Answered step by step

Verified Expert Solution

Question

1 Approved Answer

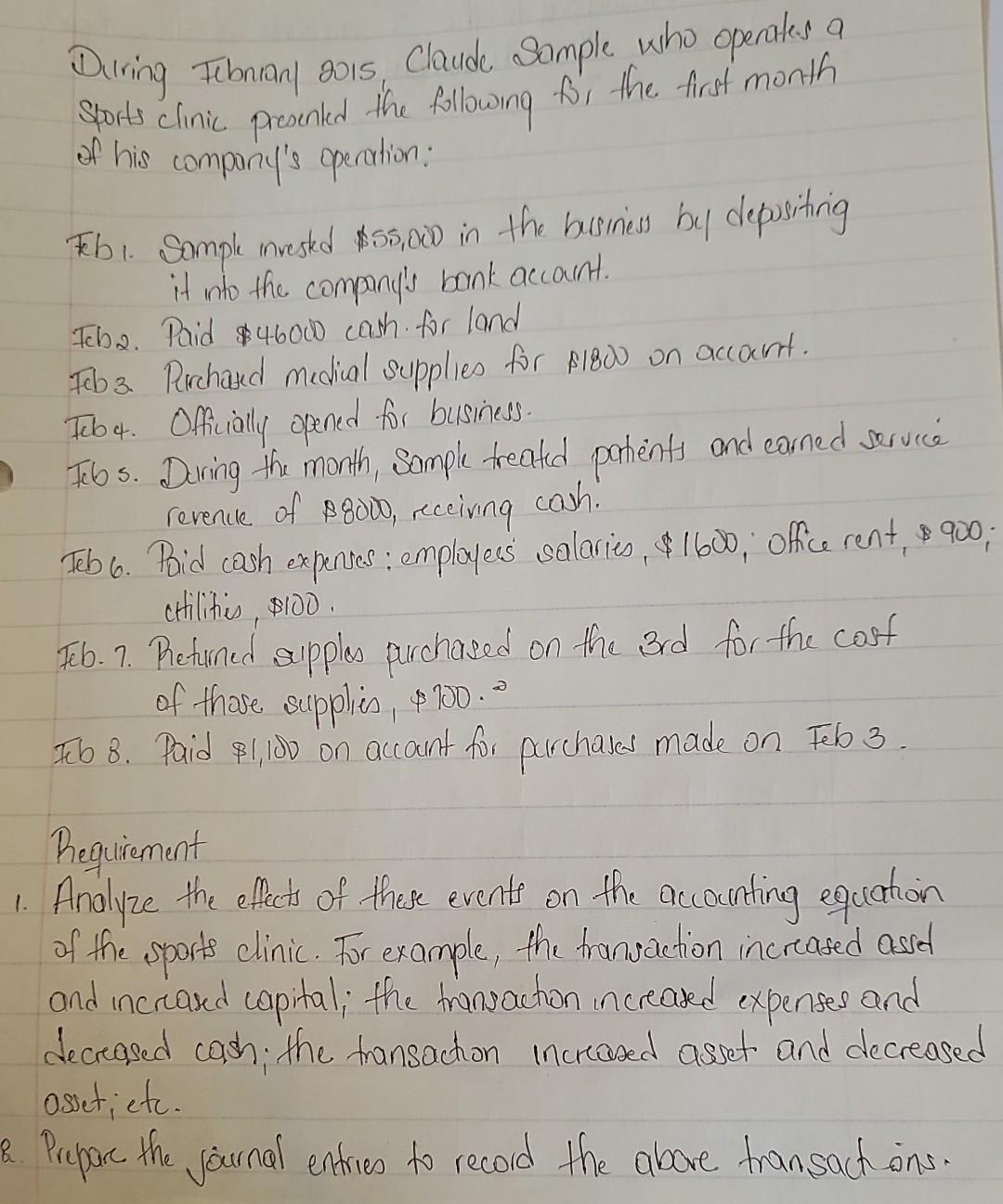

During Febrian1 gois Claude Sample who opertes a Sports clinic presented the following fir the first month of his compony's operation: Fab1. Somple invesked $5s,0iD

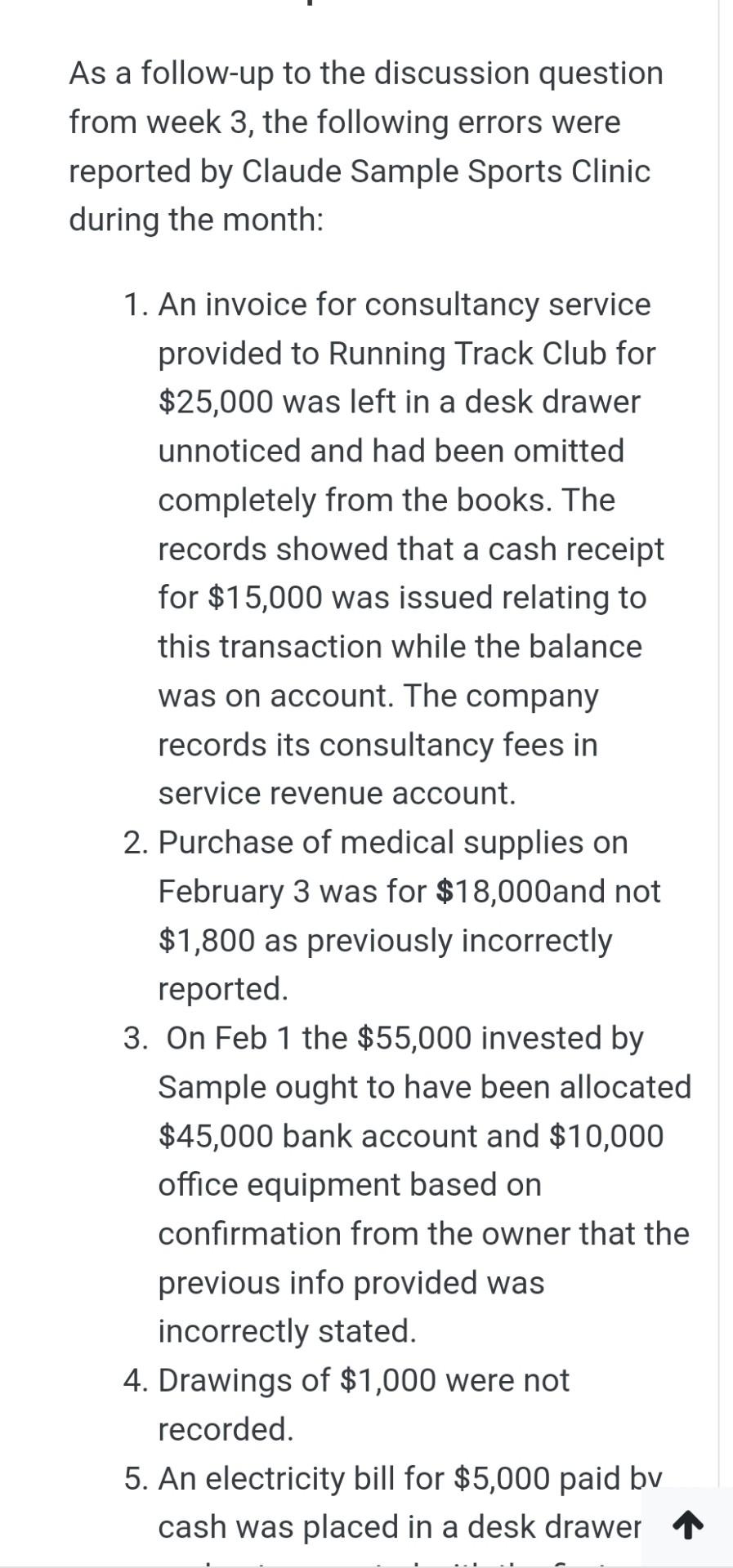

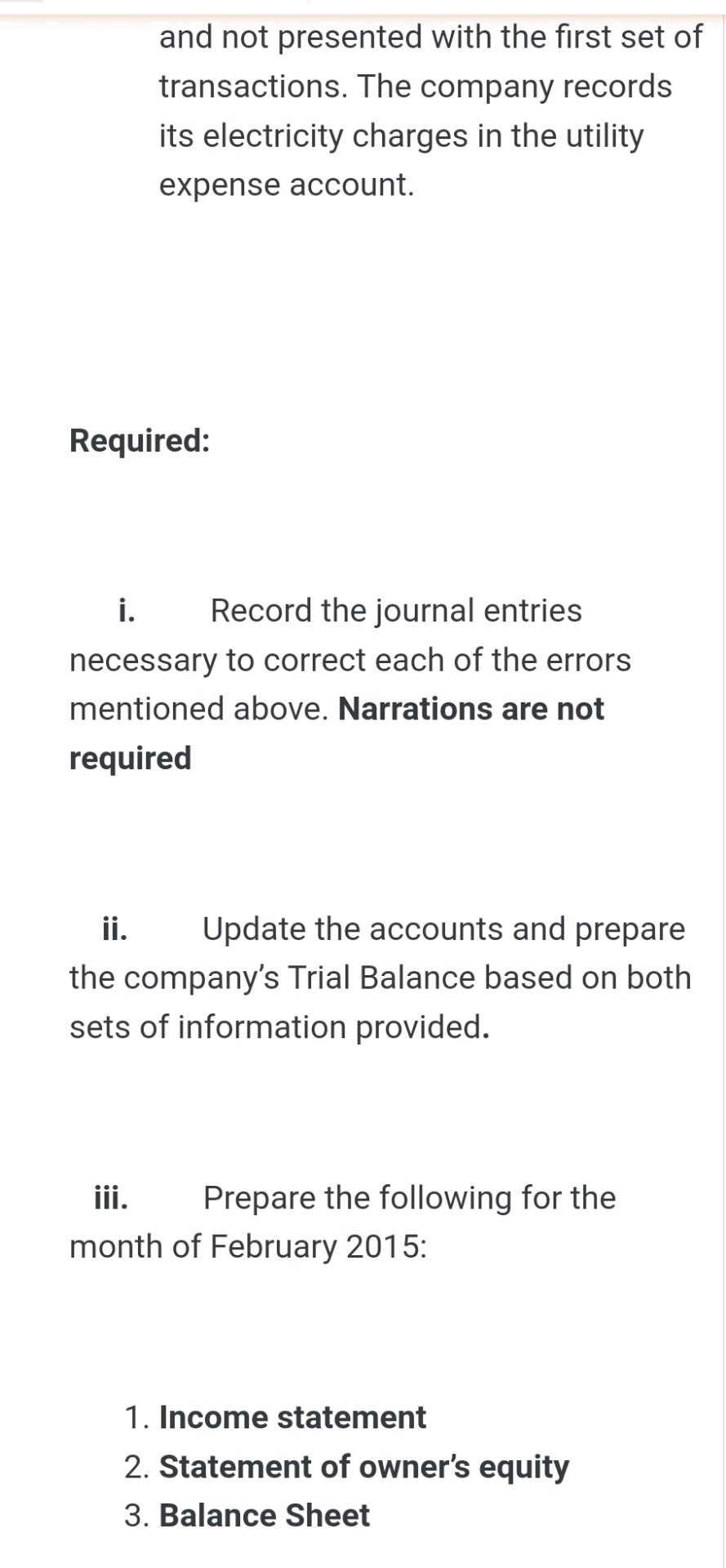

During Febrian1 gois Claude Sample who opertes a Sports clinic presented the following fir the first month of his compony's operation: Fab1. Somple invesked \$5s,0iD in the business by depusiting it into the company's bank account. Teb2. Paid $46000 cash for land Feb 3. Perchared medial supplies for 1800 on account. Teb4. Officially opened for business. Feb s. During the month, Sample treated patients and carned service revence of s8o00, receiving cash. Teb6. Paid cosh expenves: employes salaries, \$1600; office rent, $900 ctilities, $100. Feb. 7. Returned sepples purchased on the 3rd for the cost of thase supplies, $700 Teb 8. Paid $1,100 on account for perchases made on Feb 3. Requirement 1. Analyze the effects of these events on the accocinting equation of the sports clinic. For example, the transaction increased asset and incrased capital; the transaction increased expenses and decreased cash; the transaction increased asset and decreased assetietc. 2. Prepare the journal entries to record the abore transact ons. 3. Post the transactions to the " T " accounts of the companel and balance off cach account. As a follow-up to the discussion question from week 3 , the following errors were reported by Claude Sample Sports Clinic during the month: 1. An invoice for consultancy service provided to Running Track Club for $25,000 was left in a desk drawer unnoticed and had been omitted completely from the books. The records showed that a cash receipt for $15,000 was issued relating to this transaction while the balance was on account. The company records its consultancy fees in service revenue account. 2. Purchase of medical supplies on February 3 was for $18,000 and not $1,800 as previously incorrectly reported. 3. On Feb 1 the $55,000 invested by Sample ought to have been allocated $45,000 bank account and $10,000 office equipment based on confirmation from the owner that the previous info provided was incorrectly stated. 4. Drawings of $1,000 were not recorded. 5. An electricity bill for $5,000 paid bv cash was placed in a desk drawer and not presented with the first set of transactions. The company records its electricity charges in the utility expense account. Required: i. Record the journal entries necessary to correct each of the errors mentioned above. Narrations are not required ii. Update the accounts and prepare the company's Trial Balance based on both sets of information provided. iii. Prepare the following for the month of February 2015: 1. Income statement 2. Statement of owner's equity 3. Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started