Answered step by step

Verified Expert Solution

Question

1 Approved Answer

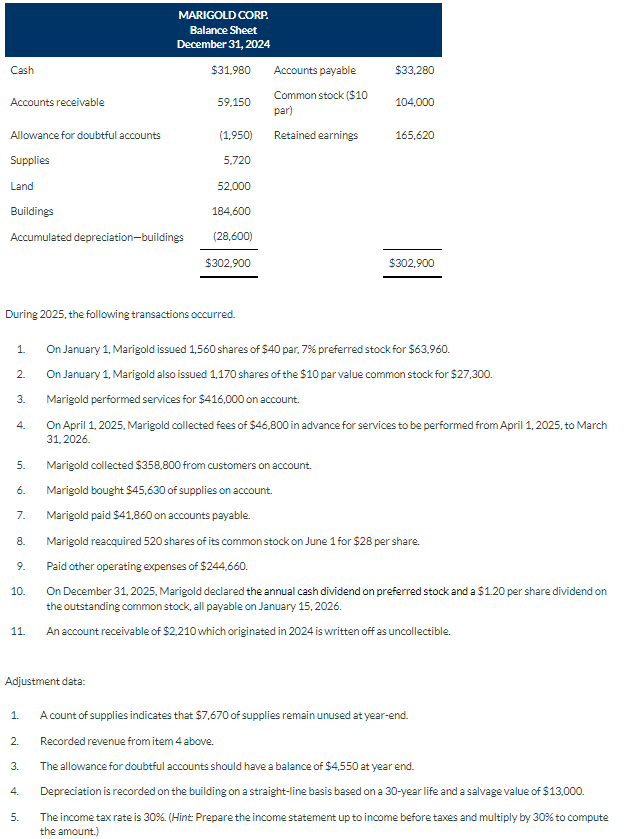

During 2025, the following transactions occurred. 1. On January 1, Marigold issued 1,560 shares of $40 par, 7% preferred stock for $63,960. 2. On January

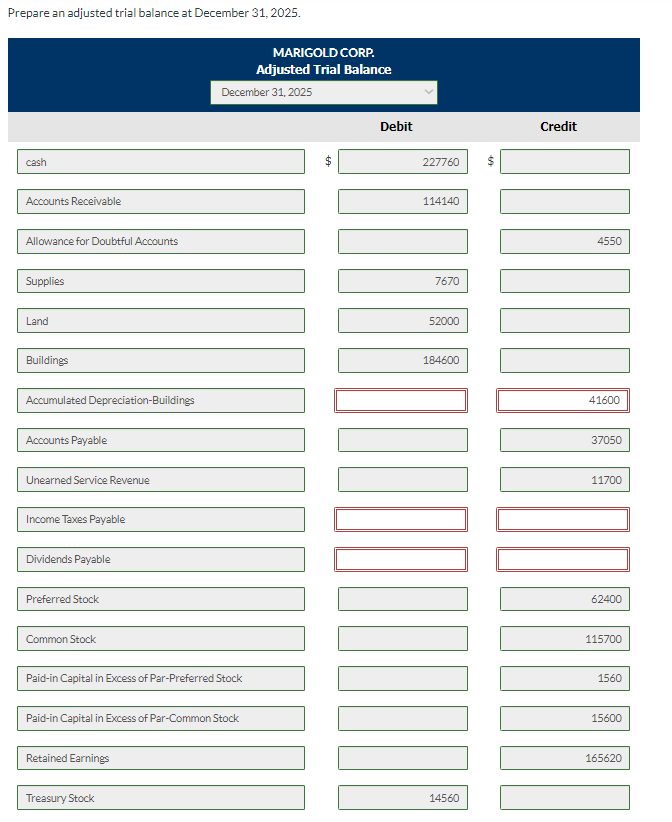

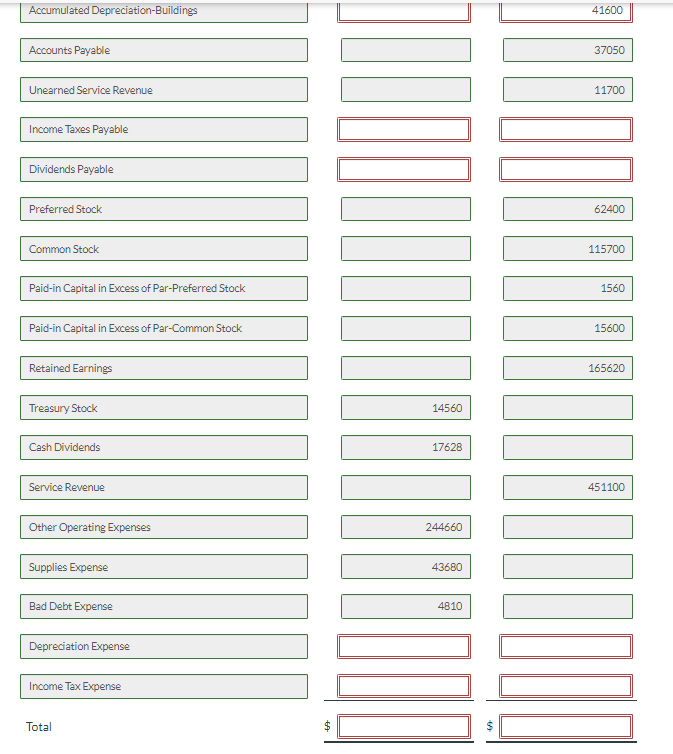

During 2025, the following transactions occurred. 1. On January 1, Marigold issued 1,560 shares of $40 par, 7% preferred stock for $63,960. 2. On January 1, Marigold also issued 1,170 shares of the $10 par value common stock for $27,300. 3. Marigold performed services for $416,000 on account. 4. On April 1, 2025, Marigold collected fees of $46,800 in advance for services to be performed from April 1, 2025, to March 31, 2026. 5. Marigold collected $358,800 from customers on account. 6. Marigold bought $45,630 of supplies on account. 7. Marigold paid $41,860 on accounts payable. 8. Marigold reacquired 520 shares of its common stock on June 1 for $28 per share. 9. Paid other operating expenses of $244,660. 10. On December 31, 2025, Marigold declared the annual cash dividend on preferred stock and a $1.20 per share dividend on the outstanding common stock, all payable on January 15, 2026. 11. An account receivable of $2,210 which originated in 2024 is written off as uncollectible. Adjustment data: 1. A count of supplies indicates that $7,670 of supplies remain unused at year-end. 2. Recorded revenue from item 4 above. 3. The allowance for doubtful accounts should have a balance of $4,550 at year end. 4. Depreciation is recorded on the building on a straight-line basis based on a 30 -year life and a salvage value of $13,000. 5. The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.) Prepare an adjusted trial balance at December 31, 2025. Accumulated Depreciation-Buildings Accounts Payable Unearned Service Revenue Income Taxes Payable Dividends Payable Preferred Stock Common Stock Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Par-Common Stock Retained Earnings Treasury Stock Cash Dividends Service Revenue Other Operating Expenses Supplies Expense Bad Debt Expense Depreciation Expense Income Tax Expense Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started