Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During its first year of operations, Turning Leaves Furniture Restoration earned net credit sales of $372,000. Industry experience suggests that bad debts will amount

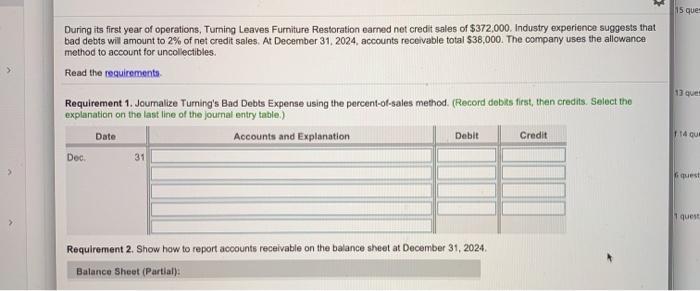

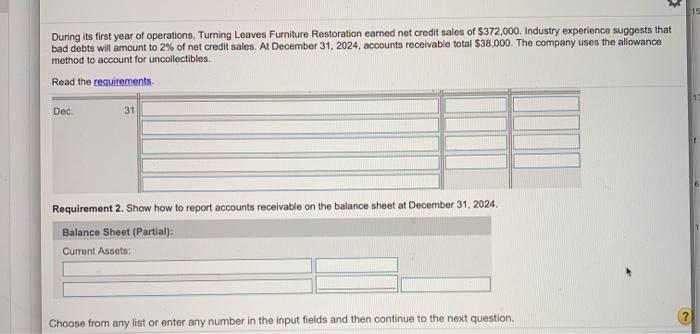

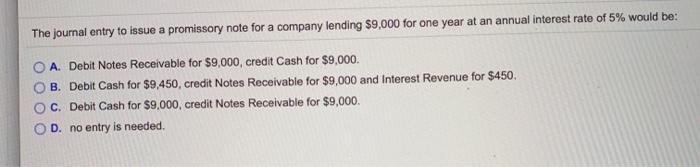

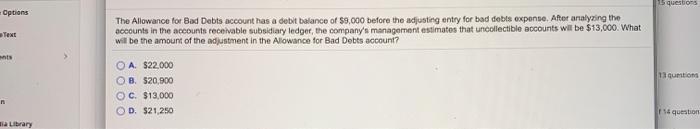

During its first year of operations, Turning Leaves Furniture Restoration earned net credit sales of $372,000. Industry experience suggests that bad debts will amount to 2% of net credit sales. At December 31, 2024, accounts receivable total $38,000. The company uses the allowance method to account for uncollectibles. Read the requirements. Requirement 1. Joumalize Turning's Bad Debts Expense using the percent-of-sales method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Accounts and Explanation Dec. Date 31 Debit Requirement 2. Show how to report accounts receivable on the balance sheet at December 31, 2024. Balance Sheet (Partial): Credit 15 ques 13 ques 114 que 6 quest 1 quest During its first year of operations, Turning Leaves Furniture Restoration earned net credit sales of $372,000. Industry experience suggests that bad debts will amount to 2% of net credit sales. At December 31, 2024, accounts receivable total $38,000. The company uses the allowance method to account for uncollectibles. Read the requirements. Dec. 31 Requirement 2. Show how to report accounts receivable on the balance sheet at December 31, 2024. Balance Sheet (Partial): Current Assets: Choose from any list or enter any number in the input fields and then continue to the next question. S 15 The journal entry to issue a promissory note for a company lending $9,000 for one year at an annual interest rate of 5% would be: A. Debit Notes Receivable for $9,000, credit Cash for $9,000. B. Debit Cash for $9,450, credit Notes Receivable for $9,000 and Interest Revenue for $450. C. Debit Cash for $9,000, credit Notes Receivable for $9,000. D. no entry is needed. Options Text ents ia Library The Allowance for Bad Debts account has a debit balance of $9,000 before the adjusting entry for bad debts expense. After analyzing the accounts in the accounts receivable subsidiary ledger, the company's management estimates that uncollectible accounts will be $13,000. What will be the amount of the adjustment in the Allowance for Bad Debts account? OA. $22.000 OB. $20,900 OC. $13,000 OD. $21,250 15 questions 13 questions f 14 question

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

2 Answer 1 10 11 12 15 Turning Leaves Furniture Accounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started