Answered step by step

Verified Expert Solution

Question

1 Approved Answer

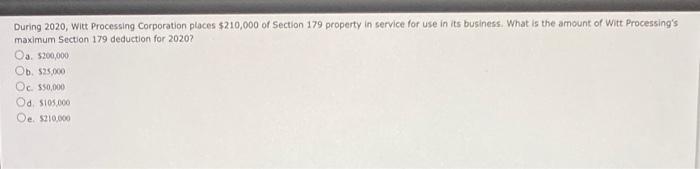

During 2020, Witt Processing Corporation places $210,000 of Section 179 property in service for use in its business. What is the amount of Witt

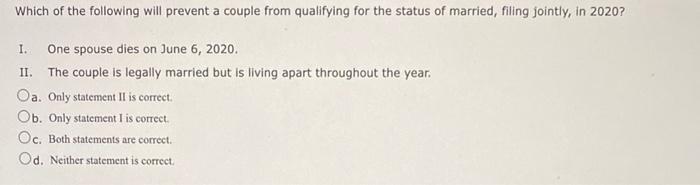

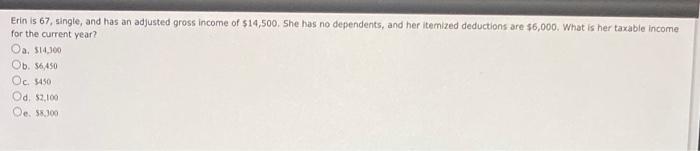

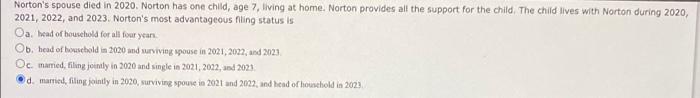

During 2020, Witt Processing Corporation places $210,000 of Section 179 property in service for use in its business. What is the amount of Witt Processing's maximum Section 179 deduction for 2020? Oa. $200,000 Ob. $25,000 Oc. $50,000 Od. $105,000 Oe. $210,000 Which of the following will prevent a couple from qualifying for the status of married, filing jointly, in 2020? I. One spouse dies on June 6, 2020. II. The couple is legally married but is living apart throughout the year. Oa. Only statement II is correct. Ob. Only statement I is correct. Oc. Both statements are correct. Od. Neither statement is correct. Erin is 67, single, and has an adjusted gross income of $14,500. She has no dependents, and her itemized deductions are $6,000. What is her taxable income for the current year? Oa. $14,300 Ob. 56,450 Oc. $450 Od. $2,100 Oe. $8,300 Norton's spouse died in 2020. Norton has one child, age 7, living at home. Norton provides all the support for the child. The child lives with Norton during 2020, 2021, 2022, and 2023. Norton's most advantageous filing status is Oa. head of household for all four years. Ob. head of household in 2020 and surviving spouse in 2021, 2022, and 2023 Oc. married, filing jointly in 2020 and single in 2021, 2022, and 2023. d. married, filing jointly in 2020, surviving spouse in 2021 and 2022, and head of household in 2023

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Answer e 210000 Section 179 allows for businesses to deduct the cost of qualifying equipment ando...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started