During 2022, Pet Kingdom made estimated tax payments of $56,000 each quarter to the IRS. Prepare Pet Kingdom's corporate tax return for tax year 2022 using Form 1120 (and any other appropriate forms and schedules).

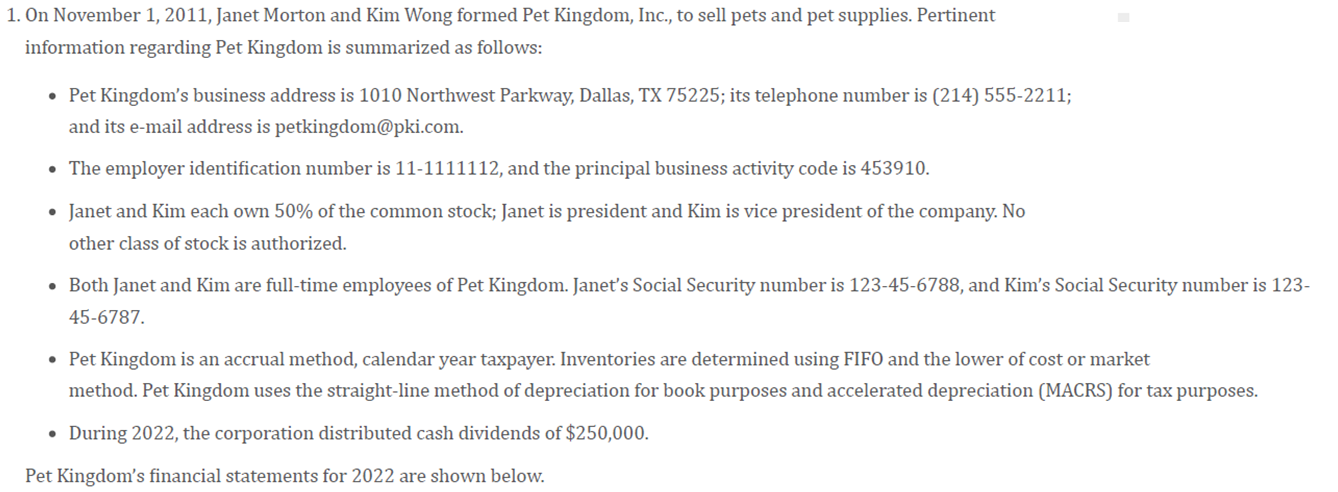

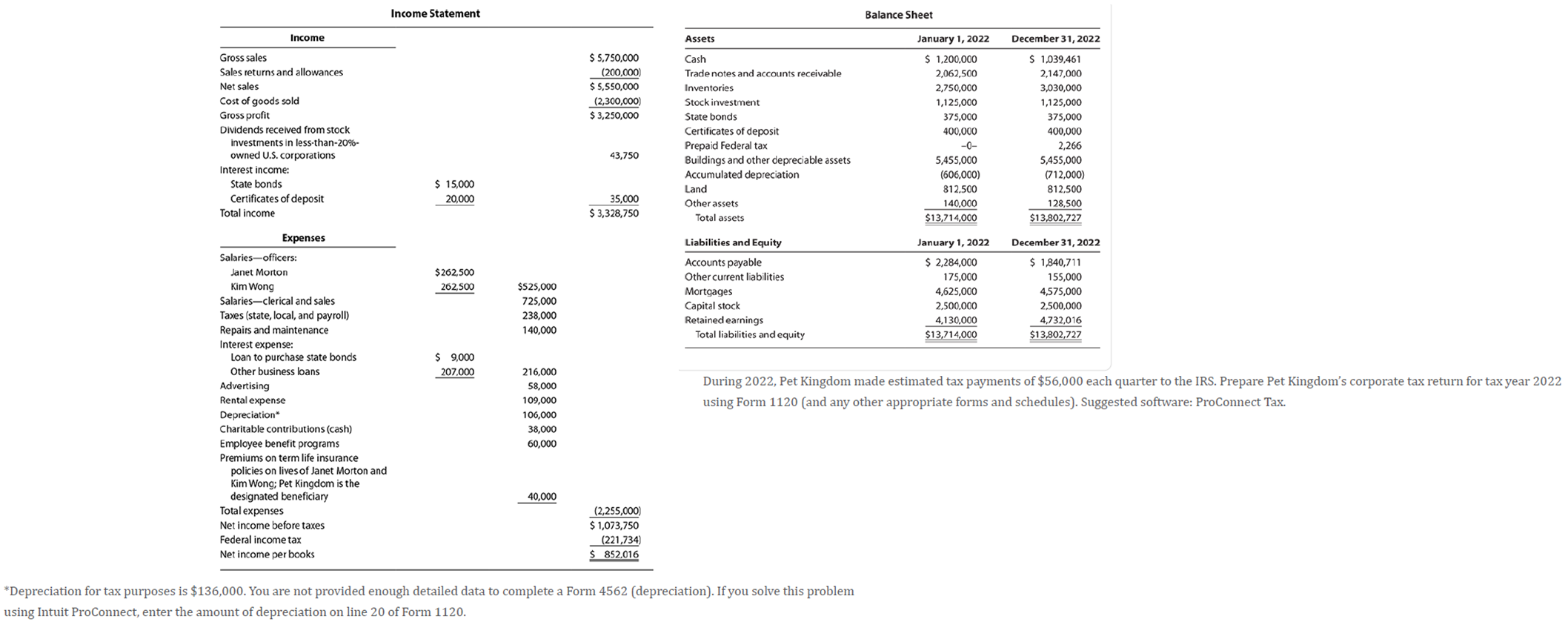

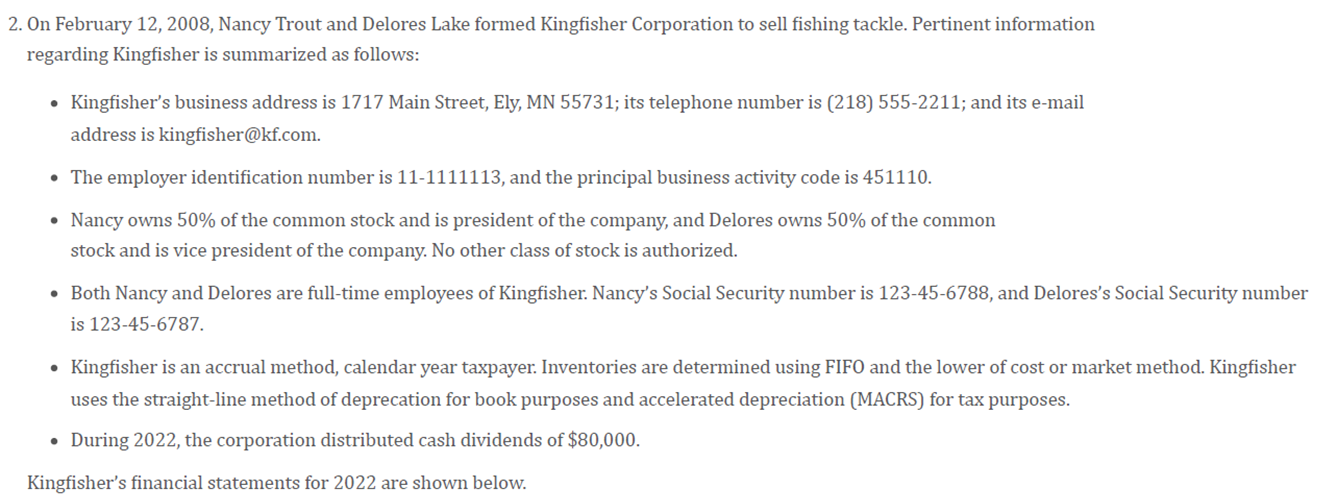

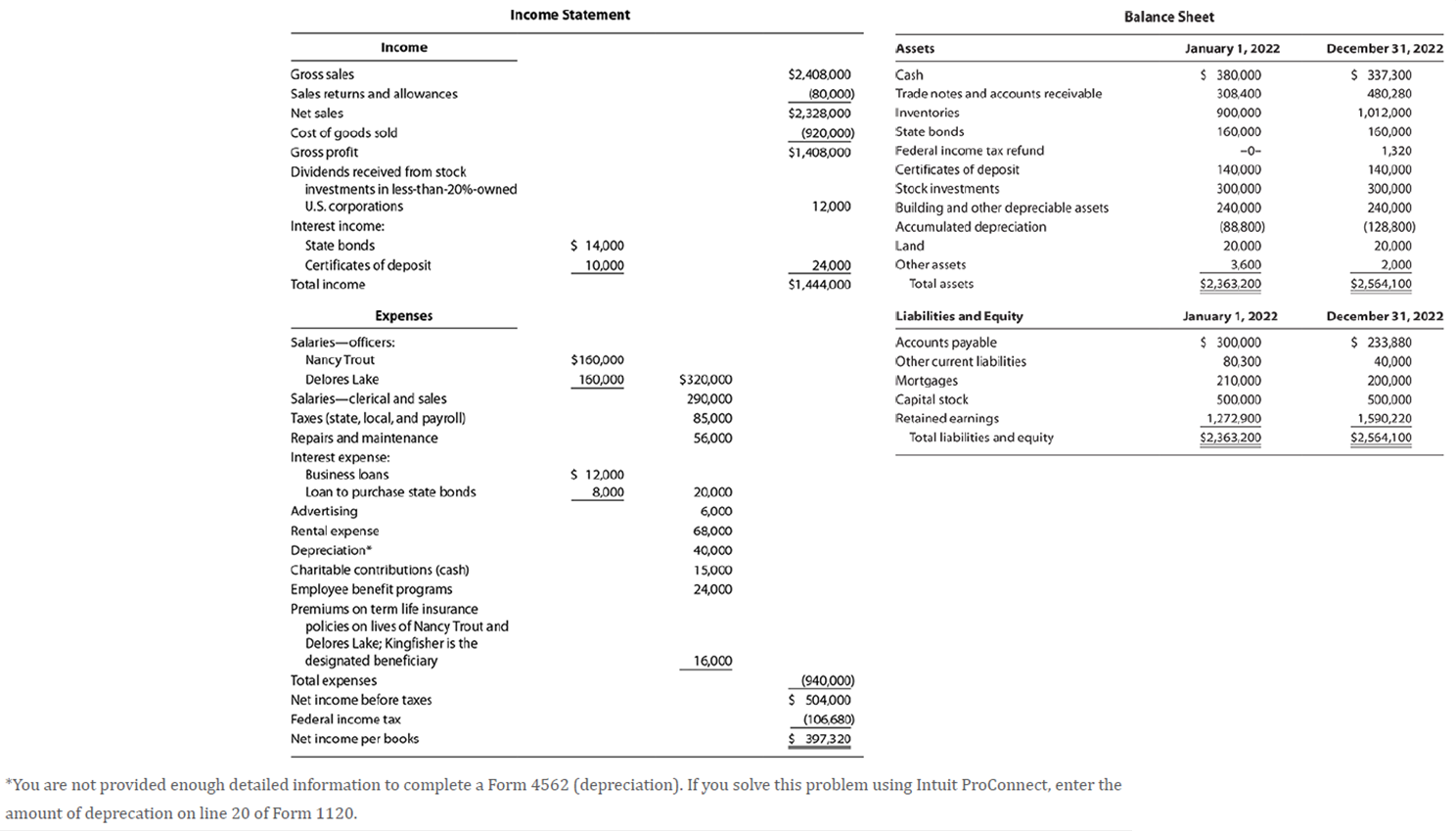

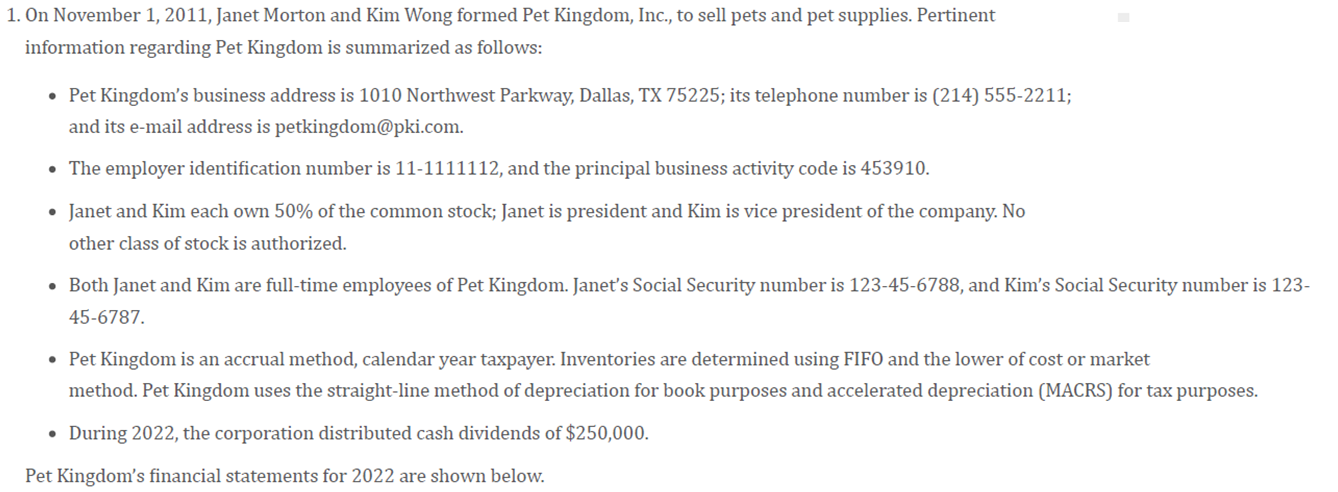

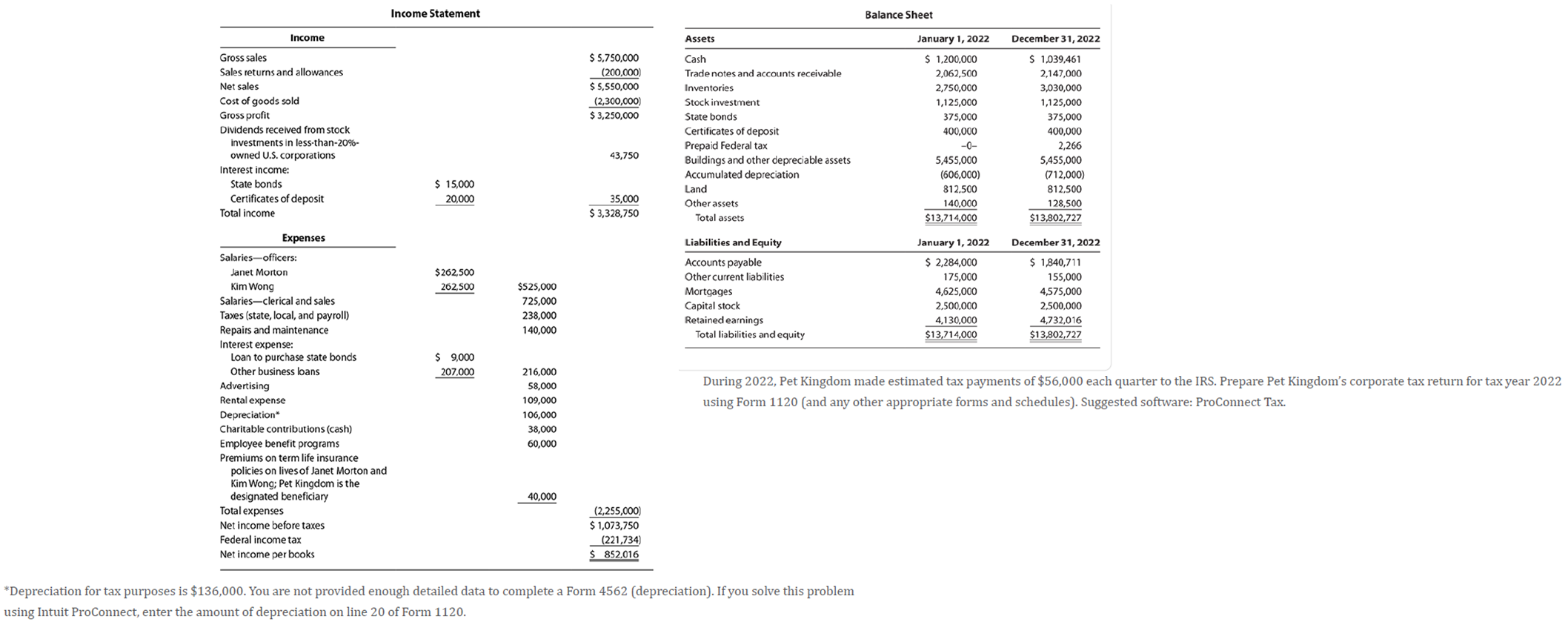

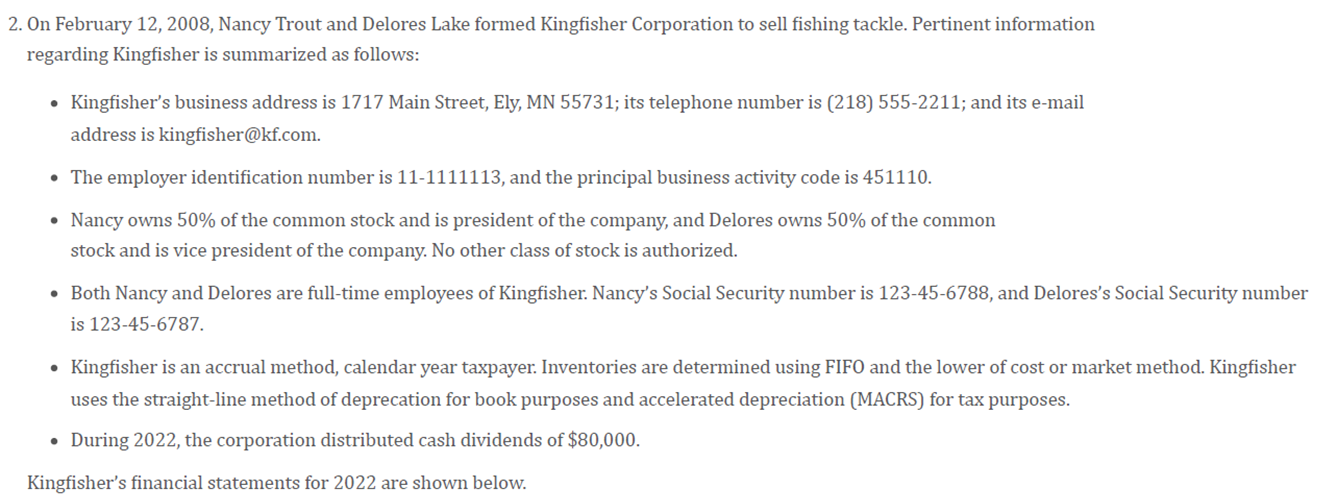

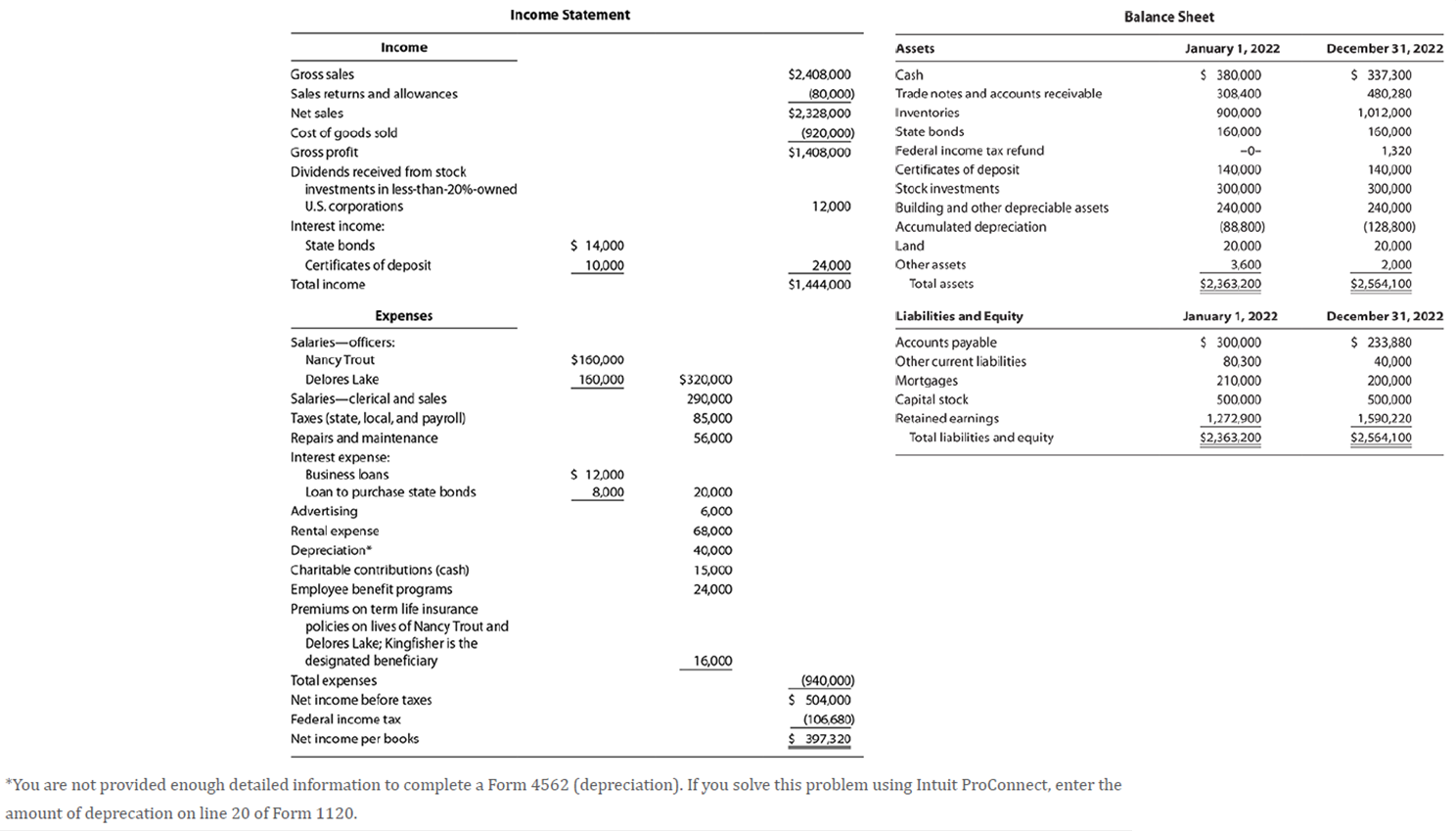

1. On November 1, 2011, Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows: - Pet Kingdom's business address is 1010 Northwest Parkway, Dallas, TX 75225; its telephone number is (214) 555-2211; and its e-mail address is petkingdom@pki.com. - The employer identification number is 11-1111112, and the principal business activity code is 453910 . - Janet and Kim each own 50% of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized. - Both Janet and Kim are full-time employees of Pet Kingdom. Janet's Social Security number is 123-45-6788, and Kim's Social Security number is 123 45-6787. - Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Pet Kingdom uses the straight-line method of depreciation for book purposes and accelerated depreciation (MACRS) for tax purposes. - During 2022, the corporation distributed cash dividends of $250,000. Pet Kingdom's financial statements for 2022 are shown below. 2. On February 12, 2008, Nancy Trout and Delores Lake formed Kingfisher Corporation to sell fishing tackle. Pertinent information regarding Kingfisher is summarized as follows: - Kingfisher's business address is 1717 Main Street, Ely, MN 55731; its telephone number is (218) 555-2211; and its e-mail address is kingfisher@kf.com. - The employer identification number is 11-1111113, and the principal business activity code is 451110 . - Nancy owns 50% of the common stock and is president of the company, and Delores owns 50% of the common stock and is vice president of the company. No other class of stock is authorized. - Both Nancy and Delores are full-time employees of Kingfisher. Nancy's Social Security number is 123-45-6788, and Delores's Social Security number is 123456787. - Kingfisher is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Kingfisher uses the straight-line method of deprecation for book purposes and accelerated depreciation (MACRS) for tax purposes. - During 2022, the corporation distributed cash dividends of $80,000. Kingfisher's financial statements for 2022 are shown below. *You are not provided enough detailed information to complete a Form 4562 (depreciation). If you solve this problem using Intuit ProConnect, enter the amount of deprecation on line 20 of Form 1120. 1. On November 1, 2011, Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows: - Pet Kingdom's business address is 1010 Northwest Parkway, Dallas, TX 75225; its telephone number is (214) 555-2211; and its e-mail address is petkingdom@pki.com. - The employer identification number is 11-1111112, and the principal business activity code is 453910 . - Janet and Kim each own 50% of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized. - Both Janet and Kim are full-time employees of Pet Kingdom. Janet's Social Security number is 123-45-6788, and Kim's Social Security number is 123 45-6787. - Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Pet Kingdom uses the straight-line method of depreciation for book purposes and accelerated depreciation (MACRS) for tax purposes. - During 2022, the corporation distributed cash dividends of $250,000. Pet Kingdom's financial statements for 2022 are shown below. 2. On February 12, 2008, Nancy Trout and Delores Lake formed Kingfisher Corporation to sell fishing tackle. Pertinent information regarding Kingfisher is summarized as follows: - Kingfisher's business address is 1717 Main Street, Ely, MN 55731; its telephone number is (218) 555-2211; and its e-mail address is kingfisher@kf.com. - The employer identification number is 11-1111113, and the principal business activity code is 451110 . - Nancy owns 50% of the common stock and is president of the company, and Delores owns 50% of the common stock and is vice president of the company. No other class of stock is authorized. - Both Nancy and Delores are full-time employees of Kingfisher. Nancy's Social Security number is 123-45-6788, and Delores's Social Security number is 123456787. - Kingfisher is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Kingfisher uses the straight-line method of deprecation for book purposes and accelerated depreciation (MACRS) for tax purposes. - During 2022, the corporation distributed cash dividends of $80,000. Kingfisher's financial statements for 2022 are shown below. *You are not provided enough detailed information to complete a Form 4562 (depreciation). If you solve this problem using Intuit ProConnect, enter the amount of deprecation on line 20 of Form 1120