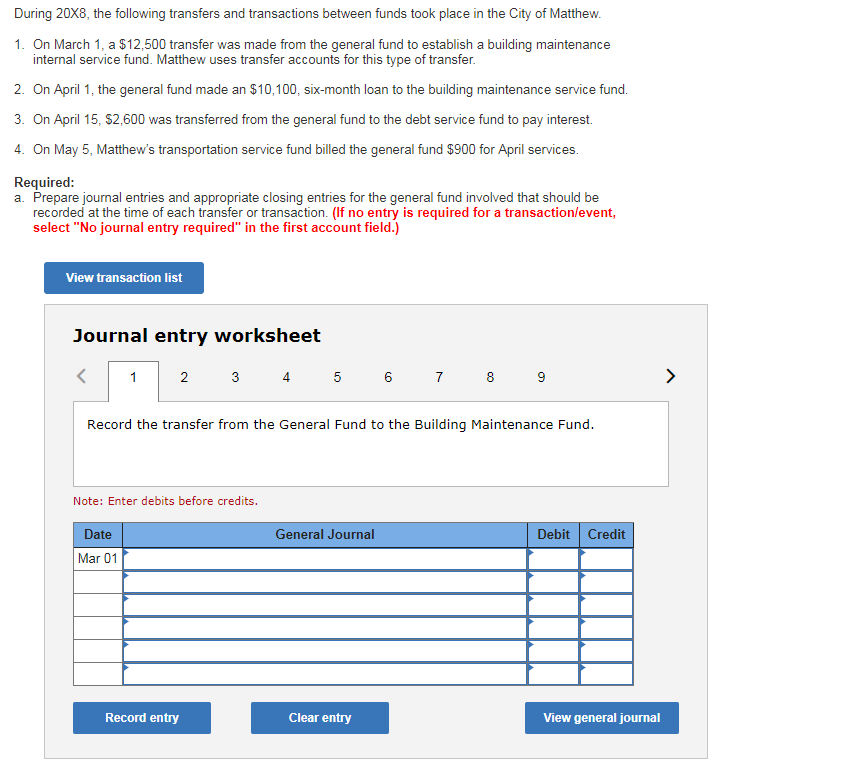

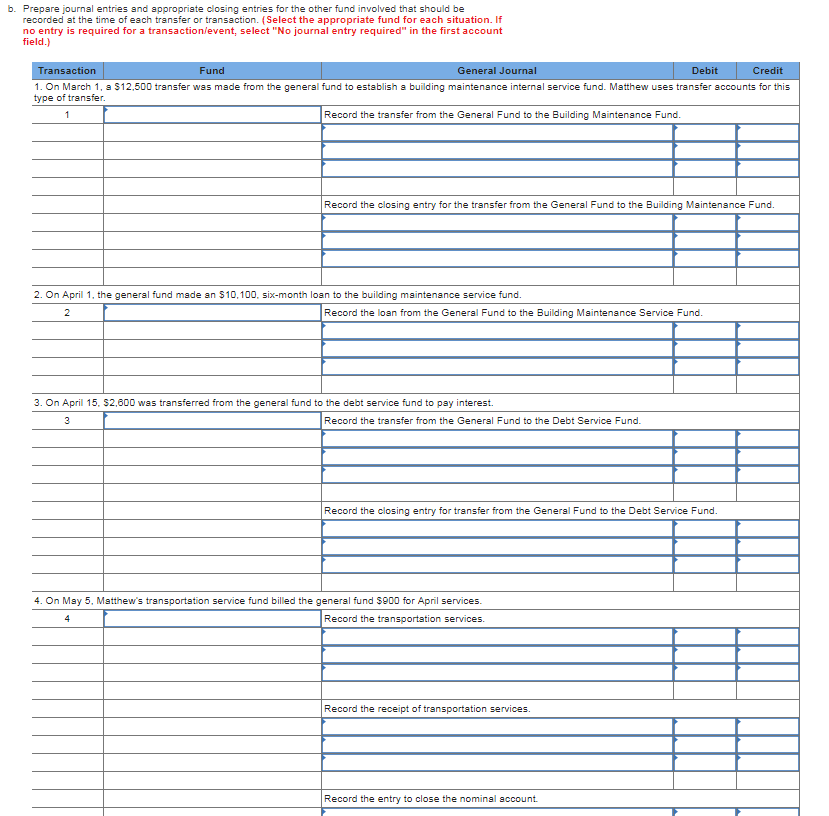

During 20X8, the following transfers and transactions between funds took place in the City of Matthew. 1. On March 1, a $12,500 transfer was made from the general fund to establish a building maintenance internal service fund. Matthew uses transfer accounts for this type of transfer. 2 On April 1, the general fund made an $10,100, six-month loan to the building maintenance service fund. 3. On April 15, S2,600 was transferred from the general fund to the debt service fund to pay interest. 4. On May 5, Matthew's transportation service fund billed the general fund $900 for April services. Required: a. Prepare journal entries and appropriate closing entries for the general fund involved that should be recorded at the time of each transfer or transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 7 Record the transfer from the General Fund to the Building Maintenance Fund Note: Enter debits before credits Debit Credit Date General Journal Mar 01 View general journal Record entry Clear entry b. Prepare journal entries and appropriate closing entries for the other fund involved that should be recorded at the time of each transfer or transaction. (Select the appropriate fund for each s ituation. If no entry is required for a transactionlevent, select "No journal entry required" in the first account field.) General Journal Transaction Fund Debit Credit 1. On March 1, a $12,500 transfer was made from the general fund to establish a building maintenance internal service fund. Matthew uses transfer accounts for this type of transfer. Record the transfer from the General Fund to the Building Maintenance Fund. 1 Record the closing entry for the transfer from the General Fund to the Building Maintenance Fund. 2. On April 1, the general fund made an $10,100, six-month loan to the building maintenance service fund. Record the losan from the General Fund to the Building Maintenance Service Fund. 3. On April 15. S2,600 wass transferred from the general fund to the debt service fund to pay interest. Record the transfer from the General Fund to the Debt Service Fund. 2. Record the closing entry for transfer from the Genersl Fund to the Debt Service Fund. 4. On May 5, Matthew's transportation service fund billed the general fund $900 for April services. Record the transportation services. 4 Record the receipt of transportation services. Record the entry to close the nominal account During 20X8, the following transfers and transactions between funds took place in the City of Matthew. 1. On March 1, a $12,500 transfer was made from the general fund to establish a building maintenance internal service fund. Matthew uses transfer accounts for this type of transfer. 2 On April 1, the general fund made an $10,100, six-month loan to the building maintenance service fund. 3. On April 15, S2,600 was transferred from the general fund to the debt service fund to pay interest. 4. On May 5, Matthew's transportation service fund billed the general fund $900 for April services. Required: a. Prepare journal entries and appropriate closing entries for the general fund involved that should be recorded at the time of each transfer or transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 7 Record the transfer from the General Fund to the Building Maintenance Fund Note: Enter debits before credits Debit Credit Date General Journal Mar 01 View general journal Record entry Clear entry b. Prepare journal entries and appropriate closing entries for the other fund involved that should be recorded at the time of each transfer or transaction. (Select the appropriate fund for each s ituation. If no entry is required for a transactionlevent, select "No journal entry required" in the first account field.) General Journal Transaction Fund Debit Credit 1. On March 1, a $12,500 transfer was made from the general fund to establish a building maintenance internal service fund. Matthew uses transfer accounts for this type of transfer. Record the transfer from the General Fund to the Building Maintenance Fund. 1 Record the closing entry for the transfer from the General Fund to the Building Maintenance Fund. 2. On April 1, the general fund made an $10,100, six-month loan to the building maintenance service fund. Record the losan from the General Fund to the Building Maintenance Service Fund. 3. On April 15. S2,600 wass transferred from the general fund to the debt service fund to pay interest. Record the transfer from the General Fund to the Debt Service Fund. 2. Record the closing entry for transfer from the Genersl Fund to the Debt Service Fund. 4. On May 5, Matthew's transportation service fund billed the general fund $900 for April services. Record the transportation services. 4 Record the receipt of transportation services. Record the entry to close the nominal account