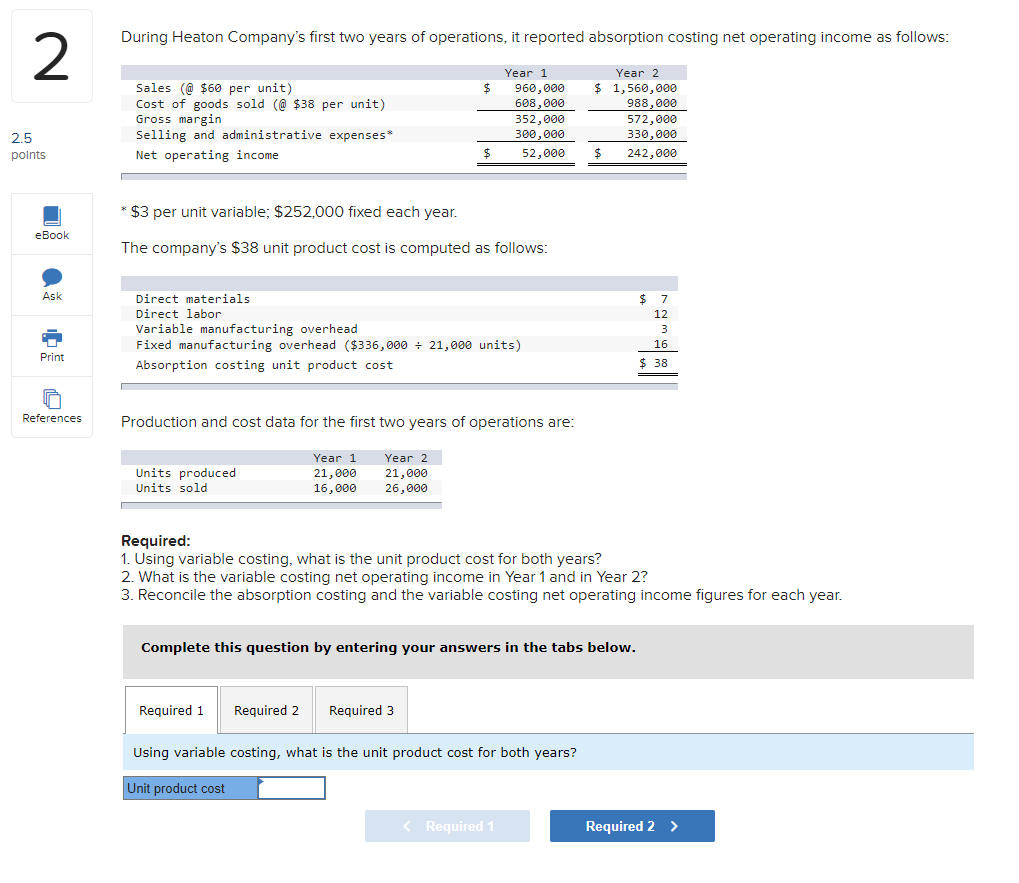

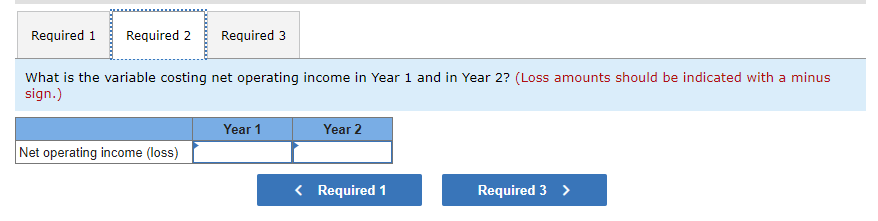

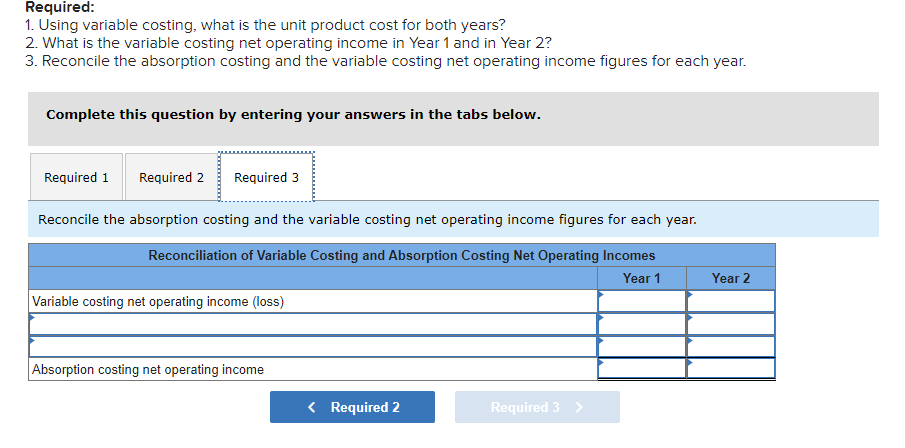

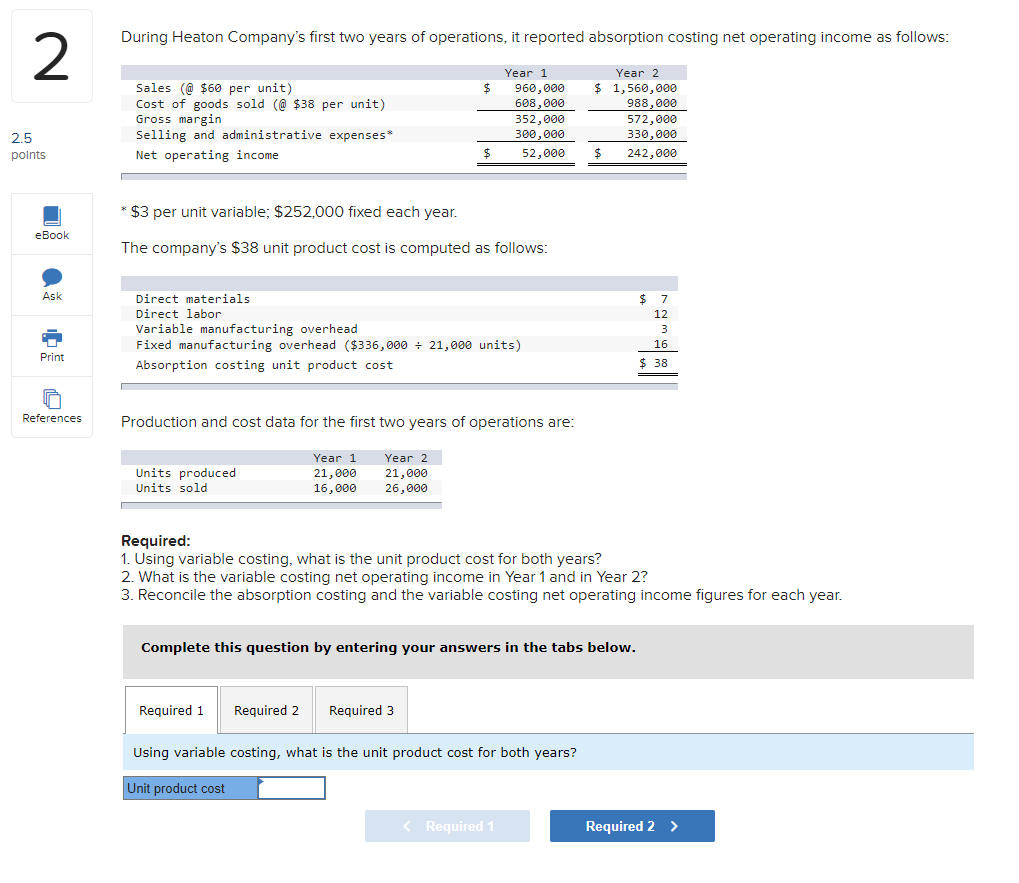

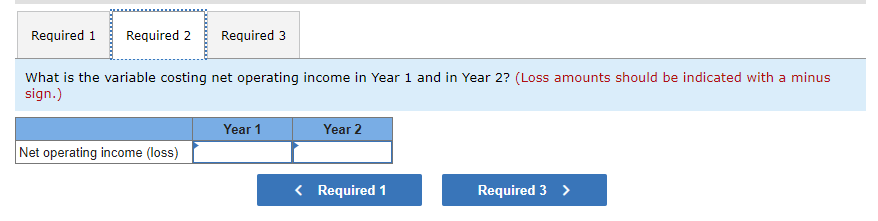

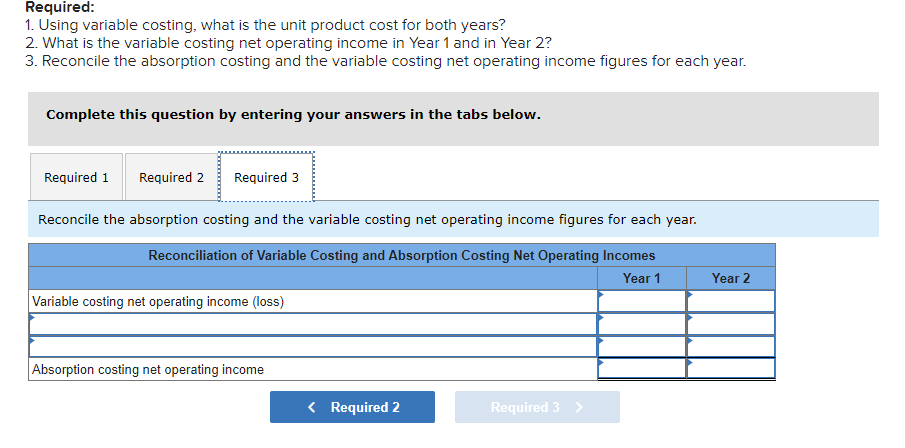

During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: 2 $ Sales (@ $60 per unit) Cost of goods sold @ $38 per unit) Gross margin Selling and administrative expenses* Net operating income Year 1 960,000 608,000 352,000 300,000 52,000 Year 2 $ 1,560,000 988,000 572,000 330,000 242,000 2.5 points $ *$3 per unit variable, $252,000 fixed each year. eBook The company's $38 unit product cost is computed as follows: Ask Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($336,000 = 21,000 units) Absorption costing unit product cost $ 7 12 3 16 $ 38 Print o References Production and cost data for the first two years of operations are: Units produced Units sold Year 1 21,000 16,000 Year 2 21,000 26,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using variable costing, what is the unit product cost for both years? Unit product cost Required 1 Required 2 Required 3 What is the variable costing net operating income in Year 1 and in Year 2? (Loss amounts should be indicated with a minus sign.) Year 1 Year 2 Net operating income (loss) Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Reconcile the absorption costing and the variable costing net operating income figures for each year. Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Variable costing net operating income (Loss) Year 2 Absorption costing net operating income