Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2020, Salina's grandfather died and she inherited land worth $30,000. The grandfather had purchased the land 20 years earlier for $2,000. Later in

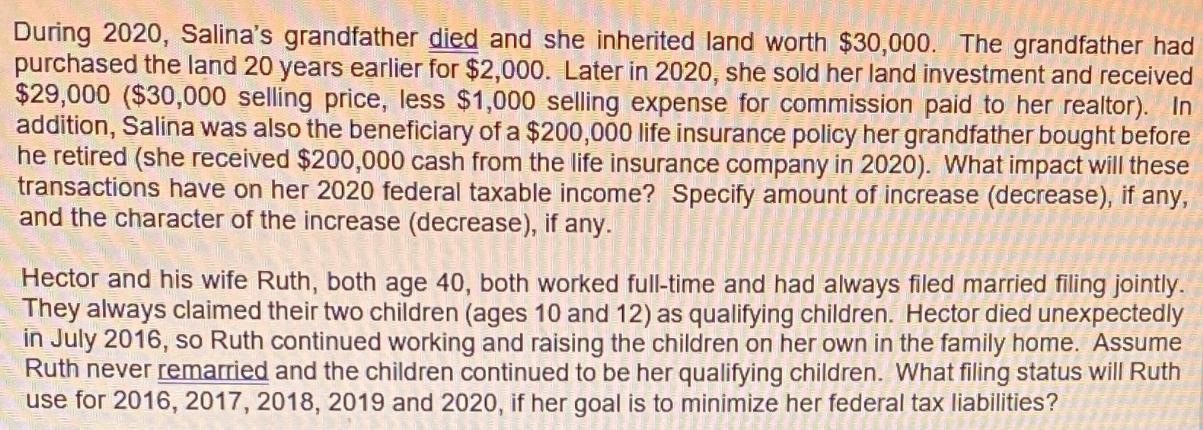

During 2020, Salina's grandfather died and she inherited land worth $30,000. The grandfather had purchased the land 20 years earlier for $2,000. Later in 2020, she sold her land investment and received $29,000 ($30,000 selling price, less $1,000 selling expense for commission paid to her realtor). In addition, Salina was also the beneficiary of a $200,000 life insurance policy her grandfather bought before he retired (she received $200,000 cash from the life insurance company in 2020). What impact will these transactions have on her 2020 federal taxable income? Specify amount of increase (decrease), if any, and the character of the increase (decrease), if any. Hector and his wife Ruth, both age 40, both worked full-time and had always filed married filing jointly. They always claimed their two children (ages 10 and 12) as qualifying children. Hector died unexpectedly in July 2016, so Ruth continued working and raising the children on her own in the family home. Assume Ruth never remarried and the children continued to be her qualifying children. What filing status will Ruth use for 2016, 2017, 2018, 2019 and 2020, if her goal is to minimize her federal tax liabilities?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Salinas Taxable Income Impact Inheritance of Land Salina received inherited land worth 30000 For federal income tax purposes inheriting property gener...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started