Answered step by step

Verified Expert Solution

Question

1 Approved Answer

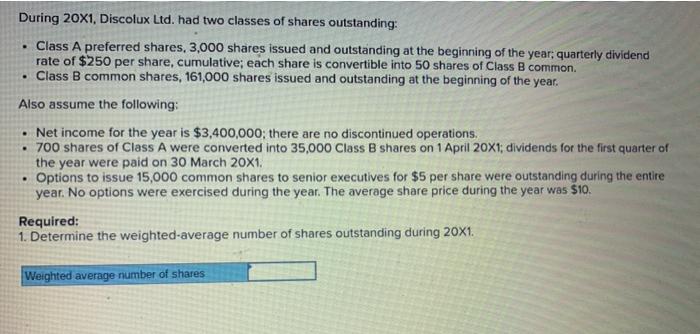

During 20X1, Discolux Ltd. had two classes of shares outstanding: . Class A preferred shares, 3,000 shares issued and outstanding at the beginning of

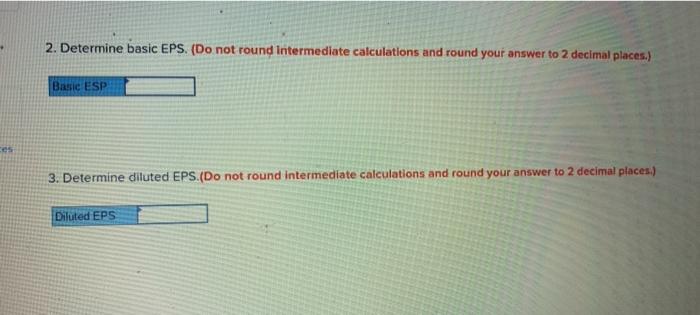

During 20X1, Discolux Ltd. had two classes of shares outstanding: . Class A preferred shares, 3,000 shares issued and outstanding at the beginning of the year; quarterly dividend rate of $250 per share, cumulative; each share is convertible into 50 shares of Class B common. . Class B common shares, 161,000 shares issued and outstanding at the beginning of the year. Also assume the following: . Net income for the year is $3,400,000; there are no discontinued operations. . 700 shares of Class A were converted into 35,000 Class B shares on 1 April 20X1; dividends for the first quarter of the year were paid on 30 March 20X1. . Options to issue 15,000 common shares to senior executives for $5 per share were outstanding during the entire year. No options were exercised during the year. The average share price during the year was $10. Required: 1. Determine the weighted-average number of shares outstanding during 20X1. Weighted average number of shares ces 2. Determine basic EPS. (Do not round Intermediate calculations and round your answer to 2 decimal places.) Basic ESP 3. Determine diluted EPS.(Do not round intermediate calculations and round your answer to 2 decimal places.) Diluted EPS

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1Calculation of WeightedAverage Number of Shares Outstanding At the beginning of the year Class A preferred shares 3000 Class B common shares 161000 O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started