Answered step by step

Verified Expert Solution

Question

1 Approved Answer

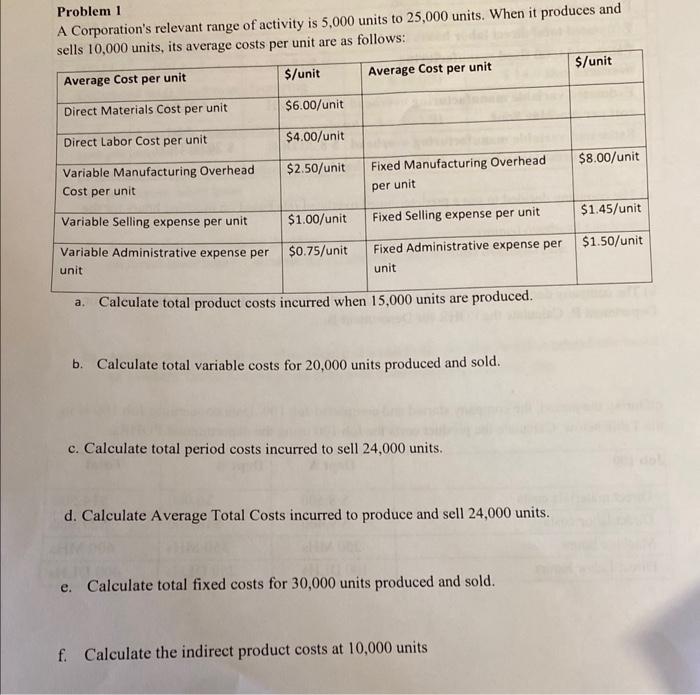

Problem 1 A Corporation's relevant range of activity is 5,000 units to 25,000 units. When it produces and sells 10,000 units, its average costs

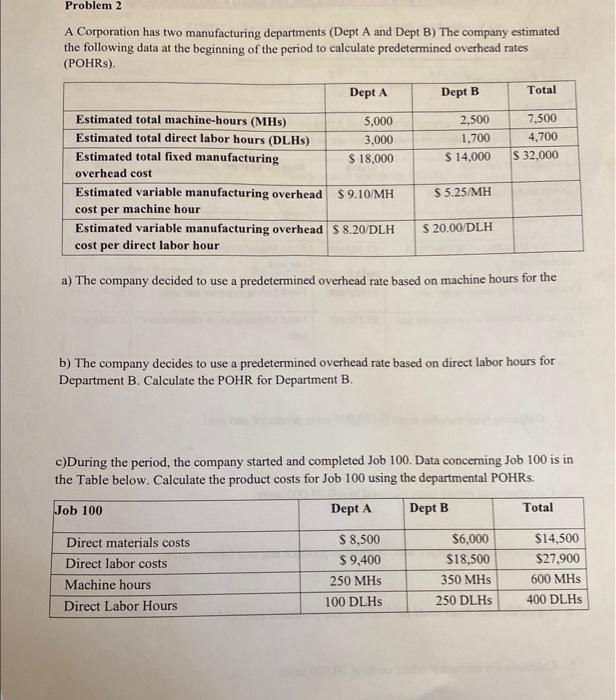

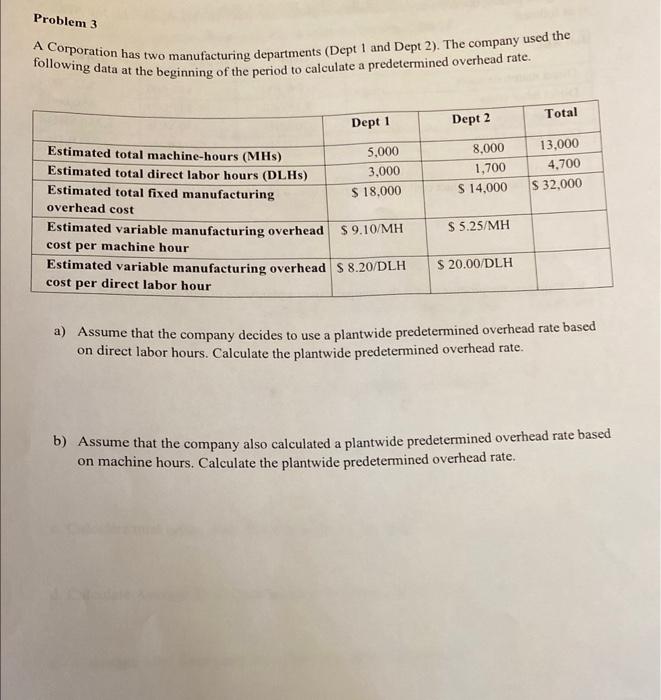

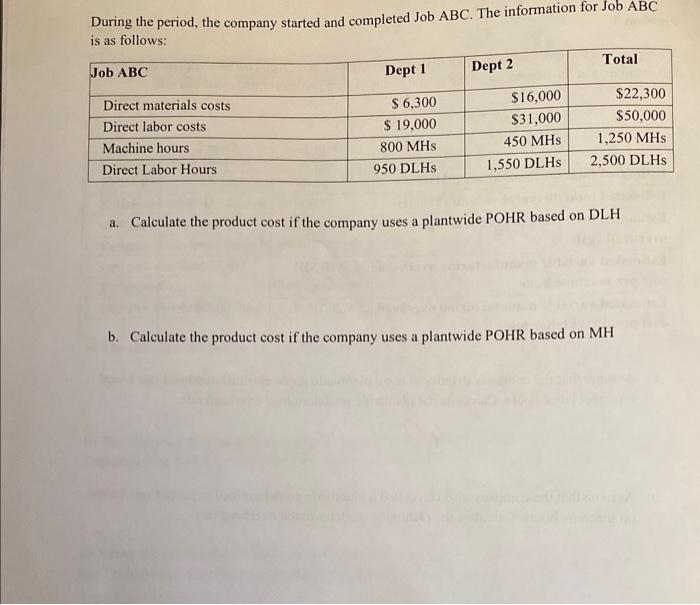

Problem 1 A Corporation's relevant range of activity is 5,000 units to 25,000 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost per unit $/unit Average Cost per unit Direct Materials Cost per unit Direct Labor Cost per unit Variable Manufacturing Overhead Cost per unit Variable Selling expense per unit Variable Administrative expense per unit $6.00/unit $4.00/unit $2.50/unit $1.00/unit $0.75/unit Fixed Manufacturing Overhead. per unit Fixed Selling expense per unit Fixed Administrative expense per unit a. Calculate total product costs incurred when 15,000 units are produced. b. Calculate total variable costs for 20,000 units produced and sold. c. Calculate total period costs incurred to sell 24,000 units. d. Calculate Average Total Costs incurred to produce and sell 24,000 units. e. Calculate total fixed costs for 30,000 units produced and sold. f. Calculate the indirect product costs at 10,000 units $/unit $8.00/unit $1.45/unit $1.50/unit Problem 2 A Corporation has two manufacturing departments (Dept A and Dept B) The company estimated the following data at the beginning of the period to calculate predetermined overhead rates (POHRS). Estimated total machine-hours (MHs) Estimated total direct labor hours (DLHS) Estimated total fixed manufacturing overhead cost Dept A 5,000 3,000 $ 18,000 Job 100 Direct materials costs Direct labor costs Machine hours Direct Labor Hours Dept B 2,500 1,700 $ 14,000 Estimated variable manufacturing overhead $9.10/MH cost per machine hour Estimated variable manufacturing overhead S 8.20/DLH $ 20.00/DLH cost per direct labor hour a) The company decided to use a predetermined overhead rate based on machine hours for the $ 8,500 $ 9,400 250 MHs 100 DLHs $ 5.25/MH b) The company decides to use a predetermined overhead rate based on direct labor hours for Department B. Calculate the POHR for Department B. Total c)During the period, the company started and completed Job 100. Data concerning Job 100 is in the Table below. Calculate the product costs for Job 100 using the departmental POHRs. Dept A Dept B 7,500 4,700 $ 32,000 $6,000 $18,500 350 MHs 250 DLHS Total $14,500 $27,900 600 MHs 400 DLHs Problem 3 A Corporation has two manufacturing departments (Dept 1 and Dept 2). The company used the following data at the beginning of the period to calculate a predetermined overhead rate. Estimated total machine-hours (MHS) Estimated total direct labor hours (DLHs) Estimated total fixed manufacturing overhead cost Estimated variable manufacturing overhead cost per machine hour Dept 1 5,000 3,000 $ 18,000 $ 9.10/MH Estimated variable manufacturing overhead S 8.20/DLH cost per direct labor hour Dept 2 8,000 1,700 $ 14,000 $ 5.25/MH $ 20.00/DLH Total 13,000 4,700 $ 32,000 a) Assume that the company decides to use a plantwide predetermined overhead rate based on direct labor hours. Calculate the plantwide predetermined overhead rate. b) Assume that the company also calculated a plantwide predetermined overhead rate based on machine hours. Calculate the plantwide predetermined overhead rate. During the period, the company started and completed Job ABC. The information for Job ABC is as follows: Job ABC Direct materials costs. Direct labor costs Machine hours Direct Labor Hours. Dept 1 $ 6,300 $ 19,000 800 MHS 950 DLHS Dept 2 $16,000 $31,000 450 MHs 1,550 DLHs Total $22,300 $50,000 1,250 MHS 2,500 DLHs a. Calculate the product cost if the company uses a plantwide POHR based on DLH b. Calculate the product cost if the company uses a plantwide POHR based on MH

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 a Total Product Costs for 15000 units Total Product Costs Direct Materials Cost Direct Labor Cost Variable Manufacturing Overhead Fixed Manufacturing Overhead Number of Units Produced 600 40...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started