Answered step by step

Verified Expert Solution

Question

1 Approved Answer

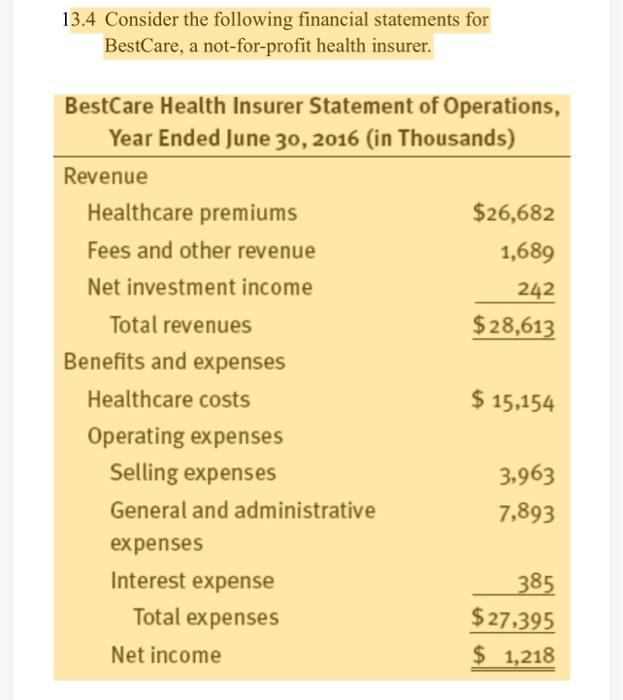

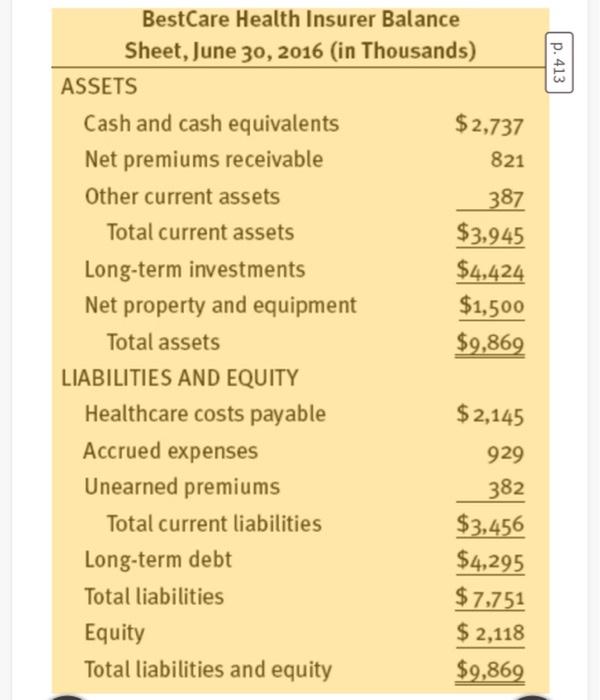

DuPont Analysis Memo. You are given financial statements for Best Care, which is a healthcare insurer. Your boss asked you to review these financial statements

DuPont Analysis Memo.

You are given financial statements for Best Care, which is a healthcare insurer. Your boss asked you to review these financial statements in this problem and to write a memo discussing the following:

* After performing the DuPont analysis, explain the analysis in your memo of your recommendation.

* Calculate the ratios provided here.

* Explain the results to your boss in your memo. The page following your memo should show the calculations for the DuPont analysis in your ratios.

Perform a DuPont analysis on BestCare.

Assume that the sector average ratios are as follows:

Total margin -3.8%

Total asset turnover _2.1

Equity multiplier -3.2

Return on equity -25.5%

b. Calculate and interpret the following ratios for BestCare.

Return on assets - 8%

Current ratio - 1:3

DCOH (assume depreciation expense is $367)- 41 days

Average collection period - 7 days

Debt ratio -69%

Debt-to-equity ratio- 2.2

Times interest earned ratio -2.8

Fixed-asset turnover ratio - 18.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started