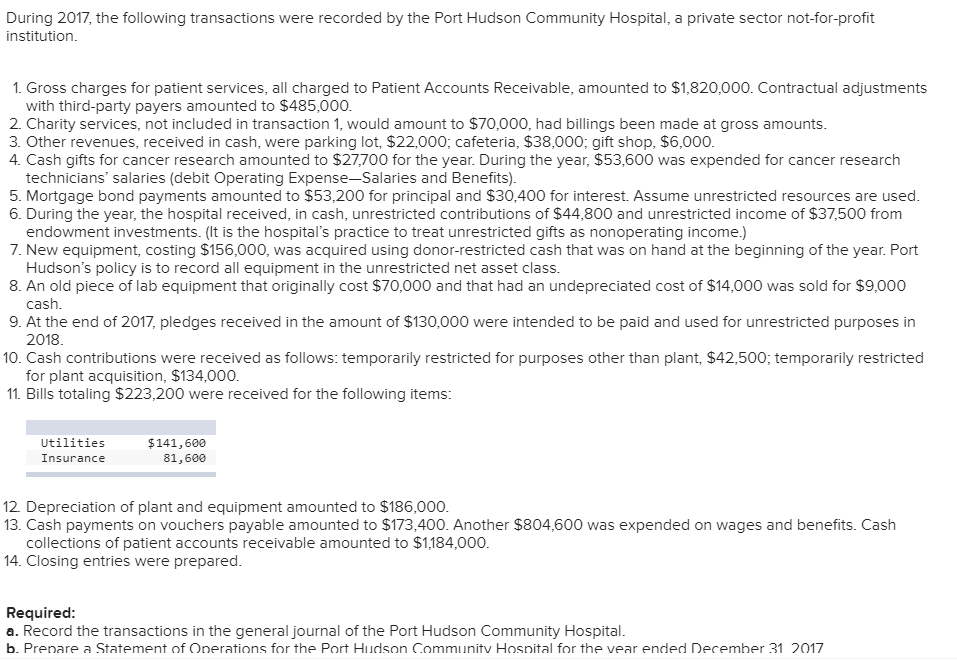

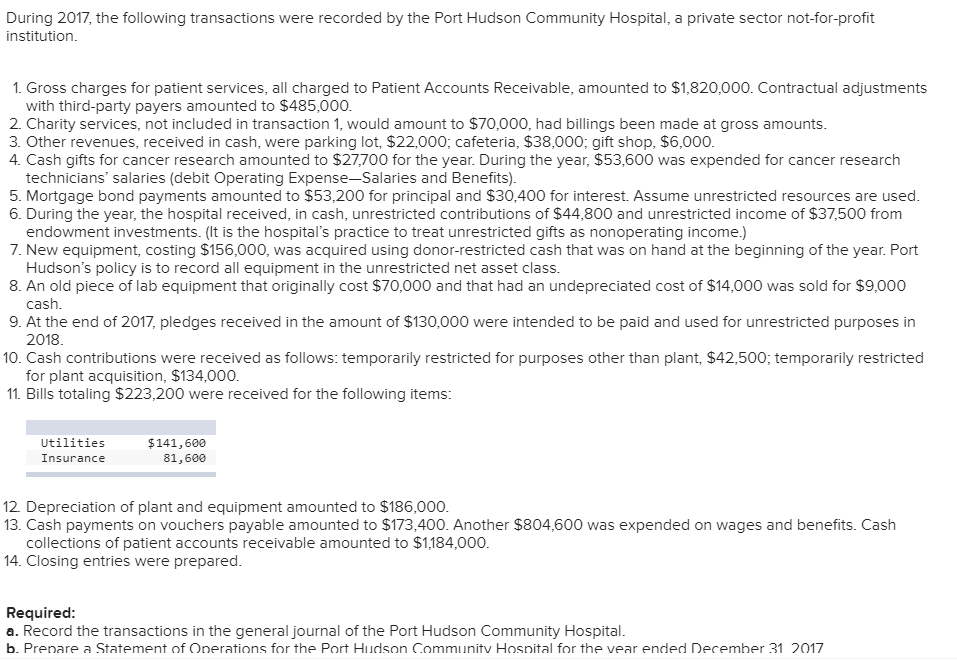

During 2017, the following transactions were recorded by the Port Hudson Community Hospital, a private sector not-for-profit institution 1. Gross charges for patient services, all charged to Patient Accounts Receivable, amounted to $1,820,000. Contractual adjustments with third-party payers amounted to $485,000 2. Charity services, not included in transaction 1, would amount to $70,000, had billings been made at gross amounts 3. Other revenues, received in cash, were parking lot, $22,000; cafeteria, $38,000; gift shop, $6,000 4. Cash gifts for cancer research amounted to $27,700 for the year. During the year, $53,600 was expended for cancer research technicians' salaries (debit Operating Expense-Salaries and Benefits) 5. Mortgage bond payments amounted to $53,200 for principal and $30,400 for interest. Assume unrestricted resources are used 6. During the year, the hospital received, in cash, unrestricted contributions of $44,800 and unrestricted income of $37,500 from 7. New equipment, costing $156,000, was acquired using donor-restricted cash that was on hand at the beginning of the year. Port 8. An old piece of lab equipment that originally cost $70,000 and that had an undepreciated cost of $14,000 was sold for $9,000 9. At the end of 2017, pledges received in the amount of $130,000 were intended to be paid and used for unrestricted purposes in 10. Cash contributions were received as follows: temporarily restricted for purposes other than plant, $42,500; temporarily restricted 11. Bills totaling $223,200 were received for the following items endowment investments. (It is the hospital's practice to treat unrestricted gifts as nonoperating income.) Hudson's policy is to record all equipment in the unrestricted net asset class cash. 2018 for plant acquisition, $134,000 Utilities Insurance $141,600 81,600 12 Depreciation of plant and equipment amounted to $186,000 13. Cash payments on vouchers payable amounted to $173,400. Another $804,600 was expended on wages and benefits. Cash collections of patient accounts receivable amounted to $1,184,000 14. Closing entries were prepared Required: a. Record the transactions in the general journal of the Port Hudson Community Hospital b. Prenare a Statement of Onerations for the Port Hiudson Communitv Hosnital for the vear ended December 31 2017