can cook and clean. They have been working on this model for some time and it is finally ready to be launched on the market. Previous versions of the model had many issues and errors but this latest version, the "mark 5" seems to be working well. Once it has been launched DJ expect competitors to be able to create a credible copy in two years. They believe it will take time for the competitors to clear any copy robots of bugs. DJ are very excited about this product and are planning a high-profile advertising campaign to ensure they gain a high percentage of market share and brand loyalty. The managing director wants to introduce the "mark 5" at a very high introductory price to signal the high quality of the product and to recoup as much of the research and development expenditure as soon as possible. However, the marketing manager feels that if too high a price is set then no one will want to buy it. It is a new product and customers will be skeptical as to whether it will work. The management accountant has gathered together some numbers and is about to start an analysis of the information. Required a) What is the cost per unit, to DJ Ltd, of a "mark 5" (Alt + A)e principles of lifecycle costing are applied to the above numbers? Comment on the numbers you have calculated. [20 marks] [10 marks for numbers and 10 marks for discussion] b) DJ have now carried out some market research about how much customers are willing to pay. 499 is the maximum they will pay. Target costing is a technique that can be used to help this type of situation. Critically evaluate how target costing works and if DJ could make use of it in this instance. [15 marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started