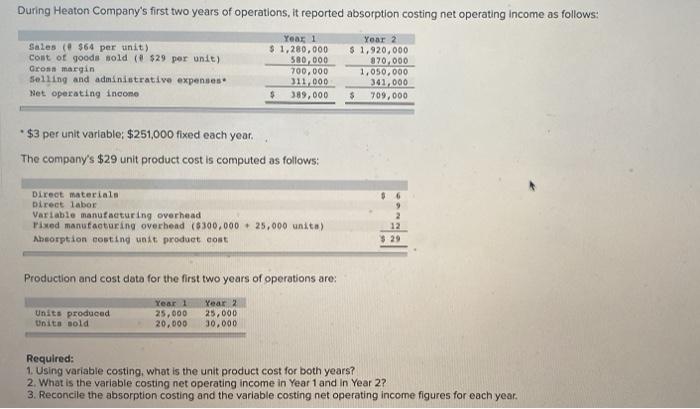

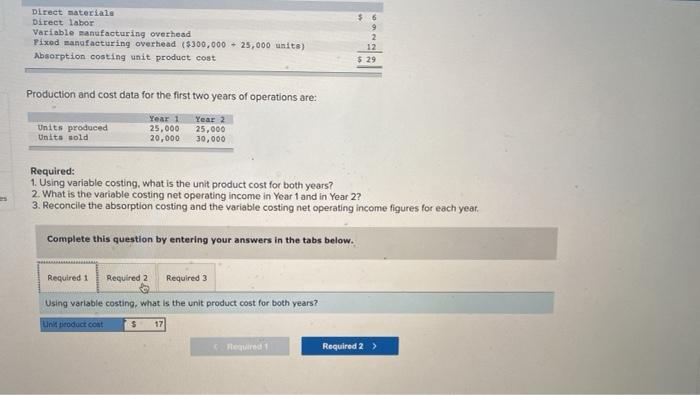

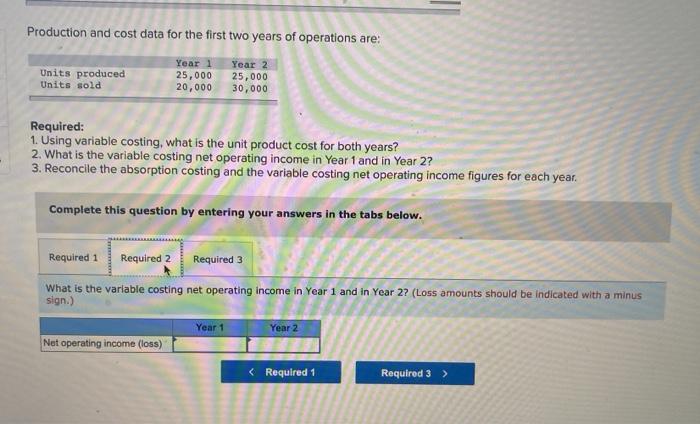

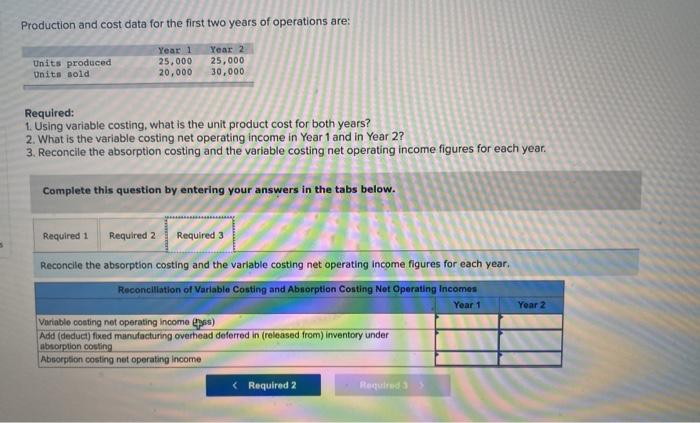

During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Sales ($64 per unit) Cost of goods sold ($29 per unit) Gross margin Selling and administrative expenses Net operating income Year 1 $ 1,280,000 580,000 700.000 311.000 $ 389,000 Year 2 $ 1,920,000 370,000 1,050,000 341,000 $ 709,000 *$3 per unit variable: $251,000 fixed each year. The company's $29 unit product cost is computed as follows: $6 Direct materiala Direct labor Variable manufacturing overhead Pixed manufacturing overhead (6300,000 - 25,000 unita) Aheorption costing unit product cost 12 $ 29 Production and cost date for the first two years of operations are: Units produced Units sold Year 1 25,000 20,000 Year 2 25,000 30.000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. $ 6 Direct materiala Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($300,000 - 25,000 units) Absorption costing unit product cost 12 5.29 Production and cost data for the first two years of operations are: Units produced Units sold Year 1 25,000 20,000 Year 2 25,000 30,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using variable costing, what is the unit product cost for both years? Unic product cost $ 17 Reg Required 2 > Production and cost data for the first two years of operations are: Units produced Units sold Year 1 25,000 20,000 Year 2 25,000 30,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the variable costing net operating income in Year 1 and in Year 2? (Loss amounts should be indicated with a minus sign.) Year 1 Year 2 Net operating income (loss) Production and cost data for the first two years of operations are: Units produced Units sold Year 1 25,000 20,000 Year 2 25,000 30,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Reconcile the absorption costing and the variable costing net operating income figures for each year. Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable conting not operating income 468) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income