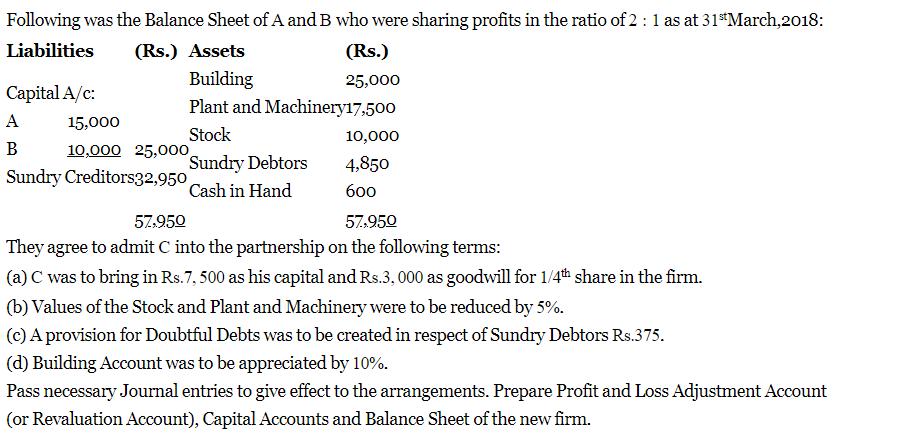

Following was the Balance Sheet of A and B who were sharing profits in the ratio of 2 : 1 as at 31st March,

Following was the Balance Sheet of A and B who were sharing profits in the ratio of 2 : 1 as at 31st March, 2018: Liabilities (Rs.) Assets Building Plant and Machinery17,500 Stock Capital A/c: A B Sundry Creditors32,950 15,000 10,000 25,000 (Rs.) 25,000 Sundry Debtors Cash in Hand 10,000 4,850 600 57.950 57,950 They agree to admit C into the partnership on the following terms: (a) C was to bring in Rs.7, 500 as his capital and Rs.3, 000 as goodwill for 1/4th share in the firm. (b) Values of the Stock and Plant and Machinery were to be reduced by 5%. (c) A provision for Doubtful Debts was to be created in respect of Sundry Debtors Rs.375. (d) Building Account was to be appreciated by 10%. Pass necessary Journal entries to give effect to the arrangements. Prepare Profit and Loss Adjustment Account (or Revaluation Account), Capital Accounts and Balance Sheet of the new firm.

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Working note Date Particulars Journal Profit and Loss Adjustment Ae To Stock Ae To Plant an...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started