Answered step by step

Verified Expert Solution

Question

1 Approved Answer

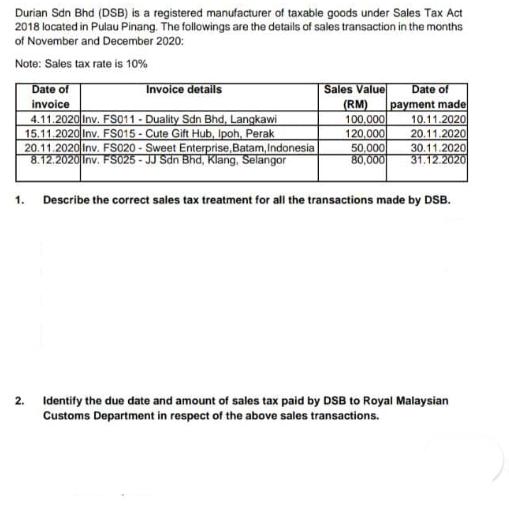

Durian Sdn Bhd (DSB) is a registered manufacturer of taxable goods under Sales Tax Act 2018 located in Pulau Pinang. The followings are the

Durian Sdn Bhd (DSB) is a registered manufacturer of taxable goods under Sales Tax Act 2018 located in Pulau Pinang. The followings are the details of sales transaction in the months of November and December 2020: Note: Sales tax rate is 10% Date of invoice 4.11.2020 Inv. FS011-Duality Sdn Bhd, Langkawi 15.11.2020 Inv. FS015-Cute Gift Hub, Ipoh, Perak 20.11.2020 Inv. FS020-Sweet Enterprise, Batam, Indonesia 8.12.2020 Inv. FS025-JJ Sdn Bhd, Klang, Selangor 1. Invoice details 2. Sales Value (RM) 100,000 120,000 50.000 80,000 Date of payment made 10.11.2020 20.11.2020 30.11.2020 31.12.2020 Describe the correct sales tax treatment for all the transactions made by DSB. Identify the due date and amount of sales tax paid by DSB to Royal Malaysian Customs Department in respect of the above sales transactions.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 The correct sales tax treatment for all the transactions made by DSB is as follows Transaction wit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started