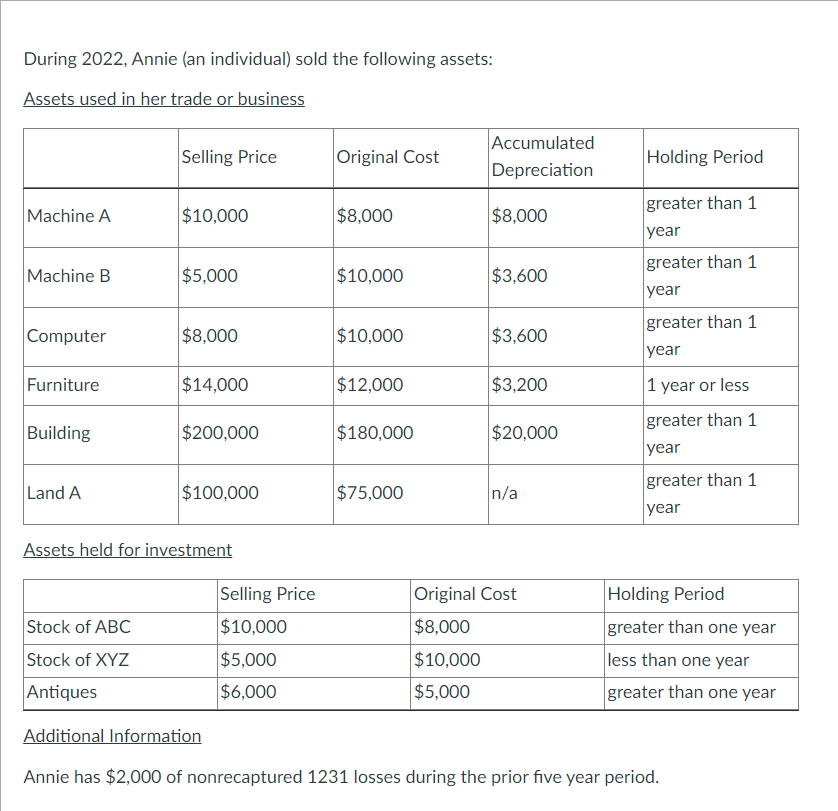

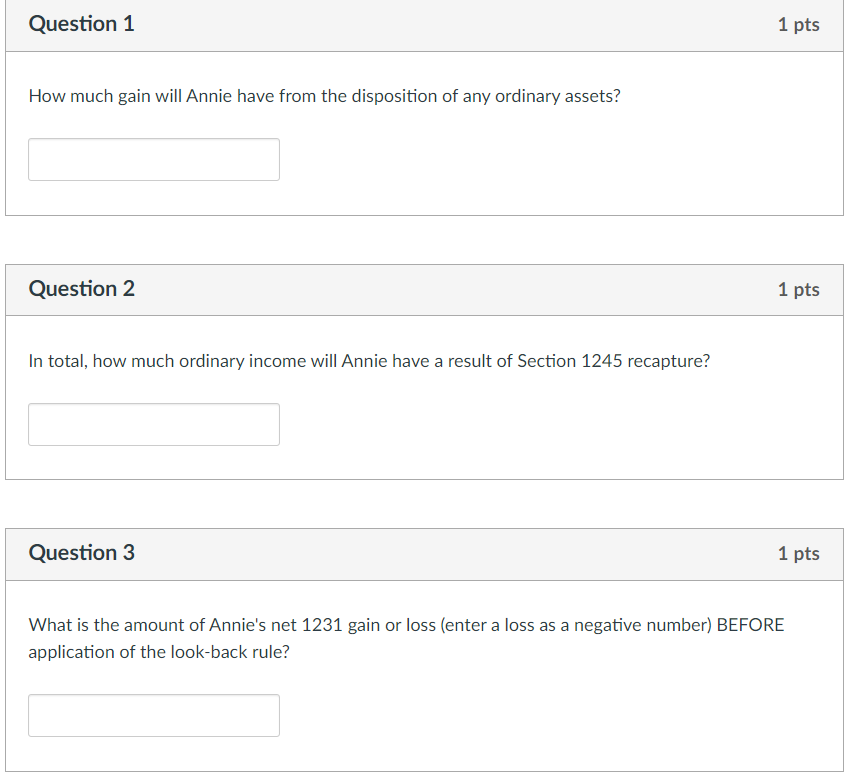

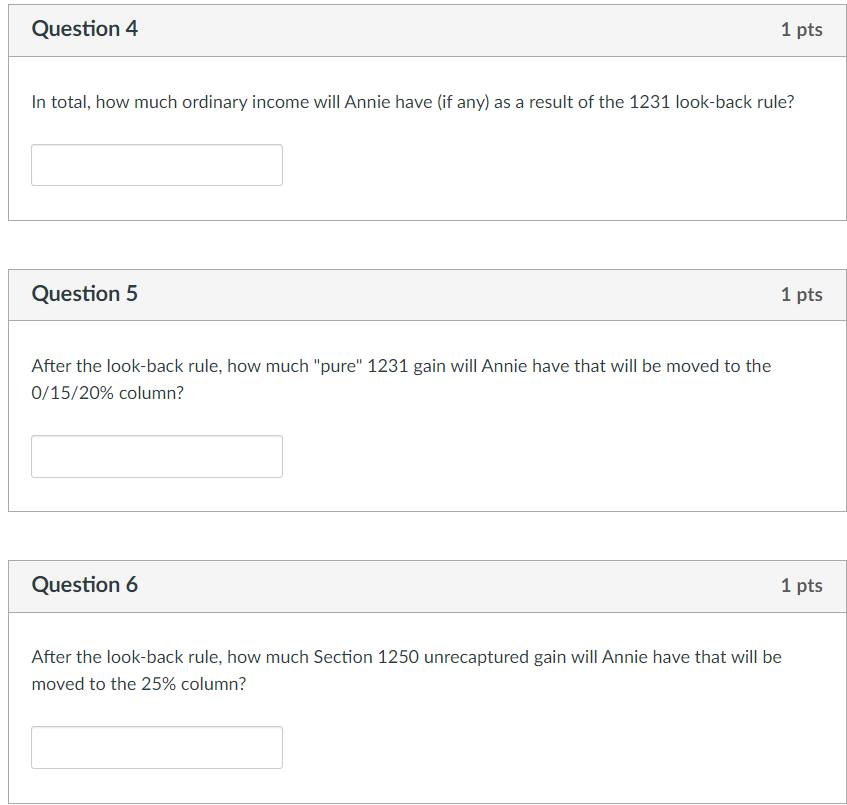

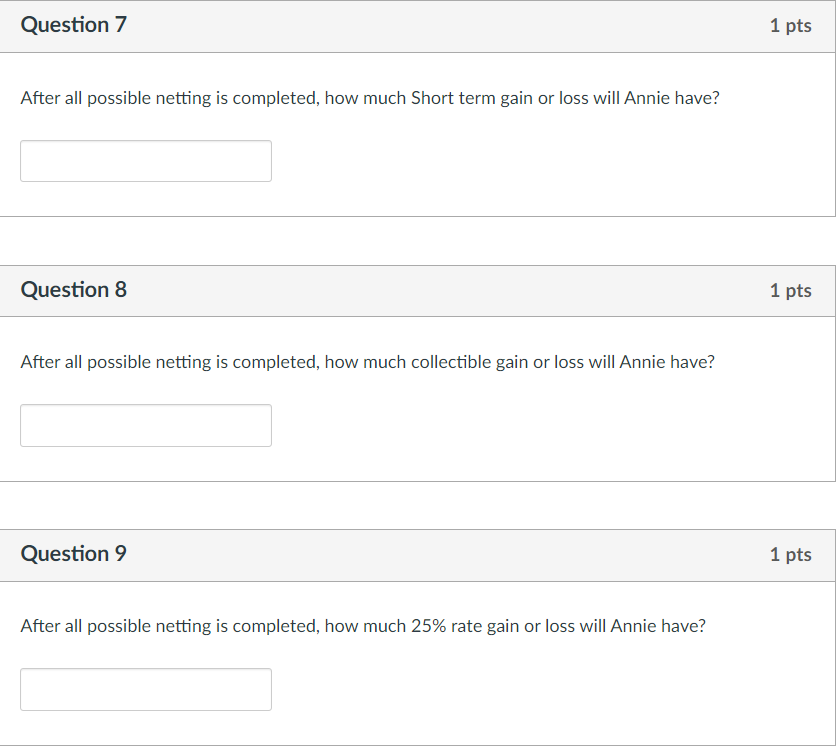

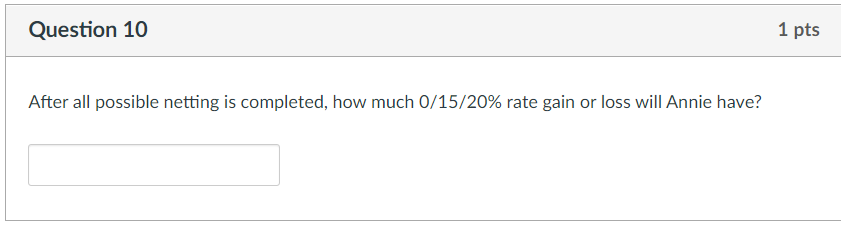

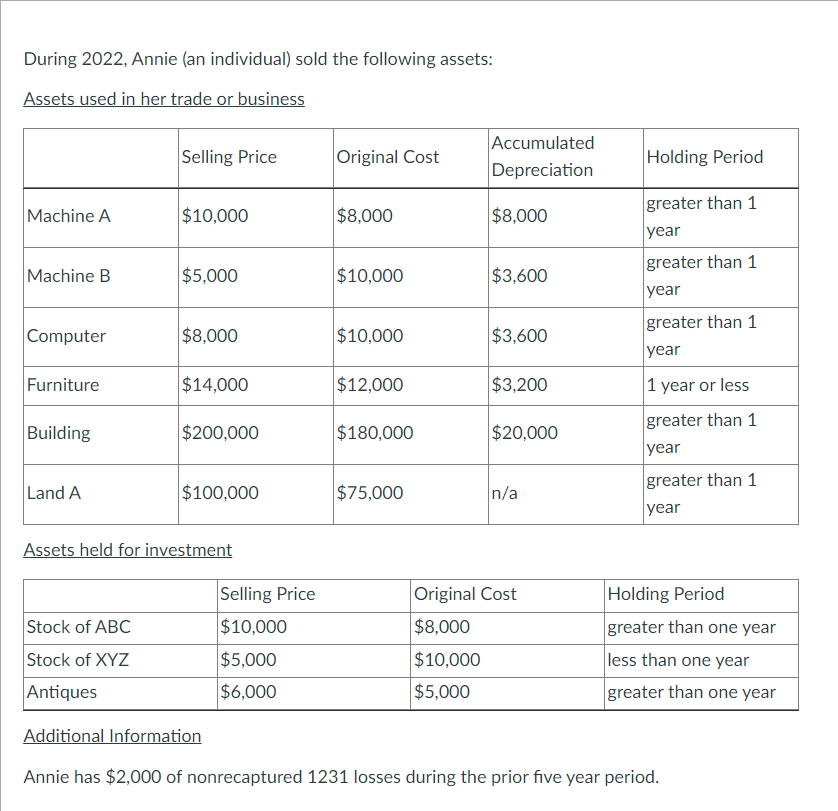

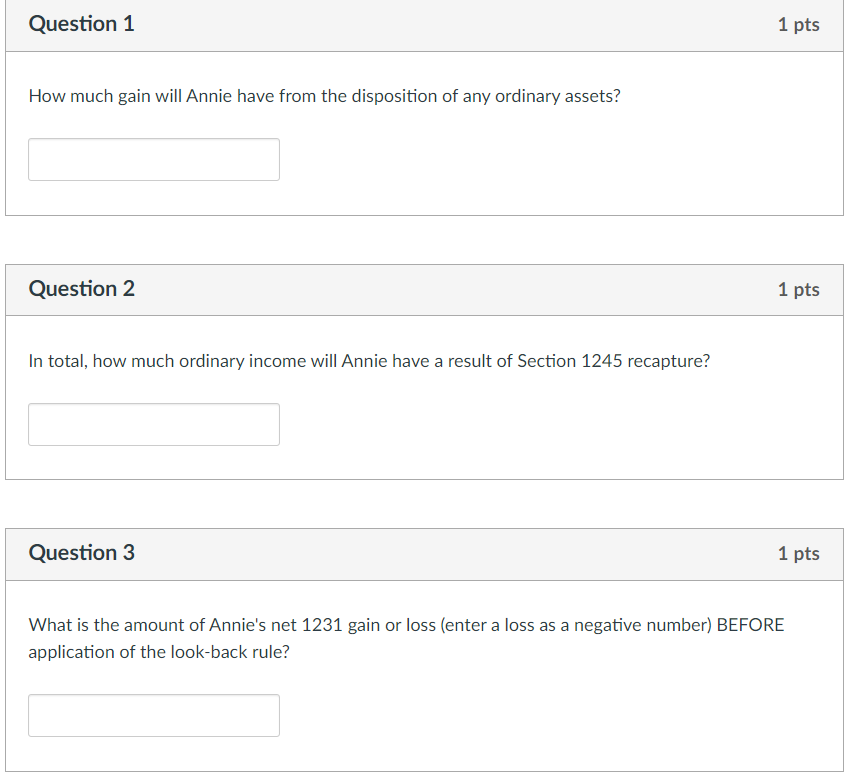

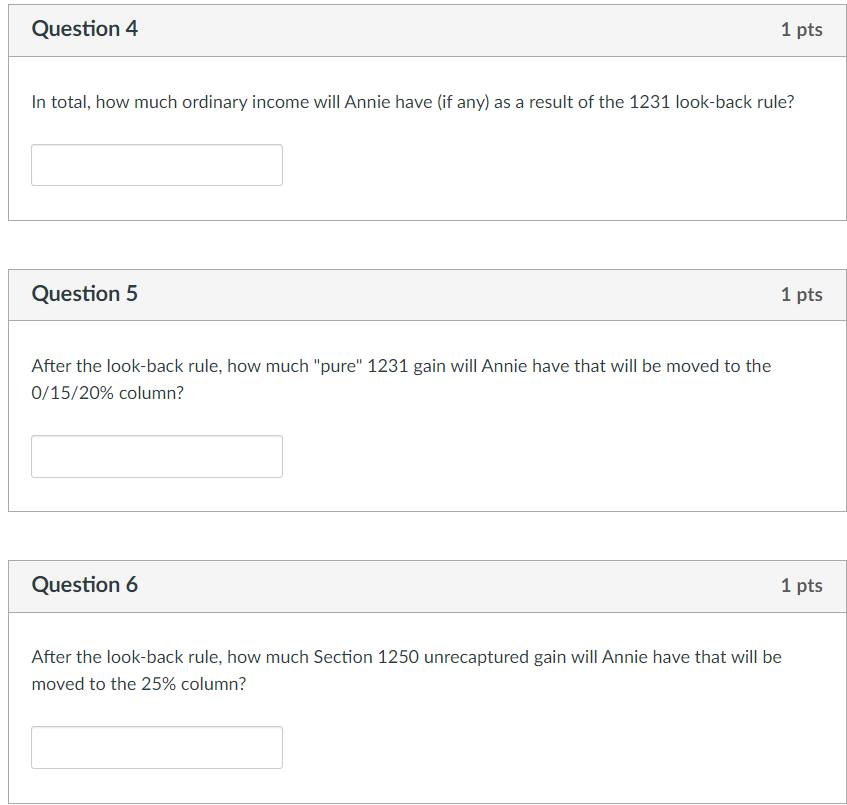

During 2022, Annie (an individual) sold the following assets: Assets used in her trade or business Assets held for investment Additional Information Annie has $2,000 of nonrecaptured 1231 losses during the prior five year period. How much gain will Annie have from the disposition of any ordinary assets? Question 2 In total, how much ordinary income will Annie have a result of Section 1245 recapture? Question 3 What is the amount of Annie's net 1231 gain or loss (enter a loss as a negative number) BEFORE application of the look-back rule? In total, how much ordinary income will Annie have (if any) as a result of the 1231 look-back rule? Question 5 1p After the look-back rule, how much "pure" 1231 gain will Annie have that will be moved to the 0/15/20% column? Question 6 After the look-back rule, how much Section 1250 unrecaptured gain will Annie have that will be moved to the 25% column? After all possible netting is completed, how much Short term gain or loss will Annie have? Question 8 After all possible netting is completed, how much collectible gain or loss will Annie have? Question 9 After all possible netting is completed, how much 25% rate gain or loss will Annie have? After all possible netting is completed, how much 0/15/20\% rate gain or loss will Annie have? During 2022, Annie (an individual) sold the following assets: Assets used in her trade or business Assets held for investment Additional Information Annie has $2,000 of nonrecaptured 1231 losses during the prior five year period. How much gain will Annie have from the disposition of any ordinary assets? Question 2 In total, how much ordinary income will Annie have a result of Section 1245 recapture? Question 3 What is the amount of Annie's net 1231 gain or loss (enter a loss as a negative number) BEFORE application of the look-back rule? In total, how much ordinary income will Annie have (if any) as a result of the 1231 look-back rule? Question 5 1p After the look-back rule, how much "pure" 1231 gain will Annie have that will be moved to the 0/15/20% column? Question 6 After the look-back rule, how much Section 1250 unrecaptured gain will Annie have that will be moved to the 25% column? After all possible netting is completed, how much Short term gain or loss will Annie have? Question 8 After all possible netting is completed, how much collectible gain or loss will Annie have? Question 9 After all possible netting is completed, how much 25% rate gain or loss will Annie have? After all possible netting is completed, how much 0/15/20\% rate gain or loss will Annie have