Question

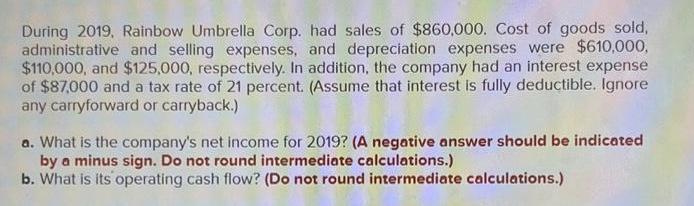

During 2019, Rainbow Umbrella Corp. had sales of $860,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $610,000, $110,000, and

During 2019, Rainbow Umbrella Corp. had sales of $860,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $610,000, $110,000, and $125,000, respectively. In addition, the company had an interest expense of $87,000 and a tax rate of 21 percent. (Assume that interest is fully deductible. Ignore any carryforward or carryback.) a. What is the company's net income for 2019? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.) b. What is its operating cash flow? (Do not round intermediate calculations.)

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the companys net income for 2019 well start with the formula for net income Net Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

12th edition

1259918947, 1260091908, 978-1259918940

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App