Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DuPont Analysis, Forecasting with the Parsimonious Method and Estimating Share Value of Cisco Systems Inc Using the DCF Model Cisco Systems, Inc. is a multinational

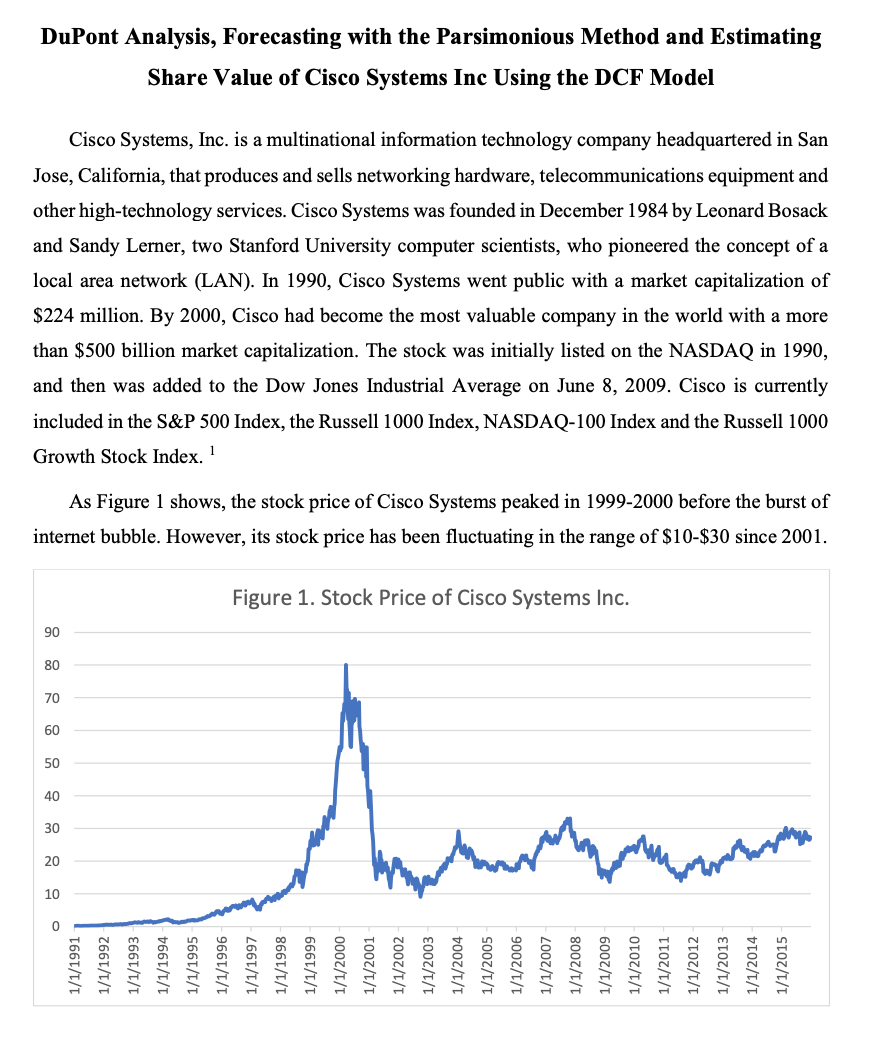

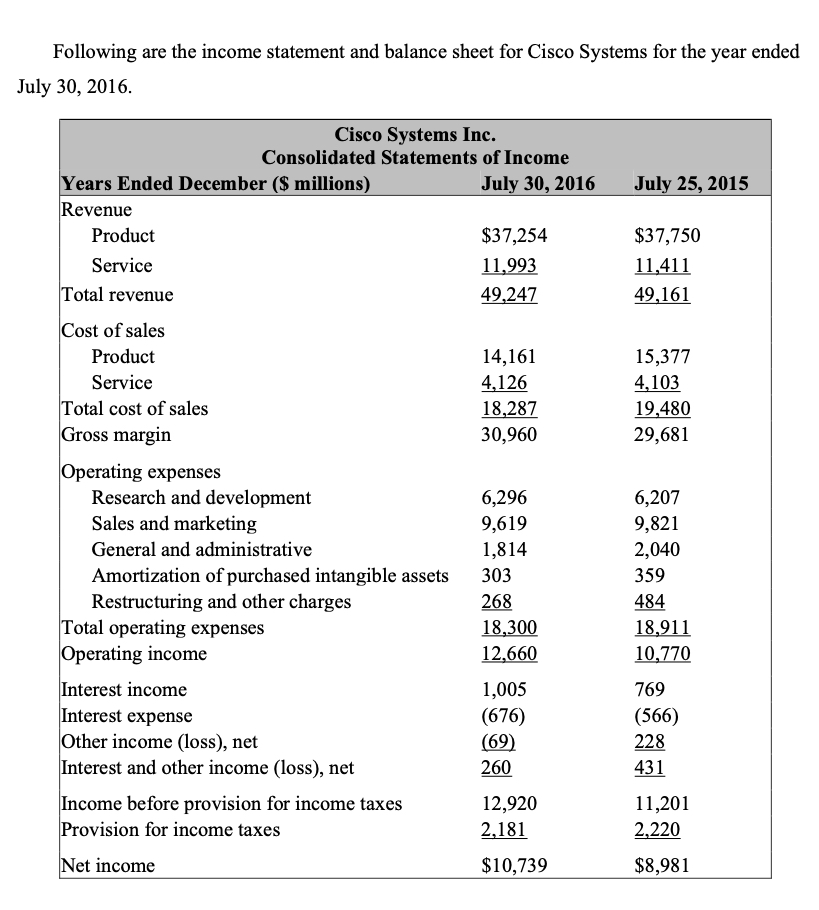

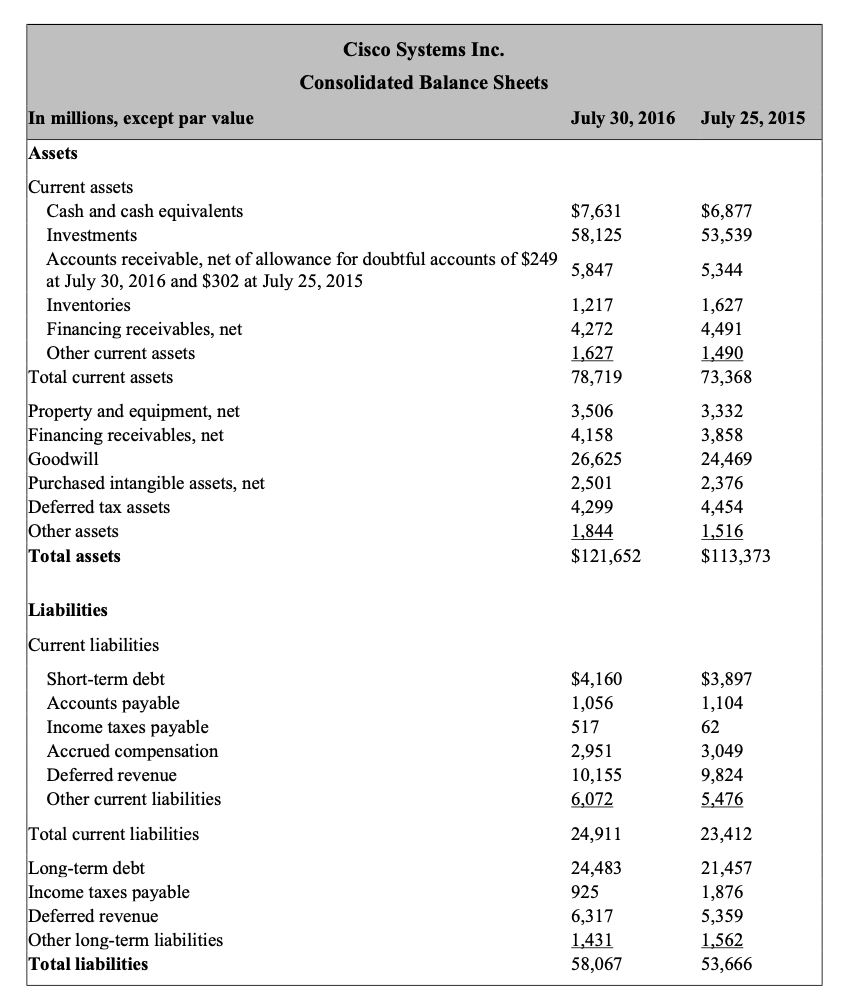

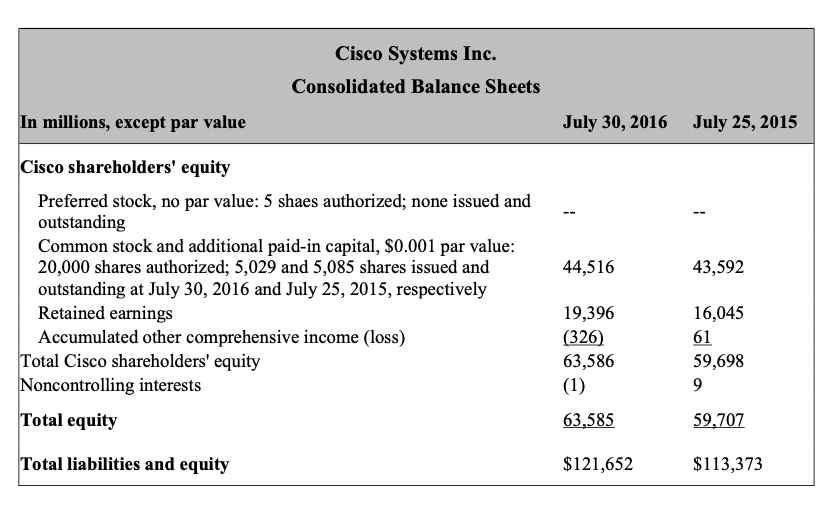

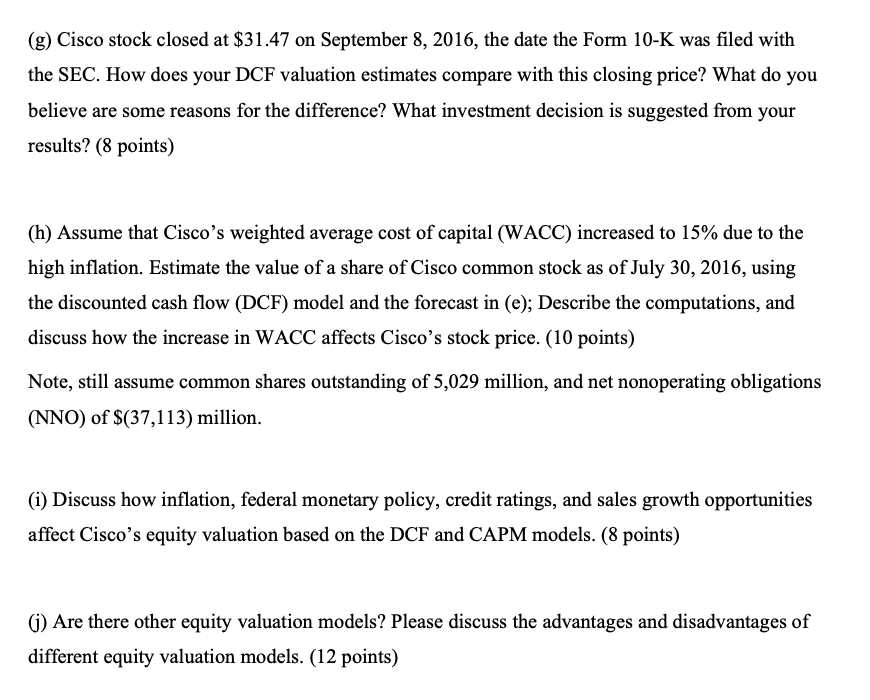

DuPont Analysis, Forecasting with the Parsimonious Method and Estimating Share Value of Cisco Systems Inc Using the DCF Model Cisco Systems, Inc. is a multinational information technology company headquartered in San Jose, California, that produces and sells networking hardware, telecommunications equipment and other high-technology services. Cisco Systems was founded in December 1984 by Leonard Bosack and Sandy Lerner, two Stanford University computer scientists, who pioneered the concept of a local area network (LAN). In 1990, Cisco Systems went public with a market capitalization of $224 million. By 2000, Cisco had become the most valuable company in the world with a more than $500 billion market capitalization. The stock was initially listed on the NASDAQ in 1990 , and then was added to the Dow Jones Industrial Average on June 8, 2009. Cisco is currently included in the S\&P 500 Index, the Russell 1000 Index, NASDAQ-100 Index and the Russell 1000 Growth Stock Index. 1 As Figure 1 shows, the stock price of Cisco Systems peaked in 1999-2000 before the burst of internet bubble. However, its stock price has been fluctuating in the range of $10$30 since 2001 . Following are the income statement and balance sheet for Cisco Systems for the year ended July 2n one Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30,2016 July 25,2015 Assets Current assets Cash and cash equivalents Investments $7,63158,125$6,87753,539 Accounts receivable, net of allowance for doubtful accounts of $249 at July 30, 2016 and $302 at July 25,2015 Inventories Financing receivables, net Other current assets Total current assets Property and equipment, net Financing receivables, net Goodwill Purchased intangible assets, net Deferred tax assets Other assets Total assets 5,8471,2174,27278,7191,6273,5064,15826,6252,5014,299$121,6521,8445,3441,6274,4911,49073,3683,3323,85824,4692,3764,454$1,516$1373 Liabilities Current liabilities Short-term debt Accounts payable Income taxes payable Accrued compensation Deferred revenue Other current liabilities Total current liabilities Long-term debt Income taxes payable Deferred revenue Other long-term liabilities Total liabilities $4,1601,0565172,95110,1556,07224,91124,4839256,3171,43158,067$3,8971,104623,0499,8245,47623,41221,4571,8765,3591,56253,666 Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30, 2016 July 25, 2015 Cisco shareholders' equity Preferred stock, no par value: 5 shaes authorized; none issued and outstanding Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; 5,029 and 5,085 shares issued and 43,592 outstanding at July 30,2016 and July 25,2015 , respectively Retainedearnings19,39616,045 Accumulated other comprehensive income (loss) Total Cisco shareholders' equity 63,586(326)59,69861 Noncontrolling interests (1) 9 Total equity 63,58559,707 Total liabilities and equity $121,652$113,373 (g) Cisco stock closed at $31.47 on September 8, 2016, the date the Form 10-K was filed with the SEC. How does your DCF valuation estimates compare with this closing price? What do you believe are some reasons for the difference? What investment decision is suggested from your results? ( 8 points) (h) Assume that Cisco's weighted average cost of capital (WACC) increased to 15% due to the high inflation. Estimate the value of a share of Cisco common stock as of July 30, 2016, using the discounted cash flow (DCF) model and the forecast in (e); Describe the computations, and discuss how the increase in WACC affects Cisco's stock price. (10 points) Note, still assume common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million. (i) Discuss how inflation, federal monetary policy, credit ratings, and sales growth opportunities affect Cisco's equity valuation based on the DCF and CAPM models. (8 points) (j) Are there other equity valuation models? Please discuss the advantages and disadvantages of different equity valuation models. (12 points) DuPont Analysis, Forecasting with the Parsimonious Method and Estimating Share Value of Cisco Systems Inc Using the DCF Model Cisco Systems, Inc. is a multinational information technology company headquartered in San Jose, California, that produces and sells networking hardware, telecommunications equipment and other high-technology services. Cisco Systems was founded in December 1984 by Leonard Bosack and Sandy Lerner, two Stanford University computer scientists, who pioneered the concept of a local area network (LAN). In 1990, Cisco Systems went public with a market capitalization of $224 million. By 2000, Cisco had become the most valuable company in the world with a more than $500 billion market capitalization. The stock was initially listed on the NASDAQ in 1990 , and then was added to the Dow Jones Industrial Average on June 8, 2009. Cisco is currently included in the S\&P 500 Index, the Russell 1000 Index, NASDAQ-100 Index and the Russell 1000 Growth Stock Index. 1 As Figure 1 shows, the stock price of Cisco Systems peaked in 1999-2000 before the burst of internet bubble. However, its stock price has been fluctuating in the range of $10$30 since 2001 . Following are the income statement and balance sheet for Cisco Systems for the year ended July 2n one Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30,2016 July 25,2015 Assets Current assets Cash and cash equivalents Investments $7,63158,125$6,87753,539 Accounts receivable, net of allowance for doubtful accounts of $249 at July 30, 2016 and $302 at July 25,2015 Inventories Financing receivables, net Other current assets Total current assets Property and equipment, net Financing receivables, net Goodwill Purchased intangible assets, net Deferred tax assets Other assets Total assets 5,8471,2174,27278,7191,6273,5064,15826,6252,5014,299$121,6521,8445,3441,6274,4911,49073,3683,3323,85824,4692,3764,454$1,516$1373 Liabilities Current liabilities Short-term debt Accounts payable Income taxes payable Accrued compensation Deferred revenue Other current liabilities Total current liabilities Long-term debt Income taxes payable Deferred revenue Other long-term liabilities Total liabilities $4,1601,0565172,95110,1556,07224,91124,4839256,3171,43158,067$3,8971,104623,0499,8245,47623,41221,4571,8765,3591,56253,666 Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30, 2016 July 25, 2015 Cisco shareholders' equity Preferred stock, no par value: 5 shaes authorized; none issued and outstanding Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; 5,029 and 5,085 shares issued and 43,592 outstanding at July 30,2016 and July 25,2015 , respectively Retainedearnings19,39616,045 Accumulated other comprehensive income (loss) Total Cisco shareholders' equity 63,586(326)59,69861 Noncontrolling interests (1) 9 Total equity 63,58559,707 Total liabilities and equity $121,652$113,373 (g) Cisco stock closed at $31.47 on September 8, 2016, the date the Form 10-K was filed with the SEC. How does your DCF valuation estimates compare with this closing price? What do you believe are some reasons for the difference? What investment decision is suggested from your results? ( 8 points) (h) Assume that Cisco's weighted average cost of capital (WACC) increased to 15% due to the high inflation. Estimate the value of a share of Cisco common stock as of July 30, 2016, using the discounted cash flow (DCF) model and the forecast in (e); Describe the computations, and discuss how the increase in WACC affects Cisco's stock price. (10 points) Note, still assume common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million. (i) Discuss how inflation, federal monetary policy, credit ratings, and sales growth opportunities affect Cisco's equity valuation based on the DCF and CAPM models. (8 points) (j) Are there other equity valuation models? Please discuss the advantages and disadvantages of different equity valuation models. (12 points)

DuPont Analysis, Forecasting with the Parsimonious Method and Estimating Share Value of Cisco Systems Inc Using the DCF Model Cisco Systems, Inc. is a multinational information technology company headquartered in San Jose, California, that produces and sells networking hardware, telecommunications equipment and other high-technology services. Cisco Systems was founded in December 1984 by Leonard Bosack and Sandy Lerner, two Stanford University computer scientists, who pioneered the concept of a local area network (LAN). In 1990, Cisco Systems went public with a market capitalization of $224 million. By 2000, Cisco had become the most valuable company in the world with a more than $500 billion market capitalization. The stock was initially listed on the NASDAQ in 1990 , and then was added to the Dow Jones Industrial Average on June 8, 2009. Cisco is currently included in the S\&P 500 Index, the Russell 1000 Index, NASDAQ-100 Index and the Russell 1000 Growth Stock Index. 1 As Figure 1 shows, the stock price of Cisco Systems peaked in 1999-2000 before the burst of internet bubble. However, its stock price has been fluctuating in the range of $10$30 since 2001 . Following are the income statement and balance sheet for Cisco Systems for the year ended July 2n one Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30,2016 July 25,2015 Assets Current assets Cash and cash equivalents Investments $7,63158,125$6,87753,539 Accounts receivable, net of allowance for doubtful accounts of $249 at July 30, 2016 and $302 at July 25,2015 Inventories Financing receivables, net Other current assets Total current assets Property and equipment, net Financing receivables, net Goodwill Purchased intangible assets, net Deferred tax assets Other assets Total assets 5,8471,2174,27278,7191,6273,5064,15826,6252,5014,299$121,6521,8445,3441,6274,4911,49073,3683,3323,85824,4692,3764,454$1,516$1373 Liabilities Current liabilities Short-term debt Accounts payable Income taxes payable Accrued compensation Deferred revenue Other current liabilities Total current liabilities Long-term debt Income taxes payable Deferred revenue Other long-term liabilities Total liabilities $4,1601,0565172,95110,1556,07224,91124,4839256,3171,43158,067$3,8971,104623,0499,8245,47623,41221,4571,8765,3591,56253,666 Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30, 2016 July 25, 2015 Cisco shareholders' equity Preferred stock, no par value: 5 shaes authorized; none issued and outstanding Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; 5,029 and 5,085 shares issued and 43,592 outstanding at July 30,2016 and July 25,2015 , respectively Retainedearnings19,39616,045 Accumulated other comprehensive income (loss) Total Cisco shareholders' equity 63,586(326)59,69861 Noncontrolling interests (1) 9 Total equity 63,58559,707 Total liabilities and equity $121,652$113,373 (g) Cisco stock closed at $31.47 on September 8, 2016, the date the Form 10-K was filed with the SEC. How does your DCF valuation estimates compare with this closing price? What do you believe are some reasons for the difference? What investment decision is suggested from your results? ( 8 points) (h) Assume that Cisco's weighted average cost of capital (WACC) increased to 15% due to the high inflation. Estimate the value of a share of Cisco common stock as of July 30, 2016, using the discounted cash flow (DCF) model and the forecast in (e); Describe the computations, and discuss how the increase in WACC affects Cisco's stock price. (10 points) Note, still assume common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million. (i) Discuss how inflation, federal monetary policy, credit ratings, and sales growth opportunities affect Cisco's equity valuation based on the DCF and CAPM models. (8 points) (j) Are there other equity valuation models? Please discuss the advantages and disadvantages of different equity valuation models. (12 points) DuPont Analysis, Forecasting with the Parsimonious Method and Estimating Share Value of Cisco Systems Inc Using the DCF Model Cisco Systems, Inc. is a multinational information technology company headquartered in San Jose, California, that produces and sells networking hardware, telecommunications equipment and other high-technology services. Cisco Systems was founded in December 1984 by Leonard Bosack and Sandy Lerner, two Stanford University computer scientists, who pioneered the concept of a local area network (LAN). In 1990, Cisco Systems went public with a market capitalization of $224 million. By 2000, Cisco had become the most valuable company in the world with a more than $500 billion market capitalization. The stock was initially listed on the NASDAQ in 1990 , and then was added to the Dow Jones Industrial Average on June 8, 2009. Cisco is currently included in the S\&P 500 Index, the Russell 1000 Index, NASDAQ-100 Index and the Russell 1000 Growth Stock Index. 1 As Figure 1 shows, the stock price of Cisco Systems peaked in 1999-2000 before the burst of internet bubble. However, its stock price has been fluctuating in the range of $10$30 since 2001 . Following are the income statement and balance sheet for Cisco Systems for the year ended July 2n one Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30,2016 July 25,2015 Assets Current assets Cash and cash equivalents Investments $7,63158,125$6,87753,539 Accounts receivable, net of allowance for doubtful accounts of $249 at July 30, 2016 and $302 at July 25,2015 Inventories Financing receivables, net Other current assets Total current assets Property and equipment, net Financing receivables, net Goodwill Purchased intangible assets, net Deferred tax assets Other assets Total assets 5,8471,2174,27278,7191,6273,5064,15826,6252,5014,299$121,6521,8445,3441,6274,4911,49073,3683,3323,85824,4692,3764,454$1,516$1373 Liabilities Current liabilities Short-term debt Accounts payable Income taxes payable Accrued compensation Deferred revenue Other current liabilities Total current liabilities Long-term debt Income taxes payable Deferred revenue Other long-term liabilities Total liabilities $4,1601,0565172,95110,1556,07224,91124,4839256,3171,43158,067$3,8971,104623,0499,8245,47623,41221,4571,8765,3591,56253,666 Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30, 2016 July 25, 2015 Cisco shareholders' equity Preferred stock, no par value: 5 shaes authorized; none issued and outstanding Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; 5,029 and 5,085 shares issued and 43,592 outstanding at July 30,2016 and July 25,2015 , respectively Retainedearnings19,39616,045 Accumulated other comprehensive income (loss) Total Cisco shareholders' equity 63,586(326)59,69861 Noncontrolling interests (1) 9 Total equity 63,58559,707 Total liabilities and equity $121,652$113,373 (g) Cisco stock closed at $31.47 on September 8, 2016, the date the Form 10-K was filed with the SEC. How does your DCF valuation estimates compare with this closing price? What do you believe are some reasons for the difference? What investment decision is suggested from your results? ( 8 points) (h) Assume that Cisco's weighted average cost of capital (WACC) increased to 15% due to the high inflation. Estimate the value of a share of Cisco common stock as of July 30, 2016, using the discounted cash flow (DCF) model and the forecast in (e); Describe the computations, and discuss how the increase in WACC affects Cisco's stock price. (10 points) Note, still assume common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million. (i) Discuss how inflation, federal monetary policy, credit ratings, and sales growth opportunities affect Cisco's equity valuation based on the DCF and CAPM models. (8 points) (j) Are there other equity valuation models? Please discuss the advantages and disadvantages of different equity valuation models. (12 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started