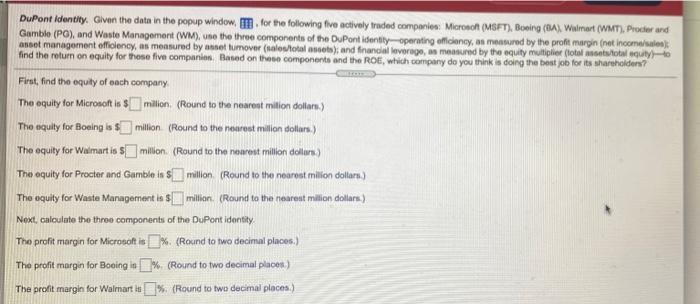

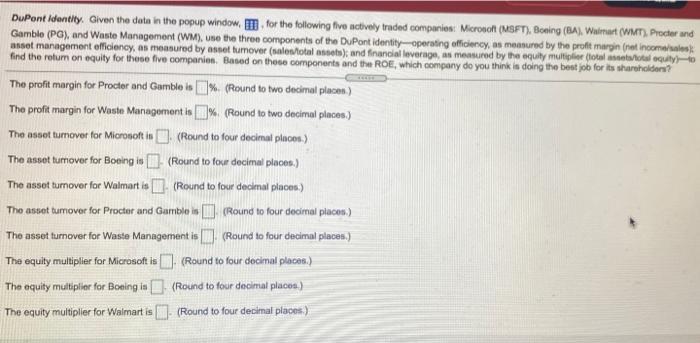

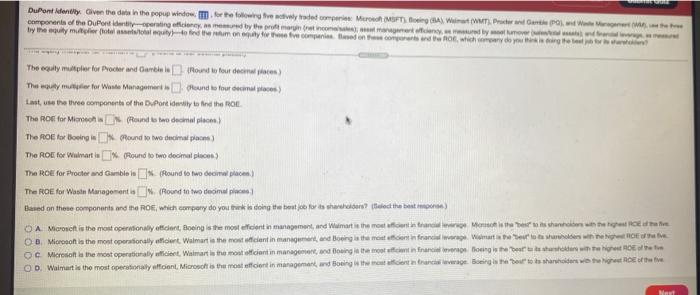

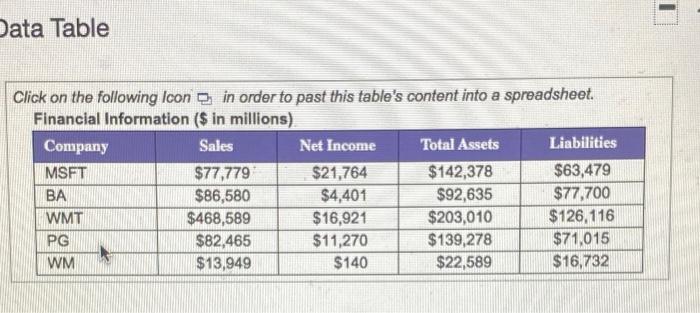

DuPont identity. Given the data in the popup window, mm. for the following five actively traded companies: Microsoft (MSFT), Boving (BA), Walmart (WMT), Prodier and Gamble (PO), and Waste Management (WM), use the three components of the DuPont identity operating efficiency, as measured by the profit margin (net income asset management officiency, as measured by annet lumover (sallal sets), and financial leverage, mesured by the equity multiplier (total otsiology find the return on equity for these five companies. Based on these components and the ROE, which company do you think is doing the best job for its shareholders? First, find the equity of each company The equity for Microsoft is smilion, (Round to the nearest milion dollars.) The equity for Boeing is $ million (Round to the nearest milion dollars) The equity for Walmartin million (Round to the nearest million dollars) The equity for Procter and Gamble in million (Round to the nearest million dollars) The equity for Waste Management is 5 million (Round to the nearest milion dollars.) Noxt , calculate the three components of the DuPont identity The profit margin for Microsoft is % (Round to two decimal places.) The profit margin for Boeing in % (Round to two decimal places) The profit margin for Walmart in % (Round to two decimal places.) DuPont identity. Given the data in the popup window, for the following five actively traded companies: Microsoft (MSFT). Boning (BA), Walmart (WMT), Procter and Gamblo (PG), and Waste Management (WM). Use the three components of the DuPont identity-operating officiency, as measured by the profit margin (net income asset management officiency, as measured by asset tumover (sales total assets and financial leverage, as measured by the equity multiplier total assets/totalguty find the return on equity for these five companion. Based on these components and the ROE, which company do you think is doing the best job for its shareholders? The profit margin for Procter and Gamble is % (Round to two decimal place) The profit margin for Waste Management is 1% (Round to two decimal places) The asset tumover for Microsoft in I. (Round to four decimal plnons.) The asset tumover for Boeing is - (Round to four decimal places.) The asset tumover for Walmart is 1 (Round to four decimal places) The asset tumover for Procter and Gamble (Round to four decimal places) The asset turnover for Waste Management is (Round to four decimal places.) The equity multiplier for Microsoft is). (Round to four decimal places.) The equity multipiter for Boting in - (Round to four decimal places.) The equity multipller for Walmart is ... (Round to four decimal places) DuPont ently live the data in the popup window for the following revelado com Micro MFT) A WWMT Practer de Wet components of the DuPont desting comed by the more con red by www by hilly multiplier otel My find the money for fe comprised on cord with company do you the The equly mutoler for Procher and Gamble under for dem) The ty mutter for Waste Management sound to four decom) Last use the three components of the DuPontidely to find the RO The Roffor Micro Rounds to decimal plane The ROE for Boeing Round to we decimal poom) The ROE for Walmart a 1% Round lowodeomat place) The role for Procter and Gamble le Round to two decimal place) The ROE for Waste Mariagement as oued to wo decimal placa Based on these components and the ROE with company do you doing it for thos? Maled the best OA Microsoft is the most operationally font, Boeing is the most efficient in management and Womatis the most entre Montes the whole OB Microsoft is the most operationally at Walmart is the most efficient in management, and Boeing the contin france Womato OC Microsoft lathe most operationally weet, Walmart is the most efficient in management, and doing the most infrarong is the book with the OD Walmart is the most personal loan, Microsoft is the most efficient in management and on two centrance Bolo to share this of the five Nam Data Table Click on the following Icon in order to past this table's content into a spreadsheet. Financial Information ($ in millions) Company Sales Net Income Total Assets Liabilities MSFT $77,779 $21,764 $142,378 $63,479 BA $86,580 $4,401 $92,635 $77,700 WMT $468,589 $16,921 $203,010 $126,116 PG $82,465 $11,270 $139,278 $71,015 WM $13,949 $140 $22,589 $16,732