Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2021, CAPTAIN AMERICA Company had two classes of shares issued and outstanding for the entire year. Additional information are as follows: Ordinary share

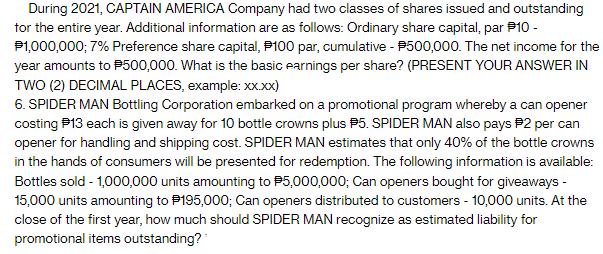

During 2021, CAPTAIN AMERICA Company had two classes of shares issued and outstanding for the entire year. Additional information are as follows: Ordinary share capital, par P10 - P1,000,000; 7% Preference share capital, P100 par, cumulative - $500,000. The net income for the year amounts to $500,000. What is the basic earnings per share? (PRESENT YOUR ANSWER IN TWO (2) DECIMAL PLACES, example: xx.xx) 6. SPIDER MAN Bottling Corporation embarked on a promotional program whereby a can opener costing P13 each is given away for 10 bottle crowns plus P5. SPIDER MAN also pays #2 per can opener for handling and shipping cost. SPIDER MAN estimates that only 40% of the bottle crowns in the hands of consumers will be presented for redemption. The following information is available: Bottles sold - 1,000,000 units amounting to $5,000,000; Can openers bought for giveaways - 15,000 units amounting to P195,000; Can openers distributed to customers - 10,000 units. At the close of the first year, how much should SPIDER MAN recognize as estimated liability for promotional items outstanding?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

6 To calculate the basic earnings per share EPS we need to determine the weighted average number of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started