Answered step by step

Verified Expert Solution

Question

1 Approved Answer

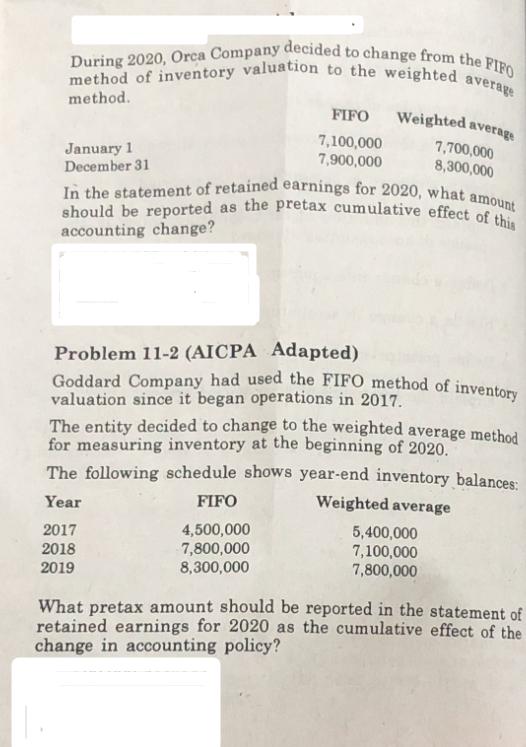

During 2020, Orca Company decided to change from the FIFO method of inventory valuation to the weighted average method. January 1 December 31 FIFO

During 2020, Orca Company decided to change from the FIFO method of inventory valuation to the weighted average method. January 1 December 31 FIFO Weighted average 7,100,000 7,900,000 In the statement of retained earnings for 2020, what amount should be reported as the pretax cumulative effect of this accounting change? 7,700,000 8,300,000 Problem 11-2 (AICPA Adapted) Goddard Company had used the FIFO method of inventory valuation since it began operations in 2017. 2017 2018 2019 The entity decided to change to the weighted average method for measuring inventory at the beginning of 2020. The following schedule shows year-end inventory balances: Weighted average Year FIFO 4,500,000 7,800,000 8,300,000 5,400,000 7,100,000 7,800,000 What pretax amount should be reported in the statement of retained earnings for 2020 as the cumulative effect of the change in accounting policy?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Q1 FIFO Weighted average Difference January 1 7200000 7700000 500000 Decemb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started