Answered step by step

Verified Expert Solution

Question

1 Approved Answer

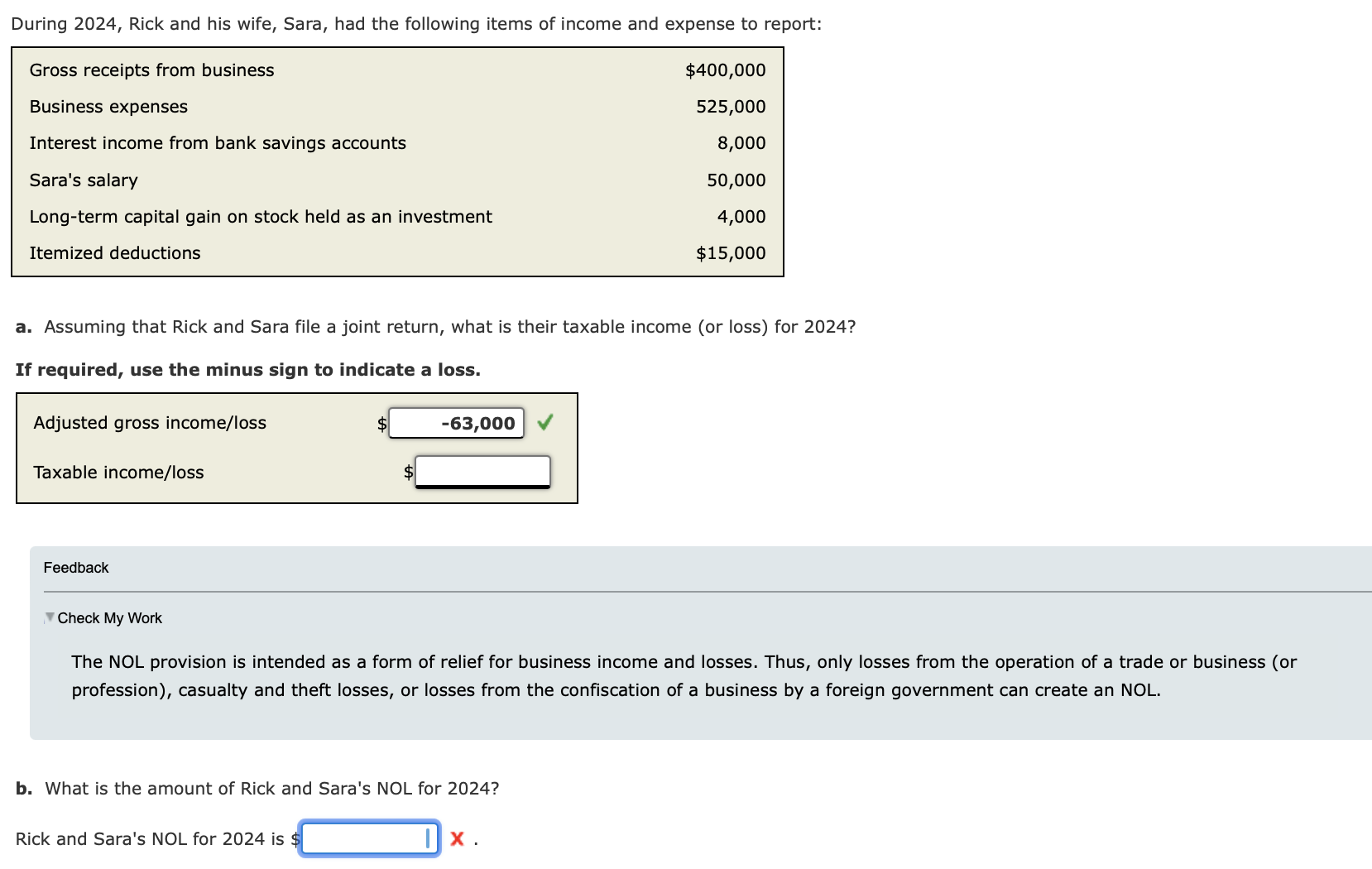

During 2 0 2 4 , Rick and his wife, Sara, had the following items of income and expense to report: Gross receipts from business$

During Rick and his wife, Sara, had the following items of income and expense to report:

Gross receipts from business$Business expensesInterest income from bank savings accountsSara's salaryLongterm capital gain on stock held as an investmentItemized deductions$

Question Content Area

aAssuming that Rick and Sara file a joint return, what is their taxable income or loss for

If required, use the minus sign to indicate a loss.

Adjusted gross incomeloss$fill in the blank aaafdTaxable incomeloss$fill in the blank aaafd During Rick and his wife, Sara, had the following items of income and expense to report:

a Assuming that Rick and Sara file a joint return, what is their taxable income or loss for

If required, use the minus sign to indicate a loss.

Adjusted gross incomeloss

$

Taxable incomeloss

$

Feedback

Check My Work

The NOL provision is intended as a form of relief for business income and losses. Thus, only losses from the operation of a trade or business or profession casualty and theft losses, or losses from the confiscation of a business by a foreign government can create an NOL.

b What is the amount of Rick and Sara's NOL for

Rick and Sara's NOL for is $ mid mathbfX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started