Chee, single, age 40, had the following income and expenses during 2017: Calculate Chee's taxable income for

Question:

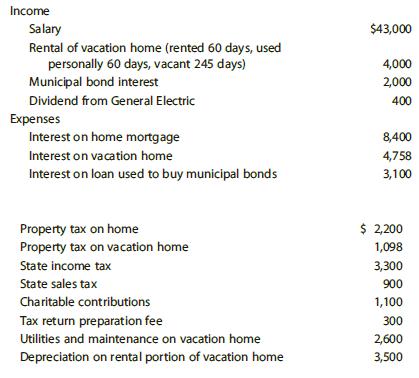

Chee, single, age 40, had the following income and expenses during 2017:

Calculate Chee's taxable income for the year before personal exemptions. If Chee has any options, choose the method that maximizes his deductions.

Transcribed Image Text:

Income $43,000 Salary Rental of vacation home (rented 60 days, used personally 60 days, vacant 245 days) Municipal bond interest 4,000 2,000 Dividend from General Electric 400 Expenses Interest on home mortgage 8,400 Interest on vacation home 4,758 Interest on loan used to buy municipal bonds 3,100 Property tax on home Property tax on vacation home $ 2,200 1,098 State income tax 3,300 State sales tax 900 Charitable contributions 1,100 Tax return preparation fee Utilities and maintenance on vacation home 300 2,600 Depreciation on rental portion of vacation home 3,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

Notes 1 The municipal bond interest of 2000 is excludible from gross income and the interest expense ...View the full answer

Answered By

Muhammad Ahtsham Shabbir

I am a professional freelance writer with more than 7 years’ experience in academic writing. I have a Bachelor`s Degree in Commerce and Master's Degree in Computer Science. I can provide my services in various subjects.

I have professional excellent skills in Microsoft ® Office packages such as Microsoft ® Word, Microsoft ® Excel, and Microsoft ® PowerPoint. Moreover, I have excellent research skills and outstanding analytical and critical thinking skills; a combination that I apply in every paper I handle.

I am conversant with the various citation styles, among them; APA, MLA, Chicago, Havard, and AMA. I also strive to deliver the best to my clients and in a timely manner.My work is always 100% original. I honestly understand the concern of plagiarism and its consequences. As such, I ensure that I check the assignment for any plagiarism before submission.

4.80+

392+ Reviews

587+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Ken (age 31) and Amy (age 28) Booth have brought you the following information regarding their income, expenses, and withholding for the year. They are unsure which of these items must be used to...

-

Russell (age 50) and Linda (age 45) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called...

-

Chee, single, age 40, had the following income and expenses during 2018: Income Salary ....................................................................................$43,000 Rental of vacation...

-

An analysis of spending by a sample of credit card bank cardholders shows that spending by cardholders in January (Jan) is related to their spending in December ( Dec): The assumptions and conditions...

-

1. Keckye Co. is a calendar year C corporation. When is Keckye's 2017 tax return due? a. March 15, 2018 b. April 16, 2018 c. June 15, 2018 d. October 15, 2018 2. Keckye Co. is a C corporation with a...

-

The following information is for Doug Santiago for the 2023 taxation year: Doug sold shares of a qualified small business corporation (QSBC), for $480,000. The ACB of the shares was $187,000. and...

-

How does PizzaHut.com incorporate the seven website design elements?

-

The financial statements of P&G are presented in Appendix B. The companys complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&Gs...

-

\\\\table[[,,Decemt,\\\\table[[Balance Sheet],[er 31,20\\\\times x ( $ millions)]],],[10,Assets, $7 ,\\\\table[[Liabilities and Shareholders' Eq],[Accounts payable]],Equity],[points,Account...

-

Nancy Nanny opened a child-care facility on January 1, Year 1. Use the Chart of Accounts below to complete the requirements on the following pages for Nancy Nanny Child Care. NANCY NANNY CHILD...

-

Using information from this chapter as well as information from the tax agency in your state (likely called the Department of Revenue) and your local government, find all of the taxes to which a sole...

-

Aman, a sole proprietor and rental property owner, had the following expenses in 2017: Specify whether each expense would be deducted for adjusted gross income (AGI) or from AGI on Amans 2017 tax...

-

Regard the enthalpy as a function of T and P. Use the cyclic rule to obtain the expression , Cp ,

-

In Exercises 25-28, construct a data set that has the given statistics. N = 8 2 3

-

Sample SAT scores for eight males and eight females are listed. Males 1010 1170 1410 920 1320 1100 690 1140 Females 1190 1010 1000 1300 1470 1250 840 1060

-

Best Actor 2018: Gary Oldman, Age: 59 Best Supporting Actor 2018: Sam Rockwell, Age: 49 The table shows population statistics for the ages of Best Actor and Best Supporting Actor winners at the...

-

Consider a market dominated by just two airlines, American and United. Each can choose to restrict capacity and charge a high price or expand capacity and charge a low price. If one of the two...

-

Using the product structure for Alpha in Solved Problem 14.1, and the following lead times, quantity on hand, and master production schedule, prepare a net MRP table for Alphas. Data From Problem...

-

According to the International Atomic Energy Agency, electricity per-capita consumption in Canada was 16,621 kWh in 2016.5 A random sample of 51 households was monitored for one year to determine...

-

What types of inventory issues Starbucks might reflect upon at the end of each year? The mission of Starbucks is to inspire and nurture the human spiritone person, one cup, and one neighborhood at a...

-

In the current year, Jeanette, an individual in the 25% marginal tax bracket, recognized a $20,000 long-term capital gain. Also in the current year, Parrot Corporation, a C corporation in the 25%...

-

In the current year, Jeanette, an individual in the 25% marginal tax bracket, recognized a $20,000 long-term capital gain. Also in the current year, Parrot Corporation, a C corporation in the 25%...

-

John (a sole proprietor) and Eagle Corporation (a C corporation) each recognize a long-term capital gain of $10,000 and a short-term capital loss of $18,000 on the sale of capital assets. Neither...

-

7 . 4 3 Buy - side vs . sell - side analysts' earnings forecasts. Refer to the Financial Analysts Journal ( July / August 2 0 0 8 ) study of earnings forecasts of buy - side and sell - side analysts,...

-

Bond P is a premium bond with a coupon of 8.6 percent , a YTM of 7.35 percent, and 15 years to maturity. Bond D is a discount bond with a coupon of 8.6 percent, a YTM of 10.35 percent, and also 15...

-

QUESTION 2 (25 MARKS) The draft financial statements of Sirius Bhd, Vega Bhd, Rigel Bhd and Capella for the year ended 31 December 2018 are as follows: Statement of Profit or Loss for the year ended...

Study smarter with the SolutionInn App