Answered step by step

Verified Expert Solution

Question

1 Approved Answer

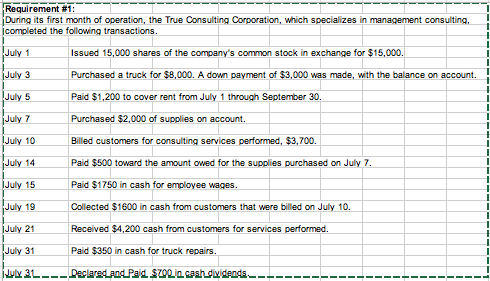

During its first month of operation, the True Consulting Corporation, which specializes in management consulting, complete the following transactions. prepare adjusting entries using the following

During its first month of operation, the True Consulting Corporation, which specializes in management consulting, complete the following transactions. prepare adjusting entries using the following information in the general journal below . show your calculations.. Requirement 8 and 9 ,please review it and make any corrections needed

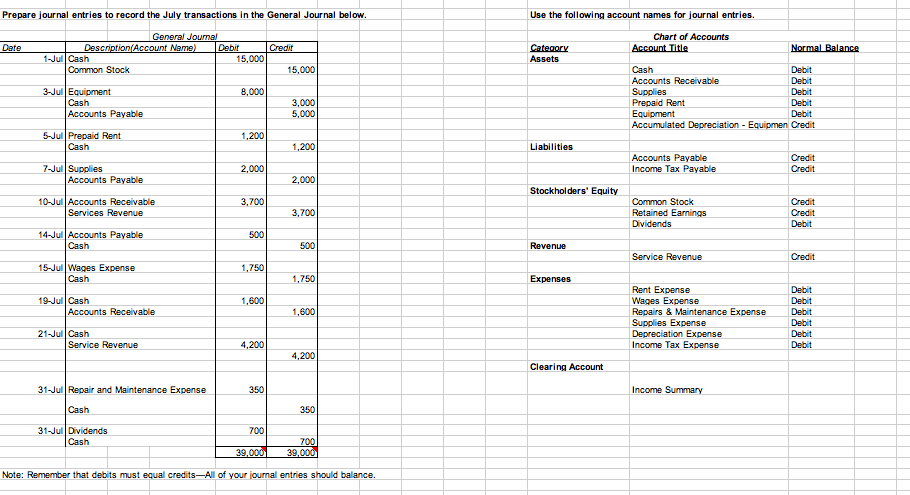

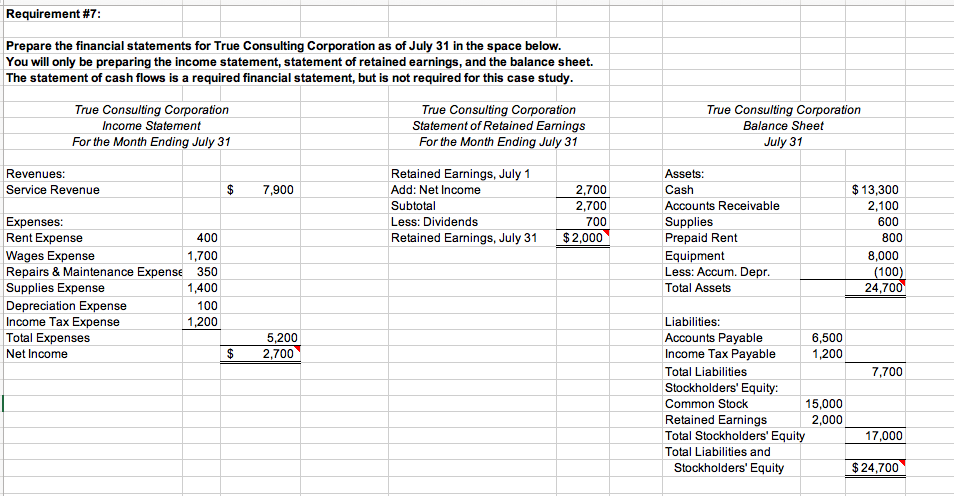

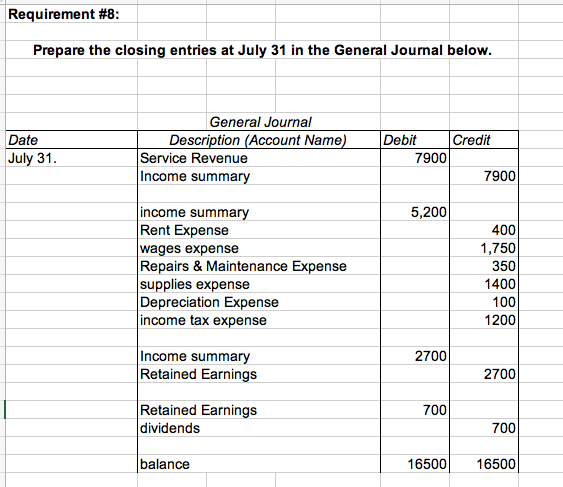

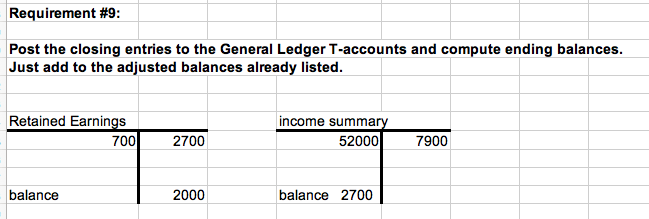

Requirement #11 : During its first month of operation, the True Consulting Corporation, which specializes in management consulting. icompleted the following transactions. July 1 Issued 15,000 shares of the company's common stock in exchange for $15,000. IJuly 3 Purchased a truck for $8,000. A down payment of $3,000 was made, with the balance on account. July 5 Paid $1,200 to cover rent from July 1 through September 30. July 7 Purchased $2,000 of supplies on account. IJuly 10 Billed customers for consulting services performed, $3,700. July 14 Paid $500 toward the amount owed for the supplies purchased on July 7. IJuly 15 Paid $1750 in cash for employee wages. July 19 Collected $1600 in cash from customers that were billed on July 10. IJuly 21 Received $4,200 cash from customers for services performed. July 31 Paid $350 in cash for truck repairs. July 31 _ Declaredand Paid szoo in cash dividends. Prepare journal entries to record the July transactions in the General Journal below. Use the following account names for journal entries. Note: Remember that debits must equal credits_All of your iournal entries should balance. Requirement \#7: Prepare the financial statements for True Consulting Corporation as of July 31 in the space below. You will only be preparing the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is a required financial statement, but is not required for this case study. Requirement \#8: Prepare the closing entries at July 31 in the General Journal below. Requirement \#9: Post the closing entries to the General Ledger T-accounts and compute ending balances. Just add to the adjusted balances already listed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started