Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During Denton Company's first two years of operations, the company reported absorption costing net operating income as follows: Year 1Year 2 Sales (@ $60 per

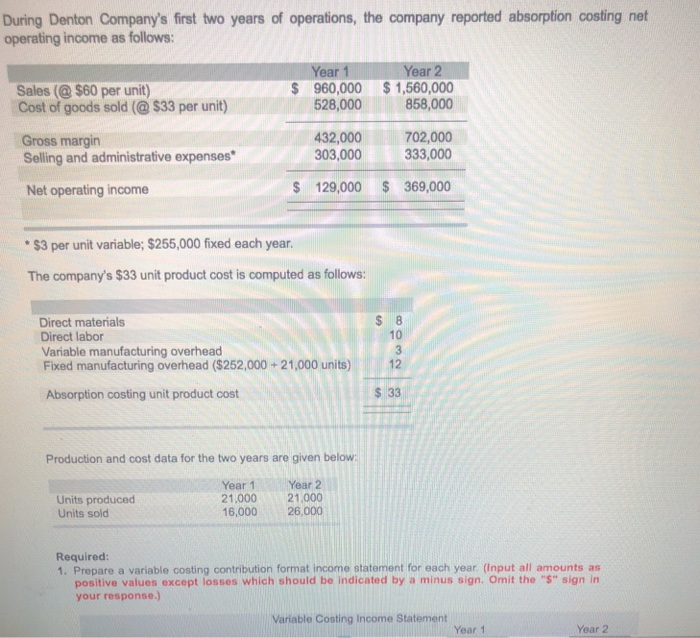

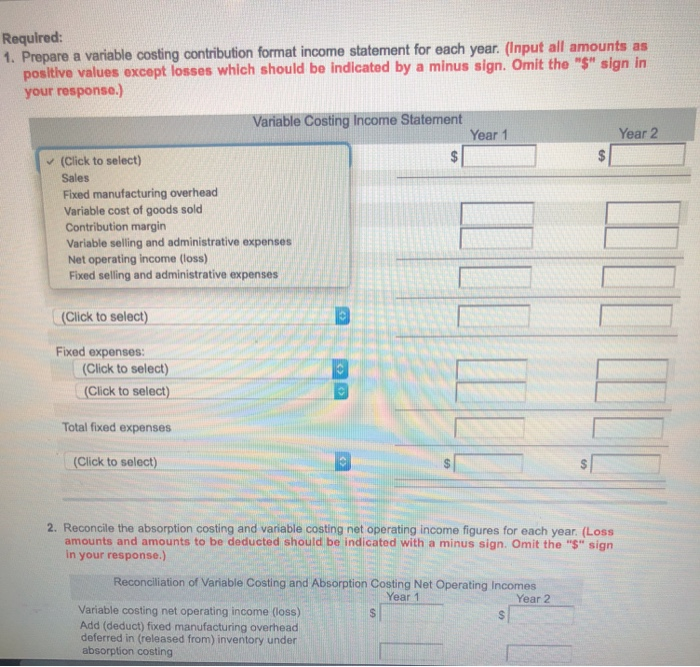

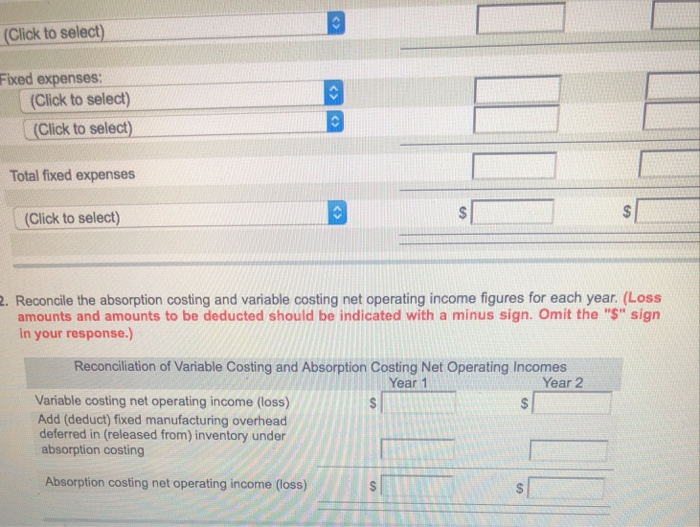

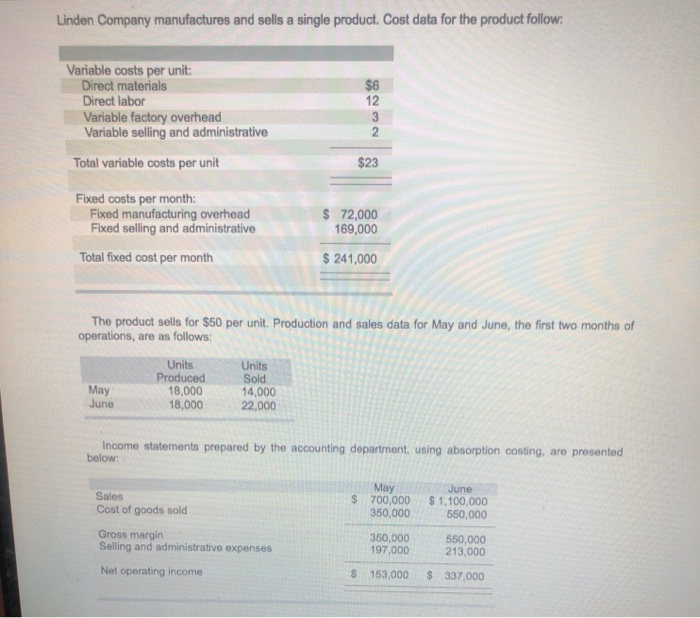

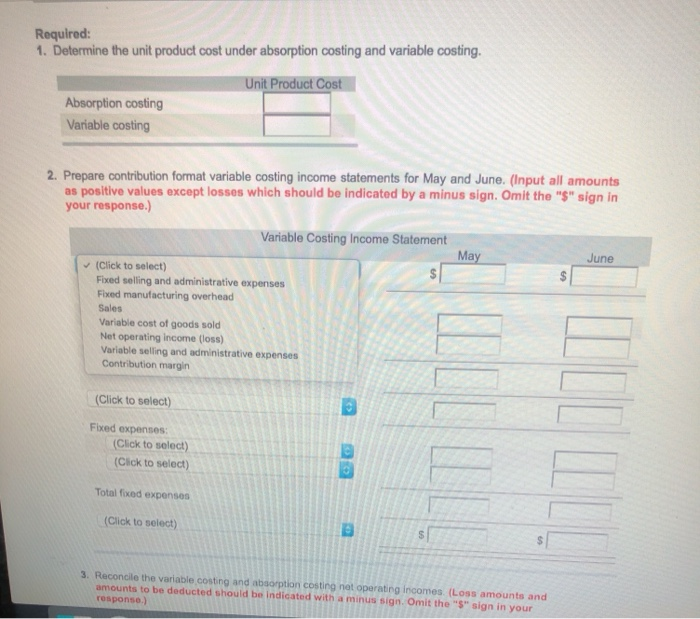

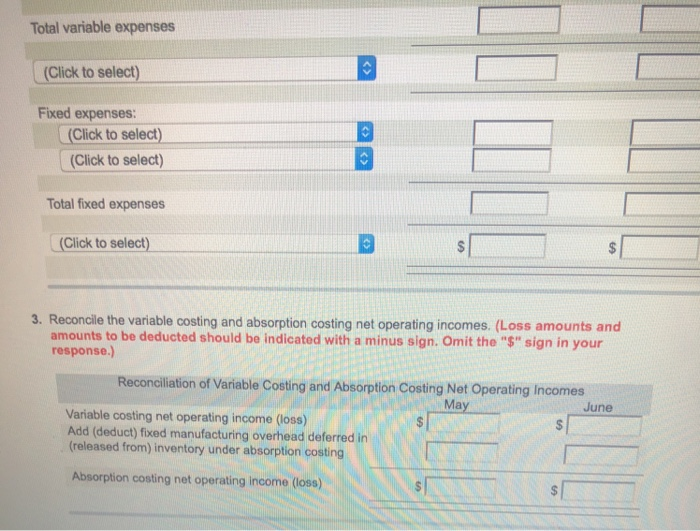

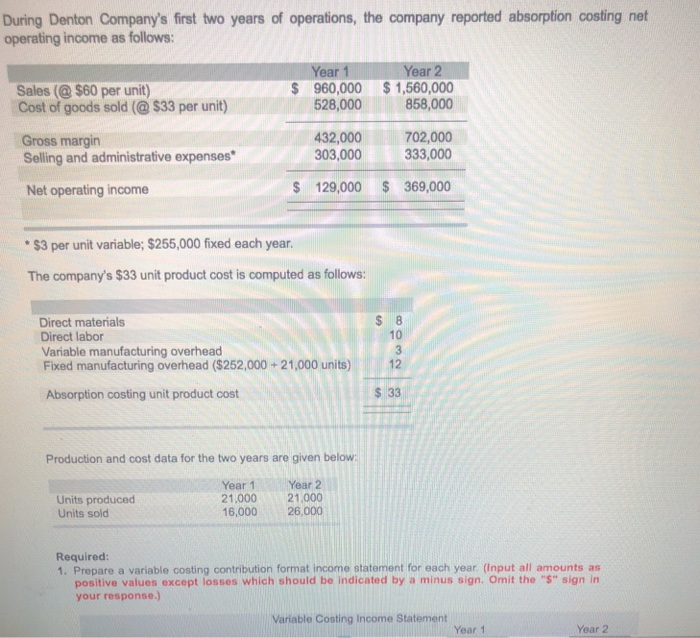

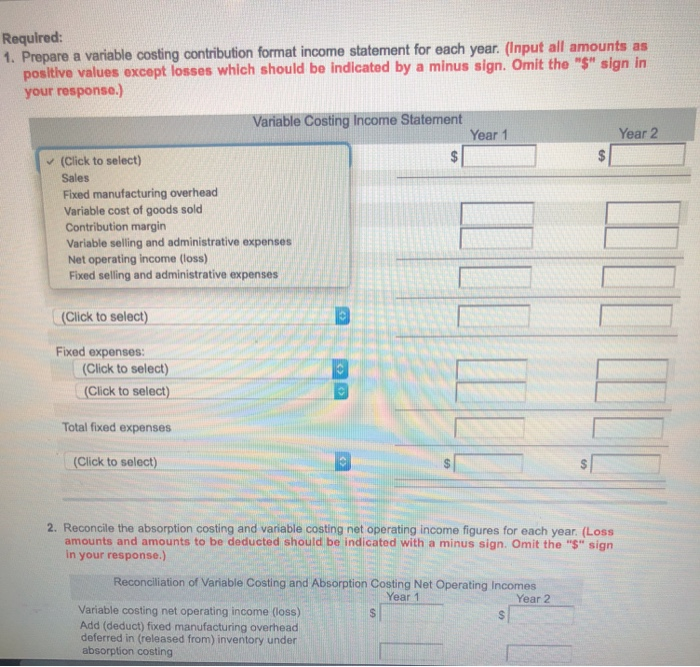

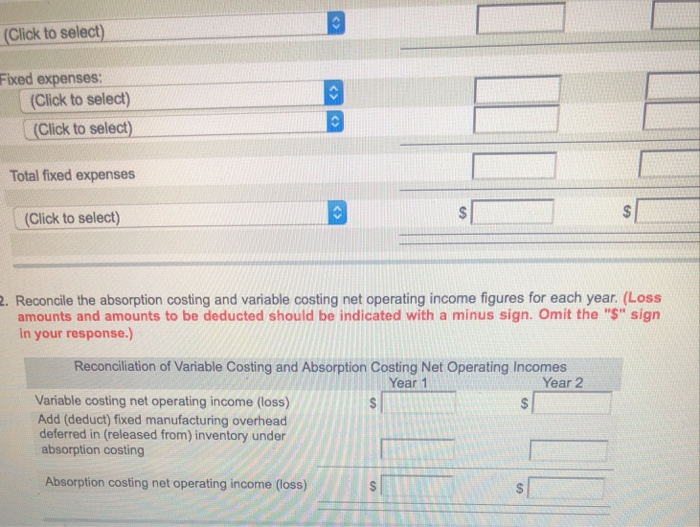

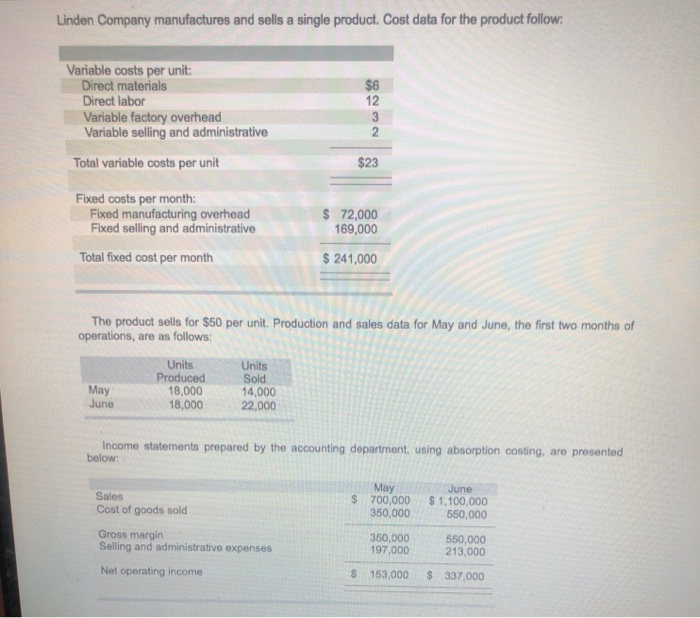

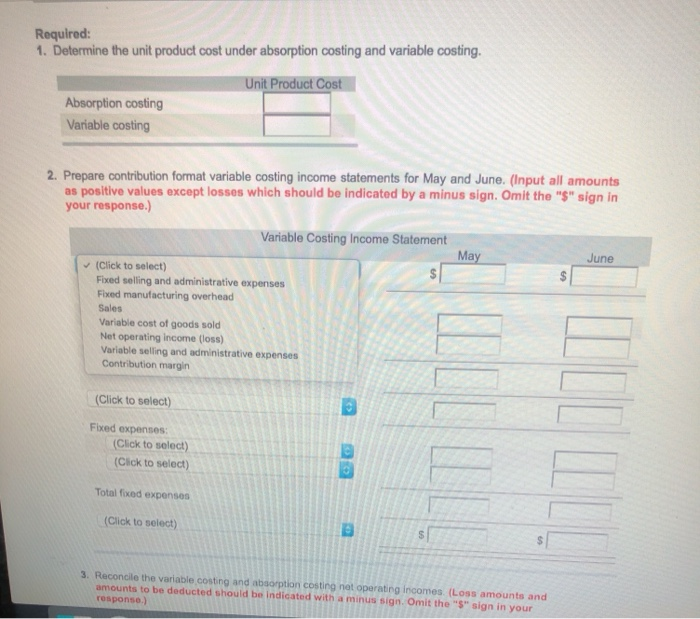

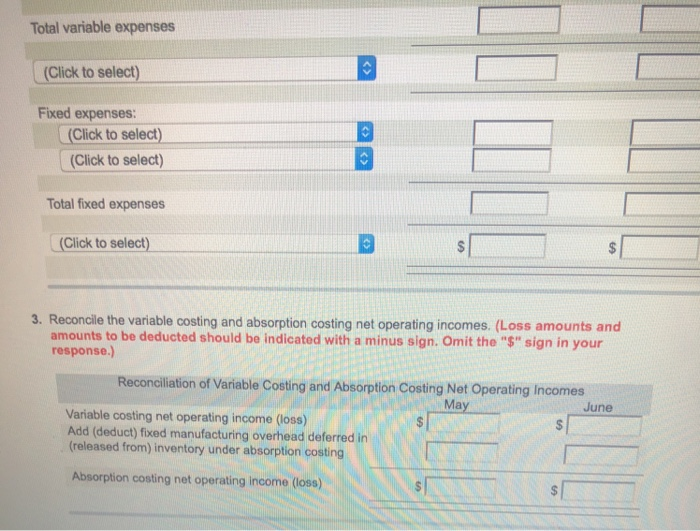

During Denton Company's first two years of operations, the company reported absorption costing net operating income as follows: Year 1Year 2 Sales (@ $60 per unit) Cost of goods sold (@ $33 per unit) $ 960,000 $1,560,000 528,000 858,000 432,000 303,000 702,000 333,000 Gross margin Selling and administrative expenses Net operating income $ 129,000 369,000 $3 per unit variable; $255,000 fixed each year. The company's $33 unit product cost is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($252,000 +21,000 units) 10 3 12 Absorption costing unit product cost $ 33 Production and cost data for the two years are given below Units produced Units sold Year 1 Year 2 21,00021.000 16,000 26,000 Required 1. Prepare a variable costing contribution format income statement for each year. (Input all amounts as positive values except losses which should be indicated by a minus sign. Omit the "$" sign in your response.) Variable Costing Income Statemernt Year 1 Year 2 Required: 1. Prepare a variable costing contribution format income statement for each year. (Input all amounts as positive values except losses which should be indicated by a minus sign. Omit the "$" sign in your response.) Variable Costing Income Statement Year 1 Year 2 v (Click to select) Sales Fixed manufacturing overhead Variable cost of goods sold Contribution margin Variable selling and administrative expenses Net operating income (loss) Fixed selling and administrative expenses (Cick to selec) Fixed expenses: (Click to select) (Click to select) Total fixed expenses (Click to select) 2. Reconcile the absorption costing and variable costing net operating income figures for each year. (Loss amounts and amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Click to select) Fixed expenses: Click to select) (Click to select) Total fixed expenses (Clicktselect) 2. Reconcile the absorption costing and variable costing net operating income figures for each year. (Loss amounts and amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) Reconcilation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing - Absorption costing net operating income (loss) s Linden Company manufactures and sells a single product. Cost data for the product follow Variable costs per unit Direct materials Direct labor $6 12 riable factory overhead Variable selling and administrative Total variable costs per unit $23 Fixed costs per month: Fixed manufacturing overhead Fixed selling and administrative S 72,000 169,000 Total fixed cost per month 241,000 The product sells for $50 per unit. Production and sales data for May and June, the first two months of operations, are as follows: Units Units Sold 14,000 22,000 May June 18,000 8,000 Income statements prepared by the accounting department, using absorption costing, are presented below: May 350,000 350,000 Sales Cost of goods sold $ 700,000 $1,100,000 550,000 Gross margin Selling and administrative expenses 550,000 213,000 197,000 Net operating income S 153,000 $ 337,000 Required: 1. Determine the unit product cost under absorption costing and variable costing. Unit Product Cost Absorption costing Variable costing 2. Prepare contribution format variable costing income statements for May and June. (Input all amounts as positive values except losses which should be indicated by a minus sign. Omit the "$" sign in your response.) Variable Costing Income Statement May June (Click to select) Fixed selling and administrative expenses Fixed manufacturing overhead Sales Variable cost of goods sold Net operating income (loss) Variable selling and administrative expenses Contribution margin (Click to select) Fixed expenses: Click to select) (Click to select) Total fixed expenses (Click to select) 3. Reconcile the variable costing and absorption costing net operating incomes. amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your responso.) (Loss amounts and Total variable expenses (Click to select) Fixed expenses: (Click to select) (Click to select) Total fixed expenses (Click to select) 3. Reconcile the variable costing and absorption costing net operating incomes. (Loss amounts and amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) Reconallation of Variable Costing and Absorption Costing Net Operalting Incomes May June Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income (loss)

During Denton Company's first two years of operations, the company reported absorption costing net operating income as follows: Year 1Year 2 Sales (@ $60 per unit) Cost of goods sold (@ $33 per unit) $ 960,000 $1,560,000 528,000 858,000 432,000 303,000 702,000 333,000 Gross margin Selling and administrative expenses Net operating income $ 129,000 369,000 $3 per unit variable; $255,000 fixed each year. The company's $33 unit product cost is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($252,000 +21,000 units) 10 3 12 Absorption costing unit product cost $ 33 Production and cost data for the two years are given below Units produced Units sold Year 1 Year 2 21,00021.000 16,000 26,000 Required 1. Prepare a variable costing contribution format income statement for each year. (Input all amounts as positive values except losses which should be indicated by a minus sign. Omit the "$" sign in your response.) Variable Costing Income Statemernt Year 1 Year 2 Required: 1. Prepare a variable costing contribution format income statement for each year. (Input all amounts as positive values except losses which should be indicated by a minus sign. Omit the "$" sign in your response.) Variable Costing Income Statement Year 1 Year 2 v (Click to select) Sales Fixed manufacturing overhead Variable cost of goods sold Contribution margin Variable selling and administrative expenses Net operating income (loss) Fixed selling and administrative expenses (Cick to selec) Fixed expenses: (Click to select) (Click to select) Total fixed expenses (Click to select) 2. Reconcile the absorption costing and variable costing net operating income figures for each year. (Loss amounts and amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Click to select) Fixed expenses: Click to select) (Click to select) Total fixed expenses (Clicktselect) 2. Reconcile the absorption costing and variable costing net operating income figures for each year. (Loss amounts and amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) Reconcilation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing - Absorption costing net operating income (loss) s Linden Company manufactures and sells a single product. Cost data for the product follow Variable costs per unit Direct materials Direct labor $6 12 riable factory overhead Variable selling and administrative Total variable costs per unit $23 Fixed costs per month: Fixed manufacturing overhead Fixed selling and administrative S 72,000 169,000 Total fixed cost per month 241,000 The product sells for $50 per unit. Production and sales data for May and June, the first two months of operations, are as follows: Units Units Sold 14,000 22,000 May June 18,000 8,000 Income statements prepared by the accounting department, using absorption costing, are presented below: May 350,000 350,000 Sales Cost of goods sold $ 700,000 $1,100,000 550,000 Gross margin Selling and administrative expenses 550,000 213,000 197,000 Net operating income S 153,000 $ 337,000 Required: 1. Determine the unit product cost under absorption costing and variable costing. Unit Product Cost Absorption costing Variable costing 2. Prepare contribution format variable costing income statements for May and June. (Input all amounts as positive values except losses which should be indicated by a minus sign. Omit the "$" sign in your response.) Variable Costing Income Statement May June (Click to select) Fixed selling and administrative expenses Fixed manufacturing overhead Sales Variable cost of goods sold Net operating income (loss) Variable selling and administrative expenses Contribution margin (Click to select) Fixed expenses: Click to select) (Click to select) Total fixed expenses (Click to select) 3. Reconcile the variable costing and absorption costing net operating incomes. amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your responso.) (Loss amounts and Total variable expenses (Click to select) Fixed expenses: (Click to select) (Click to select) Total fixed expenses (Click to select) 3. Reconcile the variable costing and absorption costing net operating incomes. (Loss amounts and amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) Reconallation of Variable Costing and Absorption Costing Net Operalting Incomes May June Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income (loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started