Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2024, its first year of operations, Riley Construction provides services on account of $148,000. By the end of 2024, cash collections on these

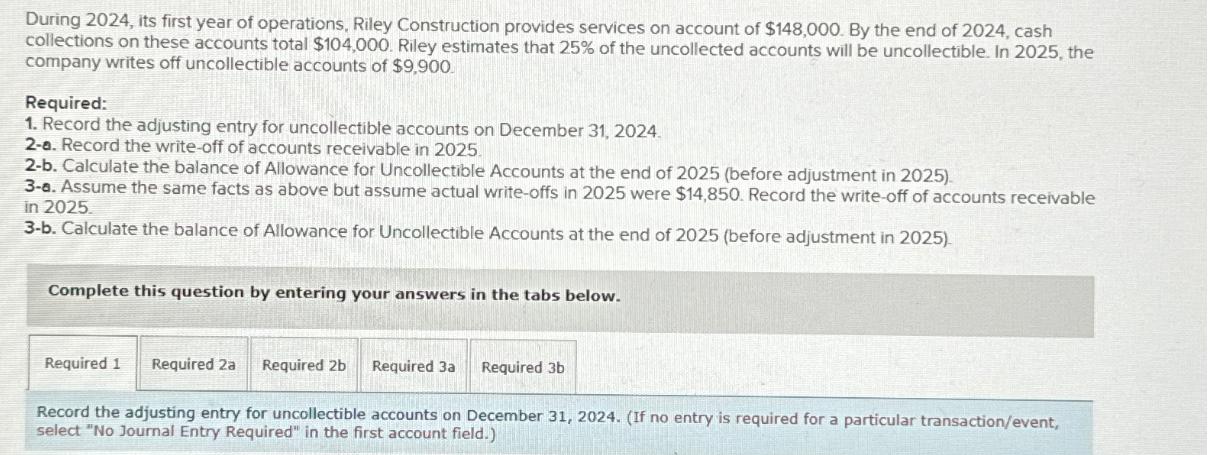

During 2024, its first year of operations, Riley Construction provides services on account of $148,000. By the end of 2024, cash collections on these accounts total $104,000. Riley estimates that 25% of the uncollected accounts will be uncollectible. In 2025, the company writes off uncollectible accounts of $9,900. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2024. 2-a. Record the write-off of accounts receivable in 2025. 2-b. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2025 (before adjustment in 2025). 3-a. Assume the same facts as above but assume actual write-offs in 2025 were $14,850. Record the write-off of accounts receivable in 2025. 3-b. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2025 (before adjustment in 2025). Complete this question by entering your answers in the tabs below. Required 1 Required 2a Required 2b Required 3a Required 3b Record the adjusting entry for uncollectible accounts on December 31, 2024. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Required 1 Record the adjusting entry for uncollectible accounts on December 31 2024 Account Debit Credit Bad Debt Expense 11000 Allowance for Doubtfu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started