Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During its fiscal year ended December 31, Year 1, transactions associated with the activities listed below occurred for the City of Barton. Prepare appropriate

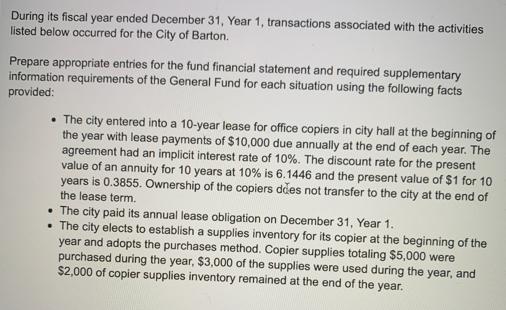

During its fiscal year ended December 31, Year 1, transactions associated with the activities listed below occurred for the City of Barton. Prepare appropriate entries for the fund financial statement and required supplementary information requirements of the General Fund for each situation using the following facts provided: The city entered into a 10-year lease for office copiers in city hall at the beginning of the year with lease payments of $10,000 due annually at the end of each year. The agreement had an implicit interest rate of 10%. The discount rate for the present value of an annuity for 10 years at 10% is 6.1446 and the present value of $1 for 10. years is 0.3855. Ownership of the copiers does not transfer to the city at the end of the lease term. The city paid its annual lease obligation on December 31, Year 1. The city elects to establish a supplies inventory for its copier at the beginning of the year and adopts the purchases method. Copier supplies totaling $5,000 were purchased during the year, $3,000 of the supplies were used during the year, and $2,000 of copier supplies inventory remained at the end of the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To record the transactions associated with the City of Bartons General Fund for the fiscal year ende...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started