Answered step by step

Verified Expert Solution

Question

1 Approved Answer

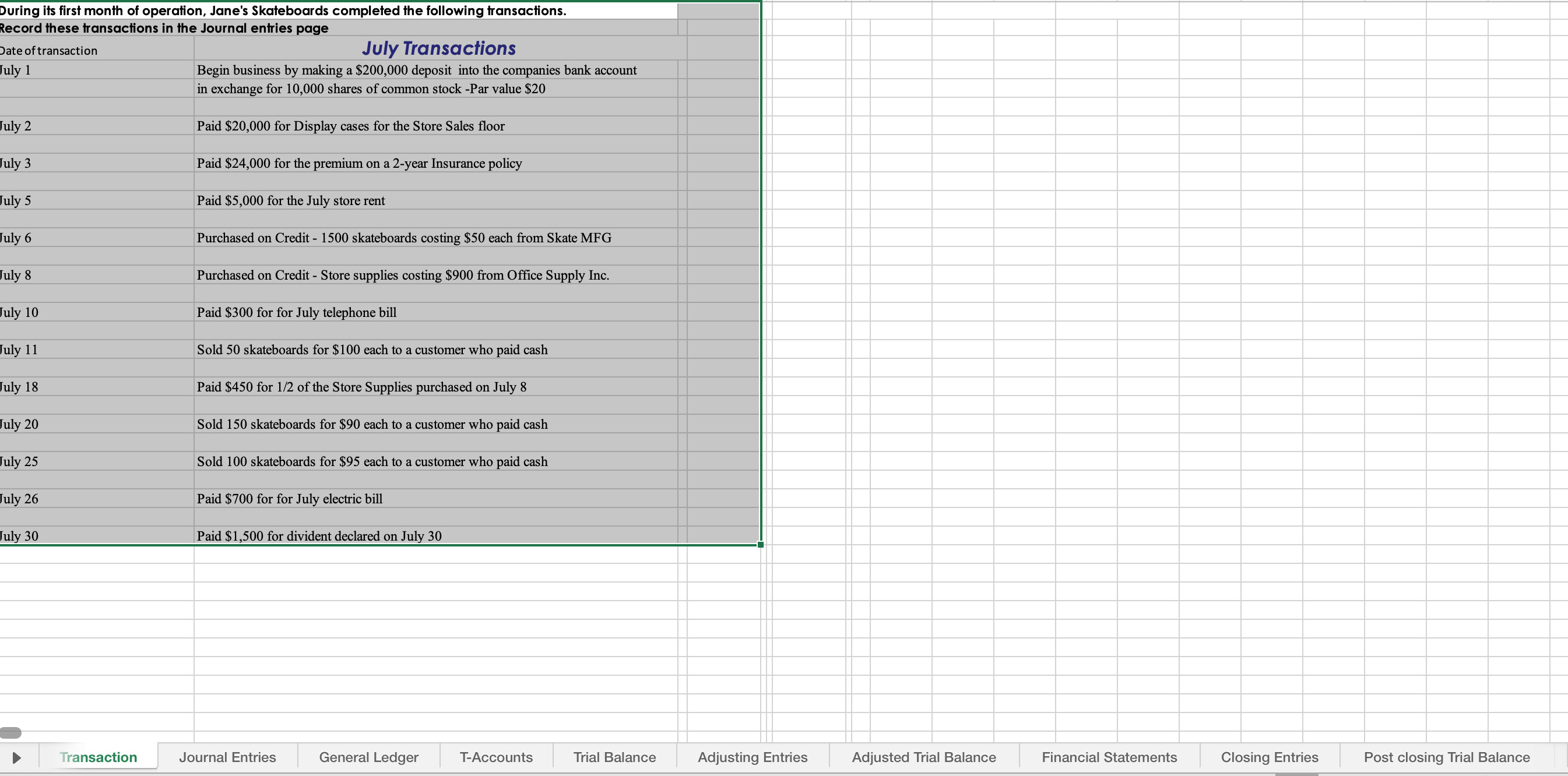

During its first month of operation, Jane's Skateboards completed the following transactions. Record these transactions in the Journal entries page Date of transaction July 1

During its first month of operation, Jane's Skateboards completed the following transactions.

Record these transactions in the Journal entries page

Date of transaction

July

July

July

July

July

July

July

July

July

July

July

July

July

July Transactions

Begin business by making a $ deposit into the companies bank account

in exchange for shares of common stock Par value $

Paid $ for Display cases for the Store Sales floor

Paid $ for the premium on a year Insurance policy

Paid $ for the July store rent

Purchased on Credit skateboards costing $ each from Skate MFG

Purchased on Credit Store supplies costing $ from Office Supply Inc.

Paid $ for for July telephone bill

Sold skateboards for $ each to a customer who paid cash

Paid $ for of the Store Supplies purchased on July

Sold skateboards for $ each to a customer who paid cash

Sold skateboards for $ each to a customer who paid cash

Paid $ for for July electric bill

Paid $ for divident declared on July

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started