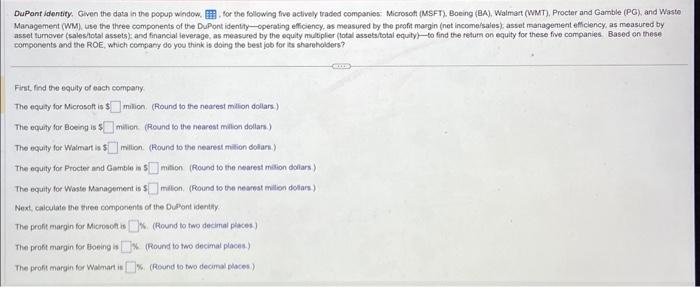

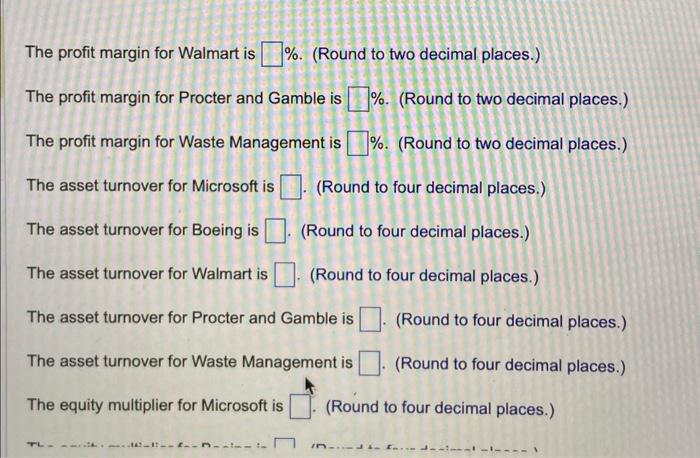

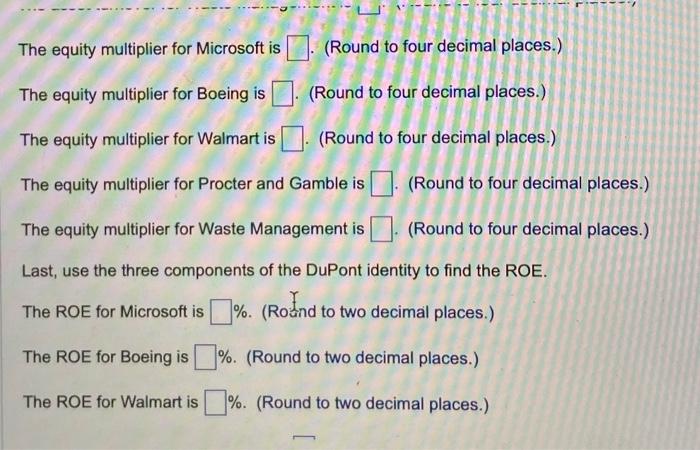

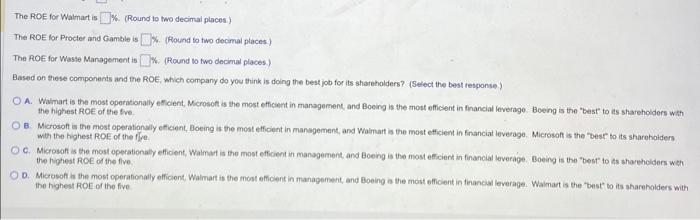

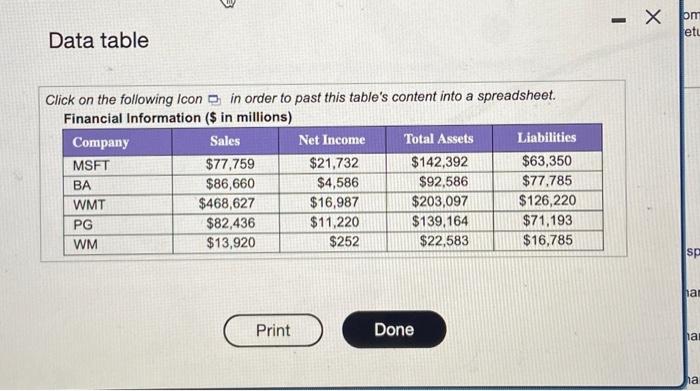

DuPant identity. Given the data in the popup window. , for the following five activey traded companies: Microsoft (MsFT). Boeing (BA), Waimat (WaMT). Procter and Gamble (PG), and Waste Management (WM), use the three components of the DuPont identiy-operating effciency, as measured by the proft margin (net income/salus), asset management efficlency, as measured by asset tumover (salestotal assets); and financial ieverage, as measured by the equity muitopler (lotal assetaitotal equily) - to find the return on equity for these five companies. Based on these comporvents and the ROE, which company do you think is doing the best job for ts sharehoiders? Fint, find the equity of each company The equety for Microsoft it $ milion. (Round to the nearest milion dollars) The equity for Boeng is 5 milion. (Reund to the nearest milion dollar.) The equity for Waimart is 1 milion. (Round to the nearest mition dollars.) The equity for Procter and Gamble is 5 mition (Round to the nearest mailion dollars) The equity for Waste Management is 5 milton, (fround to the neamst millon dollars) Next, calculate the tiree composents of the Dupont identify The profit margin for Microsof is %. (Round to two decimal places) The profit margin for beeing is K. (Round to two decimal places.) The profit margin for Waynart is (\%. (Round to two decimal blaces) The profit margin for Walmart is %. (Round to two decimal places.) The profit margin for Procter and Gamble is \%. (Round to two decimal places.) The profit margin for Waste Management is \%. (Round to two decimal places.) The asset turnover for Microsoft is . (Round to four decimal places.) The asset turnover for Boeing is . (Round to four decimal places.) The asset turnover for Walmart is . (Round to four decimal places.) The asset turnover for Procter and Gamble is . (Round to four decimal places.) The asset turnover for Waste Management is _ (Round to four decimal places.) The equity multiplier for Microsoft is (Round to four decimal places.) The equity multiplier for Microsoft is (Round to four decimal places.) The equity multiplier for Boeing is (Round to four decimal places.) The equity multiplier for Walmart is . (Round to four decimal places.) The equity multiplier for Procter and Gamble is . (Round to four decimal places.) The equity multiplier for Waste Management is _ (Round to four decimal places.) Last, use the three components of the DuPont identity to find the ROE. The ROE for Microsoft is \%. (Roand to two decimal places.) The ROE for Boeing is \%. (Round to two decimal places.) The ROE for Walmart is \%. (Round to two decimal places.) The ROE for Walmart is (6. (Round to two decimal places.) The ROE for Procter and Gamble is \%. (Found to two decimal places) The ROE for Waste Management is K: (Round to two decimal places.) Based on these components and the ROE, which company do you think is doing the best job for its shareholders? (Select the best response) A. Waimart is the most operitionaly eticient, Microsot is the most efficient in management, and Boeing is the most efficsent in financial leverago. Boeng is the "best to its sharehoiders weth the highest ROE of the five B. Microsoft is the most opetationaly efficient, Boeing is the most etficient in mansgemant, and Waimant is the most efficient in financial leverage. Microsoft is the bese to its sharehaiders wht the highest ROE of the file. c. Microsoft is the most operationaly efficent, Waimat is the most efficient in mansgement and Boeng is the most efficient in financial leverage. Boeing is the "best" to ts shareholdons weh. the highest ROE of the five. D. Microsof is the most operafionally efficiont, Waimart is the most efficient in management, and Boeing is the most efficent in tinancial leverage. Walmart is the "best" to its shareholders with Data table Click on the following Icon Financial Information (S in millions)