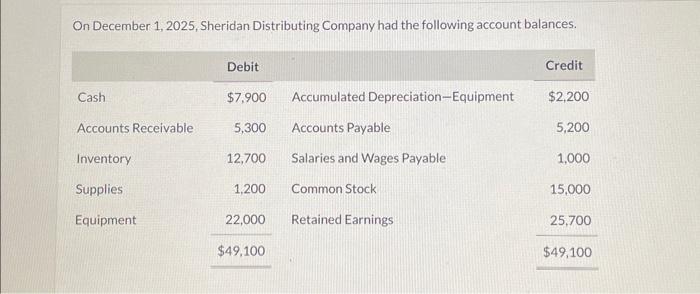

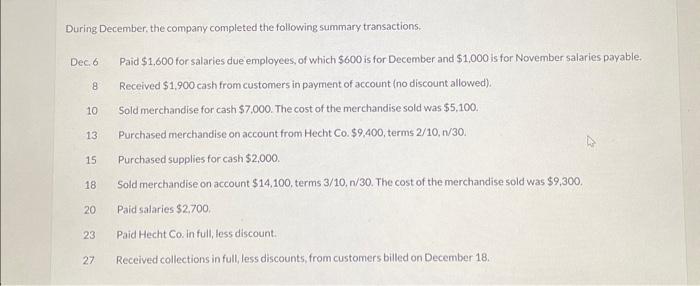

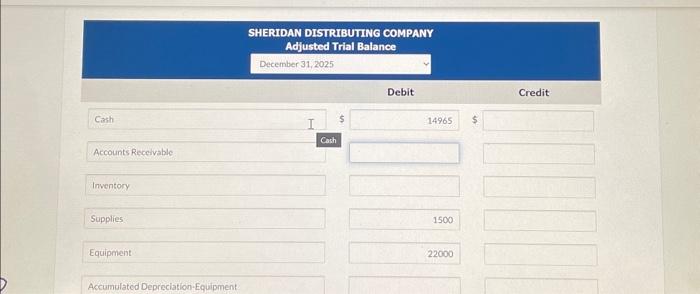

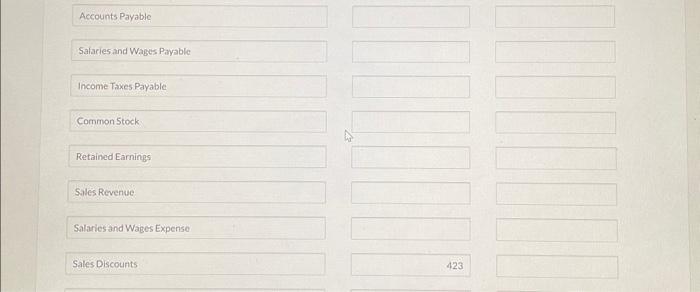

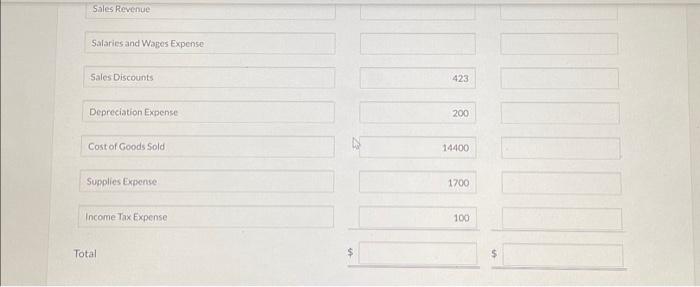

During December, the company completed the following summary transactions. Dec. 6 Paid $1,600 for salaries due employees, of which $600 is for December and $1,000 is for November salaries payable. 8 Received $1,900 cash from customers in payment of account (no discount allowed). 10 Sold merchandise for cash $7,000. The cost of the merchandise sold was $5,100. 13 Purchased merchandise on account from Hecht Co. $9,400, terms 2/10,n/30. 15 Purchased supplies for cash $2,000. 18 Sold merchandise on account $14,100, terms 3/10,n/30. The cost of the merchandise sold was $9,300. 20 Paid salaries $2.700. 23 Paid Hecht Co. in full, less discount. 27 Received collections in full, less discounts, from customers billed on December 18. On December 1, 2025, Sheridan Distributing Company had the following account balances. SHERIDAN DISTRIBUTING COMPANY Adjusted Trial Balance Adjusted Trial Balance December 31,2025 Inwentory Supplies 1500 Equipment 22000 Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Income Taxes Payable Common Stock Retained Earnings Soles Revenue Salaries and Wages Expense Sales Discounts 423 Sales Revenue Salaries and Wages Expense Sales Discounts 423 Depreciation Expense 200 Cost of Goods Sold Supplies Expense 14400 Income Tax Expense Total During December, the company completed the following summary transactions. Dec. 6 Paid $1,600 for salaries due employees, of which $600 is for December and $1,000 is for November salaries payable. 8 Received $1,900 cash from customers in payment of account (no discount allowed). 10 Sold merchandise for cash $7,000. The cost of the merchandise sold was $5,100. 13 Purchased merchandise on account from Hecht Co. $9,400, terms 2/10,n/30. 15 Purchased supplies for cash $2,000. 18 Sold merchandise on account $14,100, terms 3/10,n/30. The cost of the merchandise sold was $9,300. 20 Paid salaries $2.700. 23 Paid Hecht Co. in full, less discount. 27 Received collections in full, less discounts, from customers billed on December 18. On December 1, 2025, Sheridan Distributing Company had the following account balances. SHERIDAN DISTRIBUTING COMPANY Adjusted Trial Balance Adjusted Trial Balance December 31,2025 Inwentory Supplies 1500 Equipment 22000 Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Income Taxes Payable Common Stock Retained Earnings Soles Revenue Salaries and Wages Expense Sales Discounts 423 Sales Revenue Salaries and Wages Expense Sales Discounts 423 Depreciation Expense 200 Cost of Goods Sold Supplies Expense 14400 Income Tax Expense Total