Question

During Heaton Companys first two years of operations, the company reported the absorption costing income statement as follows: The companys manufacturing cost per unit under

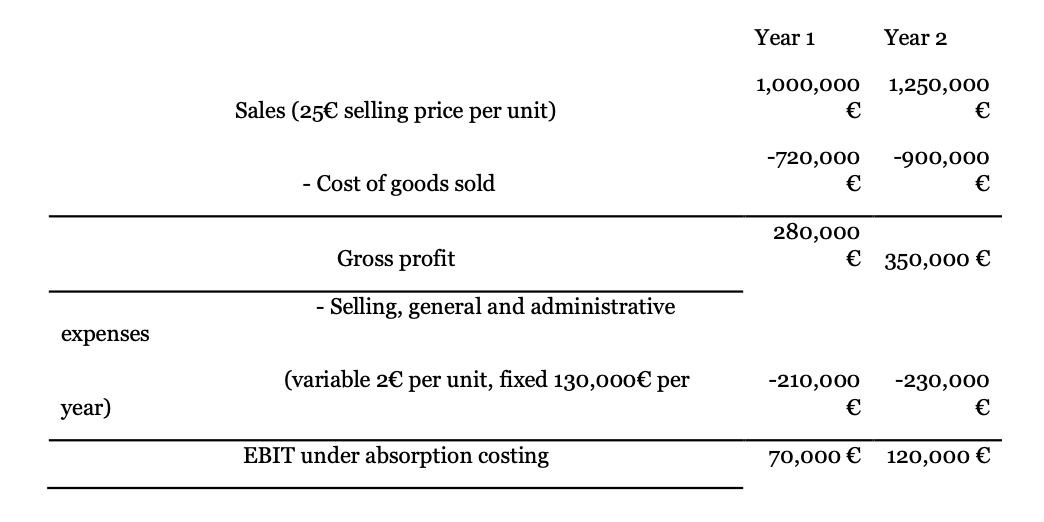

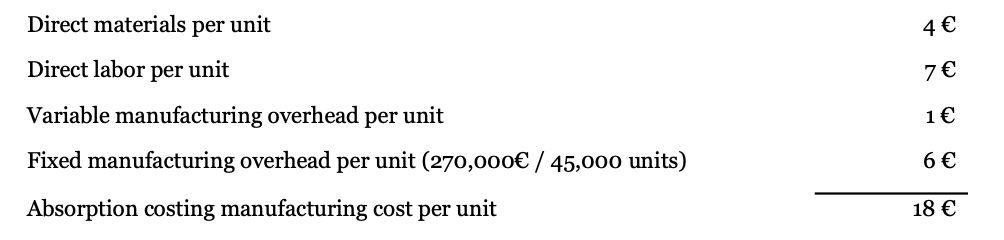

During Heaton Companys first two years of operations, the company reported the absorption costing income statement as follows:

The companys manufacturing cost per unit under absorption costing for both years is computed as follows:

Production and sales data for the two years are:

| year 1 | year 2 | |

| units produced | 45,000 | 45,000 |

| units sold | 40,000 | 50,000 |

Note: Initial inventory of finished goods for year 1 is zero as it is the first year of operations. WIP inventories are not considered (i.e., initial and ending WIP inventories are always set to zero).

Prepare a variable costing contribution margin income statement for each year (show all the intermediate computations required to obtain all the figures in the statement)

\begin{tabular}{|c|c|c|c|} \hline & & Year 1 & Year 2 \\ \hline & & 1,000,000 & 1,250,000 \\ \hline & Sales ( 25 selling price per unit) & & \\ \hline & & 720,000 & 900,000 \\ \hline & - Cost of goods sold & & \\ \hline & & 280,000 & \\ \hline & Gross profit & & 350,000 \\ \hline & - Selling, general and administrative & & \\ \hline & (variable 2 per unit, fixed 130,000 per & 210,000 & 230,000 \\ \hline year) & & & \\ \hline & EBIT under absorption costing & 70,000 & 120,000 \\ \hline \end{tabular} \begin{tabular}{lc} Direct materials per unit & 4 \\ Direct labor per unit & 7 \\ Variable manufacturing overhead per unit & 1 \\ Fixed manufacturing overhead per unit (270,0oo / 45,00o units) & 6 \\ Absorption costing manufacturing cost per unit & 18 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started