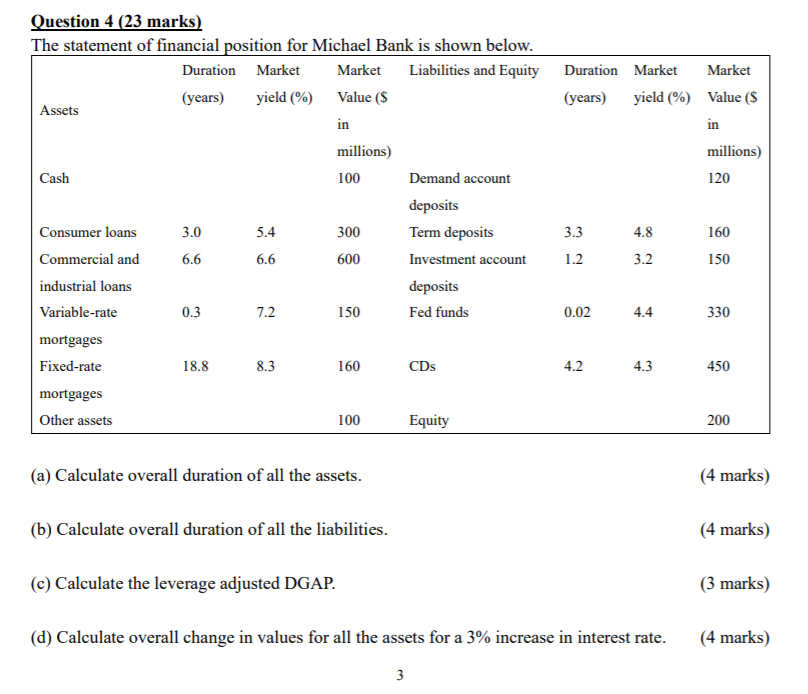

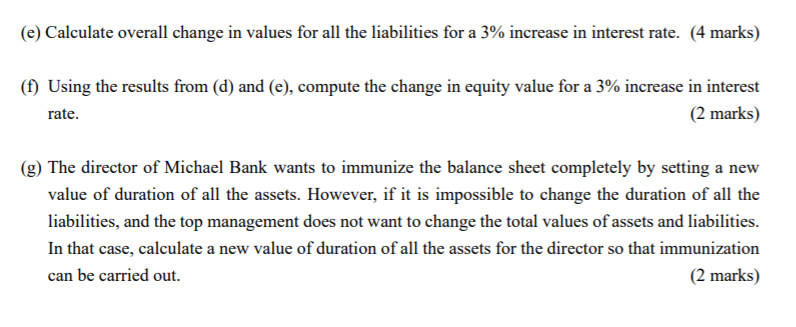

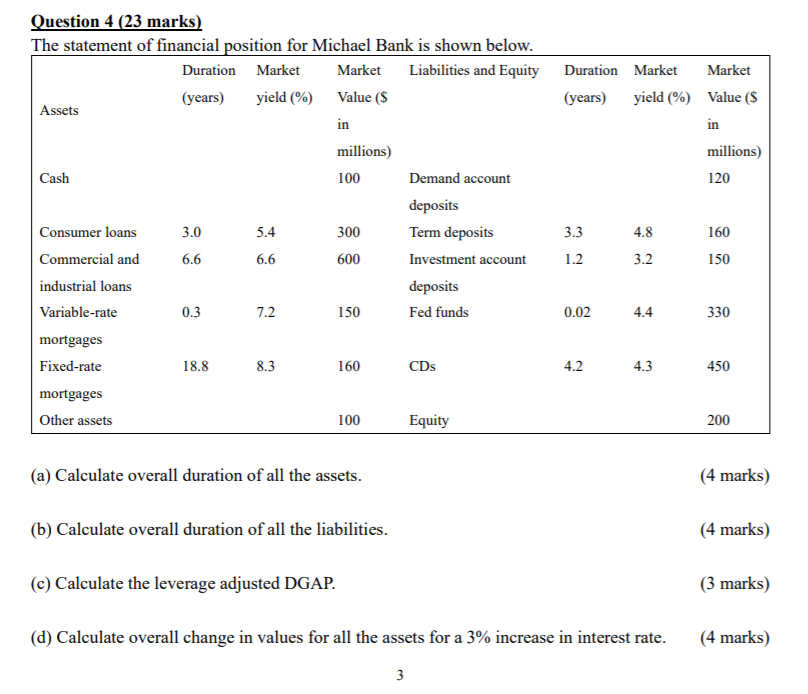

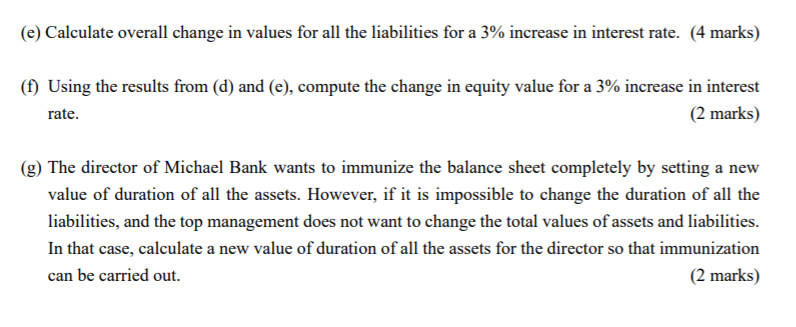

Duration Market Market (years) yield (%) Value ($ in millions) 120 Question 4 (23 marks) The statement of financial position for Michael Bank is shown below. Duration Market Market Liabilities and Equity (years) yield (%) Value ($ Assets in millions) Cash 100 Demand account deposits Consumer loans 3.0 5.4 300 Term deposits Commercial and 6.6 6.6 Investment account industrial loans deposits Variable-rate 0.3 150 Fed funds mortgages Fixed-rate 18.8 160 CDs mortgages Other assets 100 Equity 3.3 160 4.8 3.2 600 1.2 150 7.2 0.02 4.4 330 8.3 4.2 4.3 450 200 (a) Calculate overall duration of all the assets. (4 marks) (b) Calculate overall duration of all the liabilities. (4 marks) (c) Calculate the leverage adjusted DGAP. (3 marks) (d) Calculate overall change in values for all the assets for a 3% increase in interest rate. (4 marks) 3 (e) Calculate overall change in values for all the liabilities for a 3% increase in interest rate. (4 marks) (f) Using the results from (d) and (e), compute the change in equity value for a 3% increase in interest rate. (2 marks) The director of Michael Bank wants to immunize the balance sheet completely by setting a new value of duration of all the assets. However, if it is impossible to change the duration of all the liabilities, and the top management does not want to change the total values of assets and liabilities. In that case, calculate a new value of duration of all the assets for the director so that immunization can be carried out. (2 marks) Duration Market Market (years) yield (%) Value ($ in millions) 120 Question 4 (23 marks) The statement of financial position for Michael Bank is shown below. Duration Market Market Liabilities and Equity (years) yield (%) Value ($ Assets in millions) Cash 100 Demand account deposits Consumer loans 3.0 5.4 300 Term deposits Commercial and 6.6 6.6 Investment account industrial loans deposits Variable-rate 0.3 150 Fed funds mortgages Fixed-rate 18.8 160 CDs mortgages Other assets 100 Equity 3.3 160 4.8 3.2 600 1.2 150 7.2 0.02 4.4 330 8.3 4.2 4.3 450 200 (a) Calculate overall duration of all the assets. (4 marks) (b) Calculate overall duration of all the liabilities. (4 marks) (c) Calculate the leverage adjusted DGAP. (3 marks) (d) Calculate overall change in values for all the assets for a 3% increase in interest rate. (4 marks) 3 (e) Calculate overall change in values for all the liabilities for a 3% increase in interest rate. (4 marks) (f) Using the results from (d) and (e), compute the change in equity value for a 3% increase in interest rate. (2 marks) The director of Michael Bank wants to immunize the balance sheet completely by setting a new value of duration of all the assets. However, if it is impossible to change the duration of all the liabilities, and the top management does not want to change the total values of assets and liabilities. In that case, calculate a new value of duration of all the assets for the director so that immunization can be carried out. (2 marks)