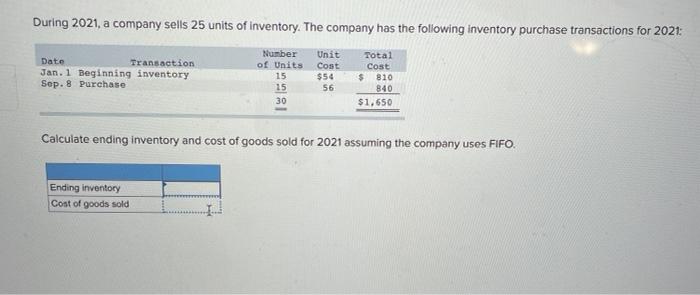

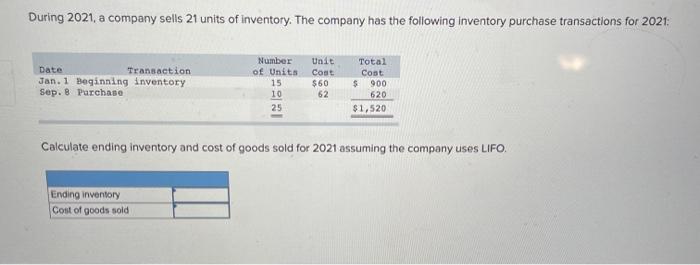

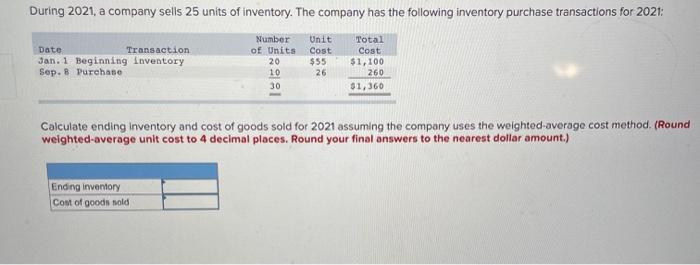

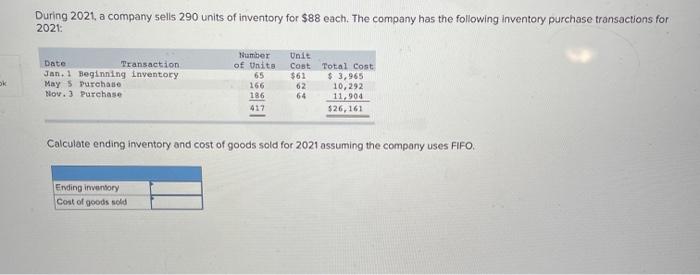

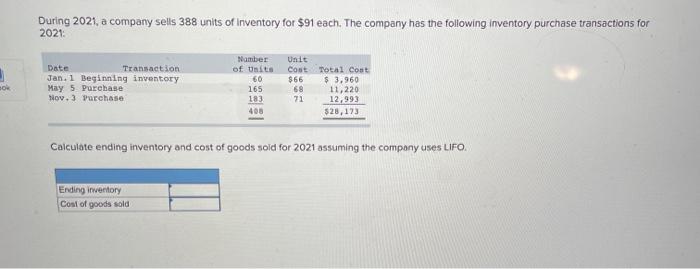

During 2021, a company sells 25 units of inventory. The company has the following inventory purchase transactions for 2021: Date Transaction Jan. 1 Beginning inventory Sep.8 Purchase Number of Units 15 15 30 Unit Cost $54 56 Total Cost $ 810 840 $1.650 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses FIFO. Ending inventory Cost of goods sold During 2021, a company sells 21 units of inventory. The company has the following Inventory purchase transactions for 2021: Date Transaction Jan. 1 Beginning inventory Sep. 8 Parchase Number of Units 15 10 25 Unit Cost $60 62 Total Cost $ 900 620 $1,520 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses LIFO. Ending inventory Cost of goods sold During 2021, a company sells 25 units of inventory. The company has the following inventory purchase transactions for 2021: Date Transaction Jan. 1 Beginning inventory Sep. Purchase Number of Units 20 10 30 Unit Cost $55 Total Cost $1,100 260 $1,360 26 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses the weighted-average cost method. (Round weighted-average unit cost to 4 decimal places. Round your final answers to the nearest dollar amount.) Ending inventory Cont of goods nold During 2021, a company sells 290 units of inventory for $88 each. The company has the following inventory purchase transactions for 2021: ok Date Transaction Jan. 1 Beginning inventory May $ Purchase Nov.) Purchase Number of Units 65 166 186 417 Unit Cost Total Cost $61 $ 3,965 62 10,292 64 11,904 $26,161 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses FIFO. Erding inventory Cost of goods sold During 2021, a company sells 388 units of Inventory for $91 each. The company has the following inventory purchase transactions for 2021 . ok Namber of Units 60 Date Transaction Jan.1 Beginning inventory May 5 Parchase Nov.) Purchase 165 Unit Cost Total Cost $66 $ 3,960 68 11,220 71 12,993 $28,173 183 Calculote ending inventory and cost of goods sold for 2021 assuming the company uses LIFO. Ending inventory Cost of goods sold