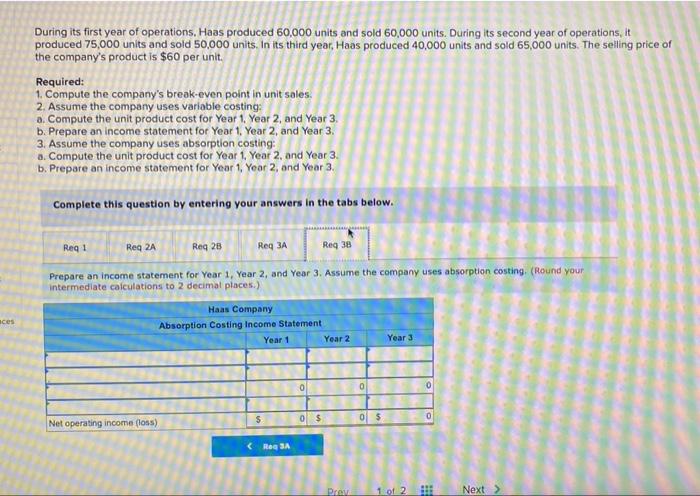

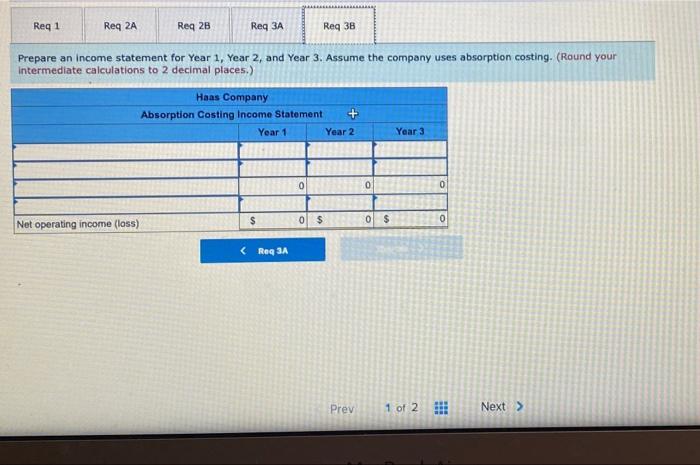

During its first year of operations. Haas produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of the company's product is $60 per unit. Required: 1. Compute the company's break-even point in unit sales. 2. Assume the company uses variable costing a. Compute the unit product cost for Year 1. Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 3. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1 Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Req 3A Reg 38 Prepare an income statement for Year 1 Year 2, and Year 3. Assume the company uses absorption costing, (Round your intermediate calculations to 2 decimal places.) aces Haas Company Absorption Costing Income Statement Year 1 Year 2 Year 3 0 0 0 $ 0 $ 05 0 Net operating income foss) Reg 1 Reg 2A Req 2B Reg 3A Reg 3B Prepare an income statement for Year 1, Year 2, and Year 3. Assume the company uses absorption costing. (Round your Intermediate calculations to 2 decimal places.) Haas Company Absorption Costing Income Statement Year 1 Year 2 Year 3 0 0 0 $ 0 0 $ $ Net operating income (loss) 0 During its first year of operations. Haas produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of the company's product is $60 per unit. Required: 1. Compute the company's break-even point in unit sales. 2. Assume the company uses variable costing a. Compute the unit product cost for Year 1. Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 3. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1 Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Req 3A Reg 38 Prepare an income statement for Year 1 Year 2, and Year 3. Assume the company uses absorption costing, (Round your intermediate calculations to 2 decimal places.) aces Haas Company Absorption Costing Income Statement Year 1 Year 2 Year 3 0 0 0 $ 0 $ 05 0 Net operating income foss) Reg 1 Reg 2A Req 2B Reg 3A Reg 3B Prepare an income statement for Year 1, Year 2, and Year 3. Assume the company uses absorption costing. (Round your Intermediate calculations to 2 decimal places.) Haas Company Absorption Costing Income Statement Year 1 Year 2 Year 3 0 0 0 $ 0 0 $ $ Net operating income (loss) 0