Question

During 2019, the Powell Corporation had the following income and expenses: Gross income from operations $20,000 Dividend income from a domestic 25% owned corporation

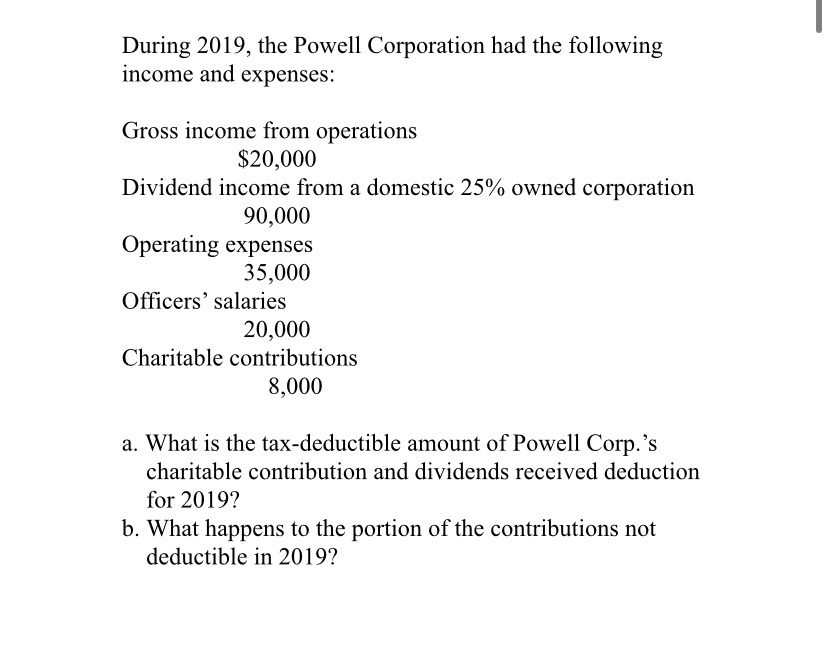

During 2019, the Powell Corporation had the following income and expenses: Gross income from operations $20,000 Dividend income from a domestic 25% owned corporation 90,000 Operating expenses 35,000 Officers' salaries 20,000 Charitable contributions 8,000 a. What is the tax-deductible amount of Powell Corp.'s charitable contribution and dividends received deduction for 2019? b. What happens to the portion of the contributions not deductible in 2019?

Step by Step Solution

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Tax deductible amount Gross Income from Operations Dividend Income Operating Expenses Officers sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2015

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

38th Edition

978-1305310810, 1305310810, 978-1285439631

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App