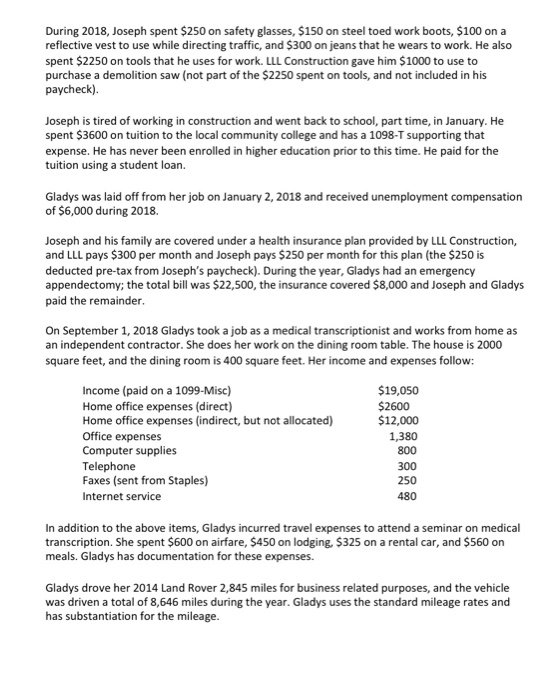

During 2018, Joseph spent $250 on safety glasses, $150 on steel toed work boots, $100 on a reflective vest to use while directing traffic, and $300 on jeans that he wears to work. He also spent $2250 on tools that he uses for work. LLL Construction gave him $1000 to use to purchase a demolition saw (not part of the $2250 spent on tools, and not included in his paycheck) Joseph is tired of working in construction and went back to school, part time, in January. He spent $3600 on tuition to the local community college and has a 1098-T supporting that expense. He has never been enrolled in higher education prior to this time. He paid for the tuition using a student loan. Gladys was laid off from her job on January 2, 2018 and received unemployment compensation of $6,000 during 2018. Joseph and his family are covered under a health insurance plan provided by LLL Construction, and LLL pays $300 per month and Joseph pays $250 per month for this plan (the $250 is deducted pre-tax from Joseph's paycheck). During the year, Gladys had an emergency appendectomy; the total bill was $22,500, the insurance covered $8,000 and Joseph and Gladys paid the remainder On September 1, 2018 Gladys took a job as a medical transcriptionist and works from home as an independent contractor. She does her work on the dining room table. The house is 2000 square feet, and the dining room is 400 square feet. Her income and expenses follow: Income (paid on a 1099-Misc) Home office expenses (direct) Home office expenses (indirect, but not allocated) Office expenses Computer supplies Telephone Faxes (sent from Staples) Internet service $19,050 $2600 $12,000 1,380 800 300 250 480 In addition to the above items, Gladys incurred travel expenses to attend a seminar on medical transcription. She spent $600 on airfare, $450 on lodging, $325 on a rental car, and $560 on meals. Gladys has documentation for these expenses. Gladys drove her 2014 Land Rover 2,845 miles for business related purposes, and the vehicle was driven a total of 8,646 miles during the year. Gladys uses the standard mileage rates and has substantiation for the mileage During 2018, Joseph spent $250 on safety glasses, $150 on steel toed work boots, $100 on a reflective vest to use while directing traffic, and $300 on jeans that he wears to work. He also spent $2250 on tools that he uses for work. LLL Construction gave him $1000 to use to purchase a demolition saw (not part of the $2250 spent on tools, and not included in his paycheck) Joseph is tired of working in construction and went back to school, part time, in January. He spent $3600 on tuition to the local community college and has a 1098-T supporting that expense. He has never been enrolled in higher education prior to this time. He paid for the tuition using a student loan. Gladys was laid off from her job on January 2, 2018 and received unemployment compensation of $6,000 during 2018. Joseph and his family are covered under a health insurance plan provided by LLL Construction, and LLL pays $300 per month and Joseph pays $250 per month for this plan (the $250 is deducted pre-tax from Joseph's paycheck). During the year, Gladys had an emergency appendectomy; the total bill was $22,500, the insurance covered $8,000 and Joseph and Gladys paid the remainder On September 1, 2018 Gladys took a job as a medical transcriptionist and works from home as an independent contractor. She does her work on the dining room table. The house is 2000 square feet, and the dining room is 400 square feet. Her income and expenses follow: Income (paid on a 1099-Misc) Home office expenses (direct) Home office expenses (indirect, but not allocated) Office expenses Computer supplies Telephone Faxes (sent from Staples) Internet service $19,050 $2600 $12,000 1,380 800 300 250 480 In addition to the above items, Gladys incurred travel expenses to attend a seminar on medical transcription. She spent $600 on airfare, $450 on lodging, $325 on a rental car, and $560 on meals. Gladys has documentation for these expenses. Gladys drove her 2014 Land Rover 2,845 miles for business related purposes, and the vehicle was driven a total of 8,646 miles during the year. Gladys uses the standard mileage rates and has substantiation for the mileage