Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During December 2013, Gateway Inc. had the following transactions: a) December 2, sold merchandise worth of $15,000 to Tom, 80% of which were on

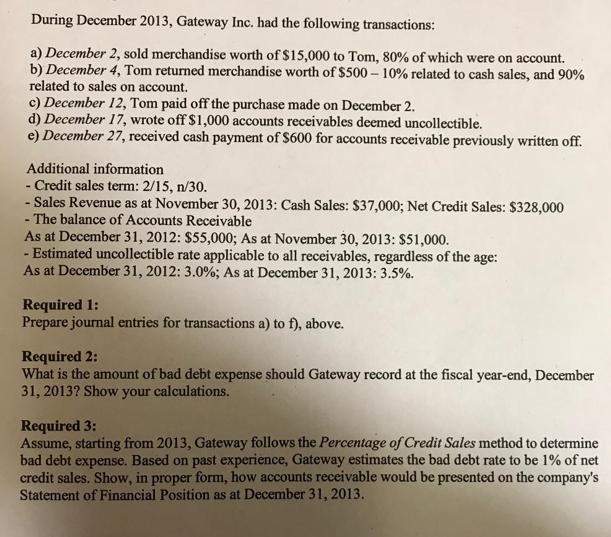

During December 2013, Gateway Inc. had the following transactions: a) December 2, sold merchandise worth of $15,000 to Tom, 80% of which were on account. b) December 4, Tom returned merchandise worth of $500-10% related to cash sales, and 90% related to sales on account. c) December 12, Tom paid off the purchase made on December 2. d) December 17, wrote off $1,000 accounts receivables deemed uncollectible. e) December 27, received cash payment of $600 for accounts receivable previously written off. Additional information - Credit sales term: 2/15, n/30. - Sales Revenue as at November 30, 2013: Cash Sales: $37,000; Net Credit Sales: $328,000 - The balance of Accounts Receivable As at December 31, 2012: $55,000; As at November 30, 2013: $51,000. - Estimated uncollectible rate applicable to all receivables, regardless of the age: As at December 31, 2012: 3.0%; As at December 31, 2013: 3.5%. Required 1: Prepare journal entries for transactions a) to f), above. Required 2: What is the amount of bad debt expense should Gateway record at the fiscal year-end, December 31, 2013? Show your calculations. Required 3: Assume, starting from 2013, Gateway follows the Percentage of Credit Sales method to determine bad debt expense. Based on past experience, Gateway estimates the bad debt rate to be 1% of net credit sales. Show, in proper form, how accounts receivable would be presented on the company's Statement of Financial Position as at December 31, 2013.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Date Dec 2 Dec 4 Dec 12 Account Title and Explanation Cash 15000 12000 Accounts r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started