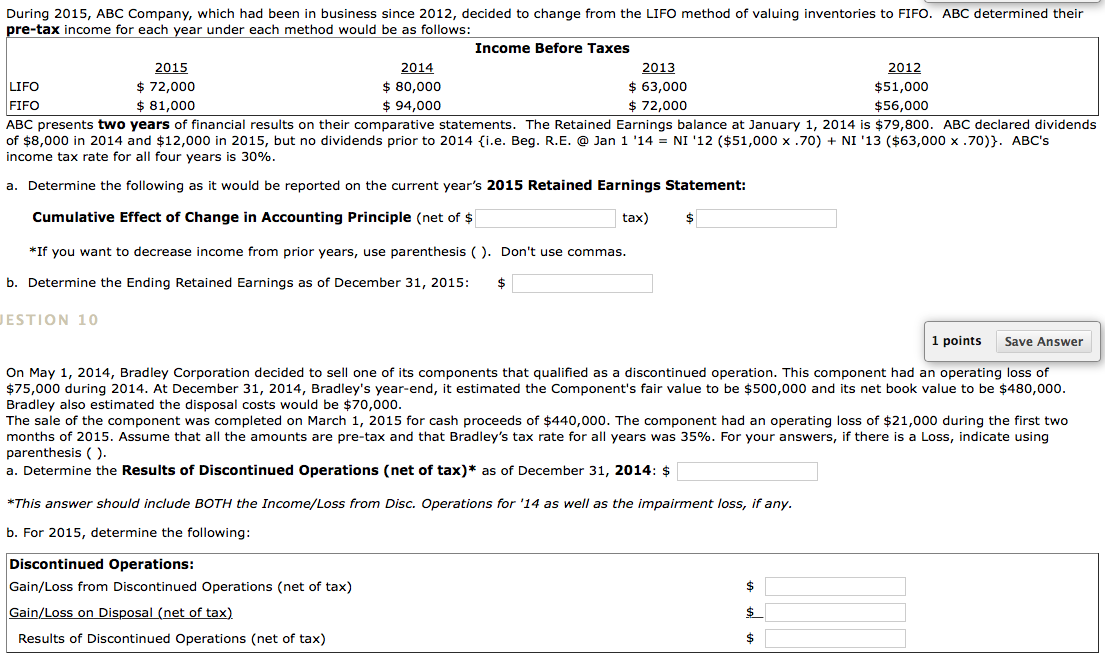

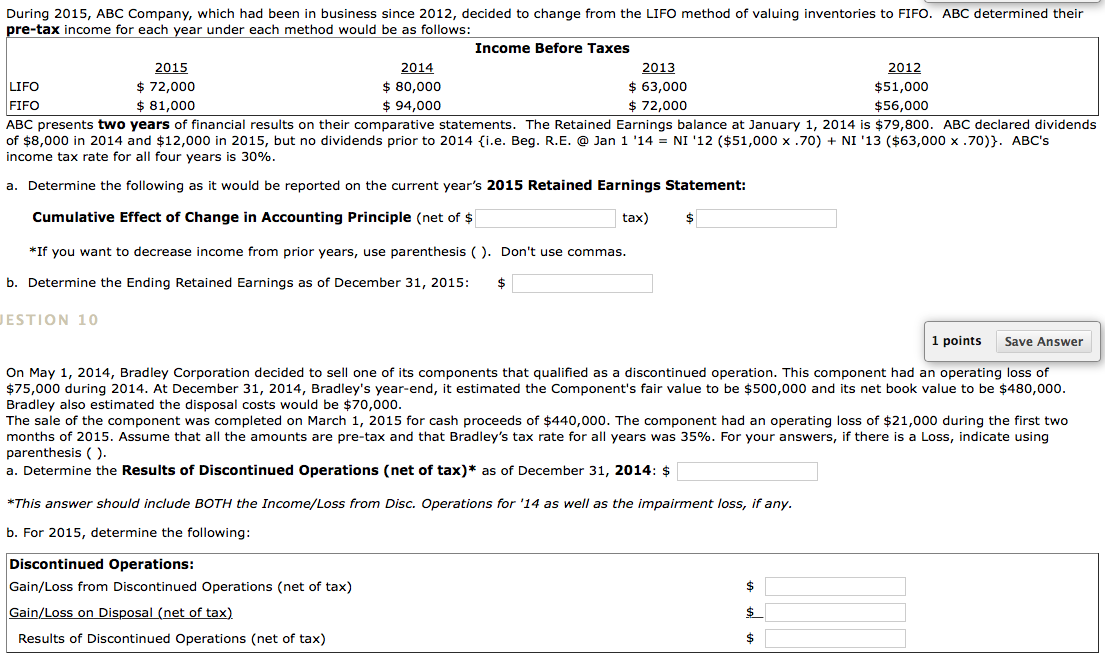

During 2015, ABC Company, which had been in business since 2012, decided to change from the LIFO method of valuing inventories to FIFO. ABC determined their pre-tax income for each year under each method would be as follows: Income Before Taxes 2015 2014 2013 2012 72,000 80,000 63,000 $51,000 LIFO 81,000 94,000 72,000 $56,000 FIFO ABC presents two years of financial results on their comparative statements. The Retained Earnings balance at January 1, 2014 is $79,800. ABC declared dividends of $8,000 in 2014 and $12,000 in 2015, but no dividend prior to 2014 e. Beg. R.E. a Jan 1 14 NI '12 ($51,000 x .70) NI '13 ($63,000 x .70) ABC's income tax rate for all four years is 30% a. Determine the following as it would be reported on the current year's 2015 Retained Earnings Statement cumulative Effect of change in Accounting Principle (net of tax) *If you want to decrease income from prior years, use parenthesis Don't use commas. b. Determine the Ending Retained Earnings as of December 3 2015: ESTION 10 1 points Save Answer On May 1, 2014, Bradley Corporation decided to sell one of its components that qualified as a discontinued operation. This component had an operating loss of $75,000 during 2014. At December 31, 2014, Bradley's year-end, it estimated the Component's fair value to be $500,000 and its net book value to be $480,000 Bradley also estimated the disposal costs would be $70,000. The sale of the component was completed on March 1, 2015 for cash proceeds of $440,000. The component had an operating loss of $21,000 during the first two months of 2015. Assume that all the amounts are pre-tax and that Bradley's tax rate for all years was 35%. For your answers, if there is a Loss, indicate using parenthesis a. Determine the Results of Discontinued operations (net of tax)* as of December 31, 2014: *This answer should include BOTH the Income/Loss from Disc. Operations for '14 as well as the impairment loss, if any b. For 2015, determine the following: Discontinued operations: Gain/Loss from Discontinued Operations (net of tax) Gain/Loss on Disposal net of tax Results of Discontinued Operations (net of tax)