Answered step by step

Verified Expert Solution

Question

1 Approved Answer

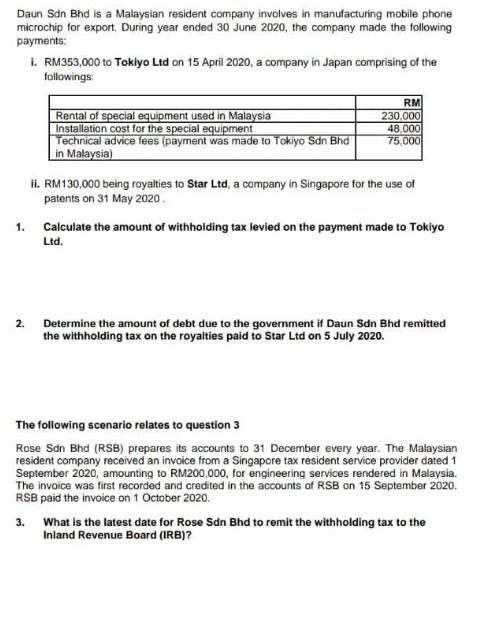

Daun Sdn Bhd is a Malaysian resident company involves in manufacturing mobile phone microchip for export. During year ended 30 June 2020, the company

Daun Sdn Bhd is a Malaysian resident company involves in manufacturing mobile phone microchip for export. During year ended 30 June 2020, the company made the following payments: 1. RM353,000 to Tokiyo Ltd on 15 April 2020, a company in Japan comprising of the followings: 2. Rental of special equipment used in Malaysia Installation cost for the special equipment Technical advice fees (payment was made to Tokiyo Sdn Bhd in Malaysia) RM 230.000 48,000 75,000 ii. RM130,000 being royalties to Star Ltd, a company in Singapore for the use of patents on 31 May 2020. 1. Calculate the amount of withholding tax levied on the payment made to Tokiyo Ltd. Determine the amount of debt due to the government if Daun Sdn Bhd remitted the withholding tax on the royalties paid to Star Ltd on 5 July 2020. The following scenario relates to question 3 Rose Sdn Bhd (RSB) prepares its accounts to 31 December every year. The Malaysian resident company received an invoice from a Singapore tax resident service provider dated 1 September 2020, amounting to RM200,000, for engineering services rendered in Malaysia. The invoice was first recorded and credited in the accounts of RSB on 15 September 2020. RSB paid the invoice on 1 October 2020. 3. What is the latest date for Rose Sdn Bhd to remit the withholding tax to the Inland Revenue Board (IRB)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of Withholding Tax on Payment to Tokiyo Ltd Rental of special equipment RM 230000 Instal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started