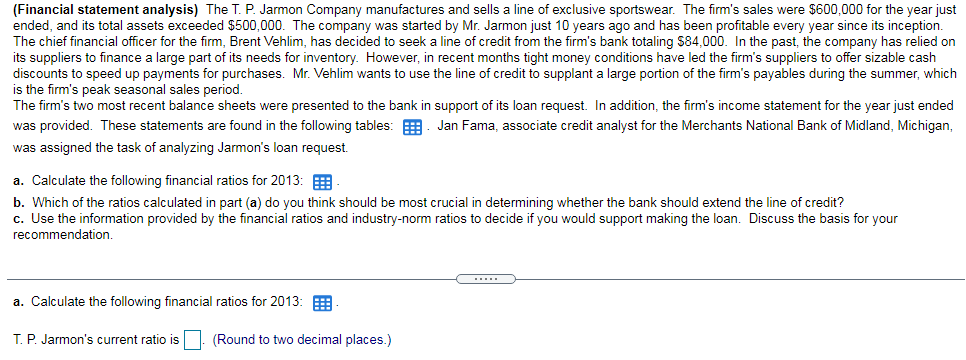

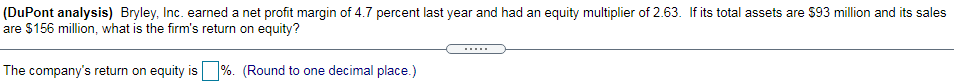

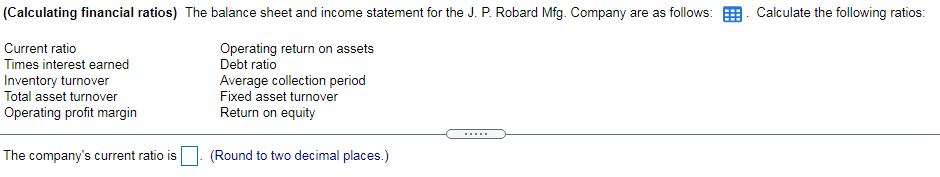

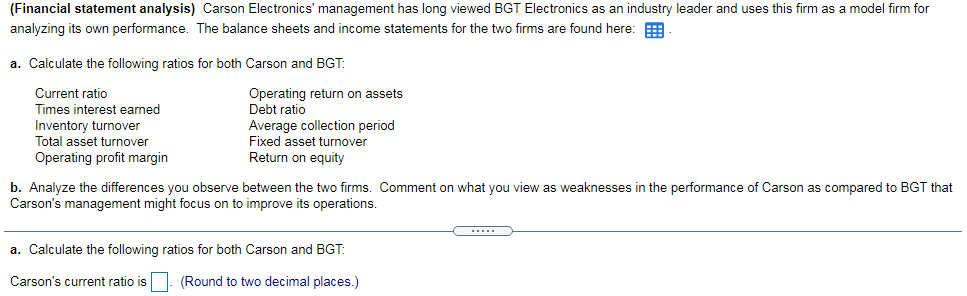

(DuPont analysis) Bryley, Inc. earned a net profit margin of 4.7 percent last year and had an equity multiplier of 2.63. If its total assets are 593 million and its sales are $156 million, what is the firm's return on equity? The company's return on equity is %. (Round to one decimal place.) (Calculating financial ratios) The balance sheet and income statement for the J. P. Robard Mfg. Company are as follows: Calculate the following ratios: Current ratio Times interest earned Inventory turnover Total asset turnover Operating profit margin Operating return on assets Debt ratio Average collection period Fixed asset turnover Return on equity The company's current ratio is (Round to two decimal places.) (Financial statement analysis) Carson Electronics' management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheets and income statements for the two firms are found here: 5 a. Calculate the following ratios for both Carson and BGT: Current ratio Times interest earned Inventory turnover Total asset turnover Operating profit margin Operating return on assets Debt ratio Average collection period Fixed asset turnover Return on equity b. Analyze the differences you observe between the two firms. Comment on what you view as weaknesses in the performance of Carson as compared to BGT that Carson's management might focus on to improve its operations. a. Calculate the following ratios for both Carson and BGT: Carson's current ratio is (Round to two decimal places.) (Analyzing financial statements) The last two years of financial statements for Blunt Industries are found here: a. Calculate the following financial ratios for 2015 and 2016: B b. Evaluate the firm's financial position at the end of 2015 in terms of its liquidity, capital structure, asset management efficiency, and profitability. c. At the end of 2016, the firm had 4,990 shares of common stock outstanding, selling for $15.77 each. What were the firm's (i) earnings per share, (ii) price-earnings ratio, and (iii) market-to-book ratio? d. What observations can you make about the financial condition and performance of the firm from your answers to parts (a) through (c)? a. Calculate the following financial ratios for 2015 and 2016: Blunt's 2015 current ratio is (Round to two decimal places.) (Financial statement analysis) The T. P. Jarmon Company manufactures and sells a line of exclusive sportswear. The firm's sales were $600,000 for the year just ended, and its total assets exceeded $500,000. The company was started by Mr. Jarmon just 10 years ago and has been profitable every year since its inception The chief financial officer for the firm, Brent Vehlim, has decided to seek a line of credit from the firm's bank totaling $84.000. In the past, the company has relied on its suppliers to finance a large part of its needs for inventory. However, in recent months tight money conditions have led the firm's suppliers to offer sizable cash discounts to speed up payments for purchases. Mr. Vehlim wants to use the line of credit to supplant a large portion of the firm's payables during the summer, which is the firm's peak seasonal sales period. The firm's two most recent balance sheets were presented to the bank in support of its loan request. In addition, the firm's income statement for the year just ended was provided. These statements are found in the following tables: : Jan Fama, associate credit analyst for the Merchants National Bank of Midland, Michigan, was assigned the task of analyzing Jarmon's loan request. a. Calculate the following financial ratios for 2013: E b. Which of the ratios calculated in part (a) do you think should be most crucial in determining whether the bank should extend the line of credit? c. Use the information provided by the financial ratios and industry-norm ratios to decide if you would support making the loan. Discuss the basis for your recommendation. a. Calculate the following financial ratios for 2013: :: T. P. Jarmon's current ratio is (Round to two decimal places.)