Answered step by step

Verified Expert Solution

Question

1 Approved Answer

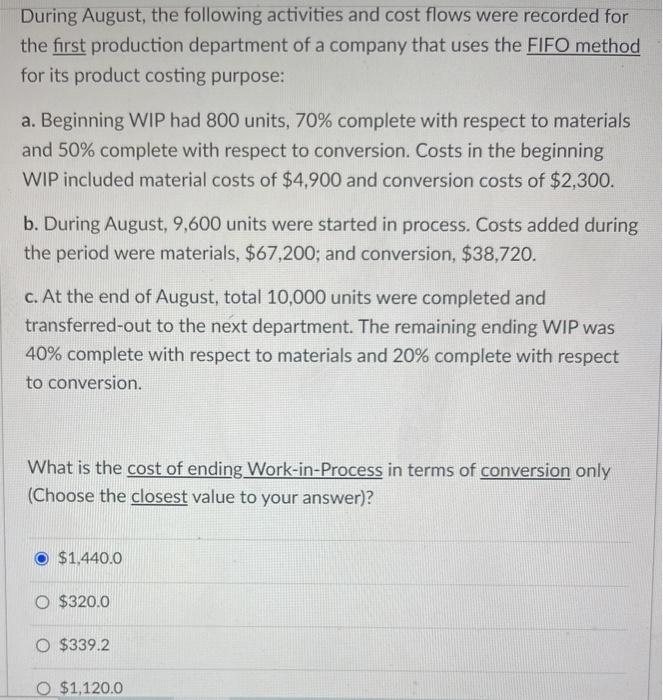

During August , the following activities and cost flows were recorded for the first production department of a company that uses the FIFO method for

During August , the following activities and cost flows were recorded for the first production department of a company that uses the FIFO method for its product costing purpose : a. Beginning WIP had 800 units, 70% complete with respect to materials and 50% complete with respect to conversion. Costs in the beginning WIP included material costs of $4,900 and conversion costs of $2,300. b. During August9,600 units were started in process. Costs added during the period were materials, $67,200; and conversion$38,720. . At the end of August, total 10,000 units were completed and transferred-out to the next department. The remaining ending WIP was 40% complete with respect to materials and 20% complete with respect to conversion. What is the cost of ending Work-in-Process in terms of conversion only (Choose the closest value to your answer)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started