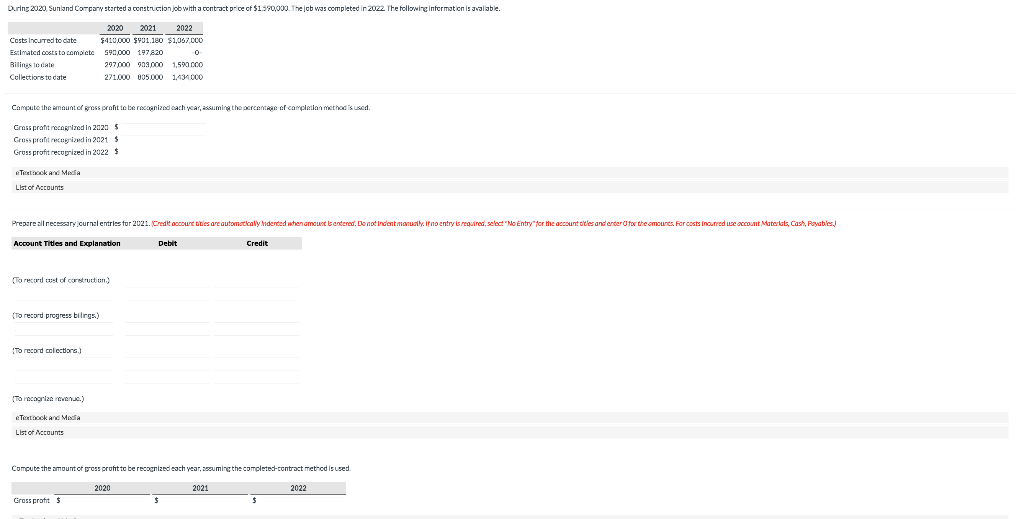

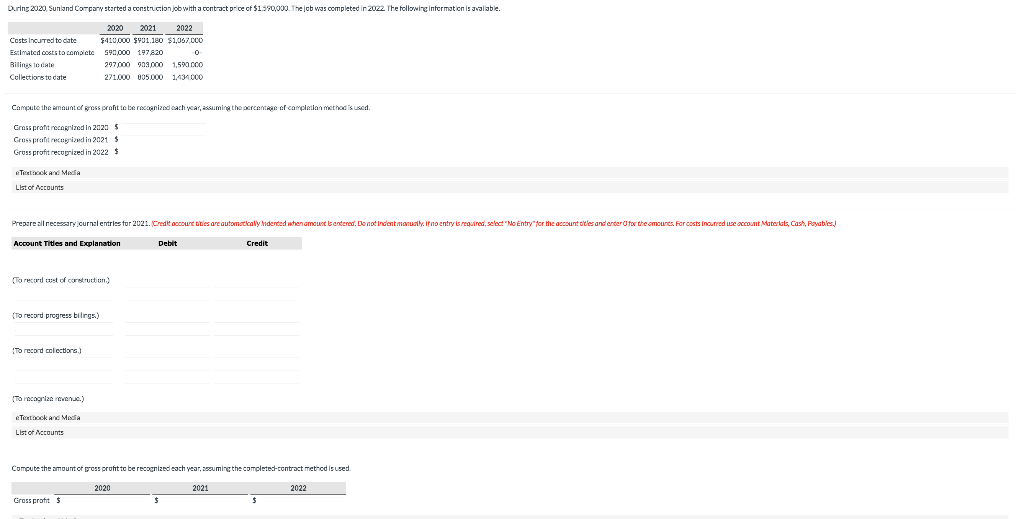

During 2020, Sunland Company started a construction job with a contract price of $1.590,000. The cb was completed in 2022. The following information is available. Costs incurred to date Estimated costs to complicto Bilinastocate Collections to cate 2020 2021 2022 $410,000 $401,180 $1,067.000 S90,000 197 820 0 297000 909.000 1.500.000 221.000 05.000 1.4137000 Campute the amount of gross proht to be recanizadach year, assuming the con of completion method is used. Gross profit necognized in 2020 $ Grosspracyclin 2021 $ Gruss profit recuprized in 2022 $ Tetokand Moda List of Accounts Prepare all necessary ournal entries for 2021. Create account bibles are automatically indented when amount is entered. Do not indent manually it no entry is required, select "No Entry"for the accountotes and ender for the amounts. For costs incurred use account Materials, Cash, Royables. Account Titles and Explanation Debit Credit To record cost of construction) (To record progress bilings) To record eclectors.) To recognizer .) Tetok And Moda List of Accounts Compute the amount of gross proht to be recognized each year, asuming the completed-contract method is used 2020 2021 2022 Gross profit $ During 2020, Sunland Company started a construction job with a contract price of $1.590,000. The cb was completed in 2022. The following information is available. Costs incurred to date Estimated costs to complicto Bilinastocate Collections to cate 2020 2021 2022 $410,000 $401,180 $1,067.000 S90,000 197 820 0 297000 909.000 1.500.000 221.000 05.000 1.4137000 Campute the amount of gross proht to be recanizadach year, assuming the con of completion method is used. Gross profit necognized in 2020 $ Grosspracyclin 2021 $ Gruss profit recuprized in 2022 $ Tetokand Moda List of Accounts Prepare all necessary ournal entries for 2021. Create account bibles are automatically indented when amount is entered. Do not indent manually it no entry is required, select "No Entry"for the accountotes and ender for the amounts. For costs incurred use account Materials, Cash, Royables. Account Titles and Explanation Debit Credit To record cost of construction) (To record progress bilings) To record eclectors.) To recognizer .) Tetok And Moda List of Accounts Compute the amount of gross proht to be recognized each year, asuming the completed-contract method is used 2020 2021 2022 Gross profit $