Question

During its useful life, the machine is expected to be used for 10,000 hours. Actual annual use is as follows: 1,300 hours in 2024;

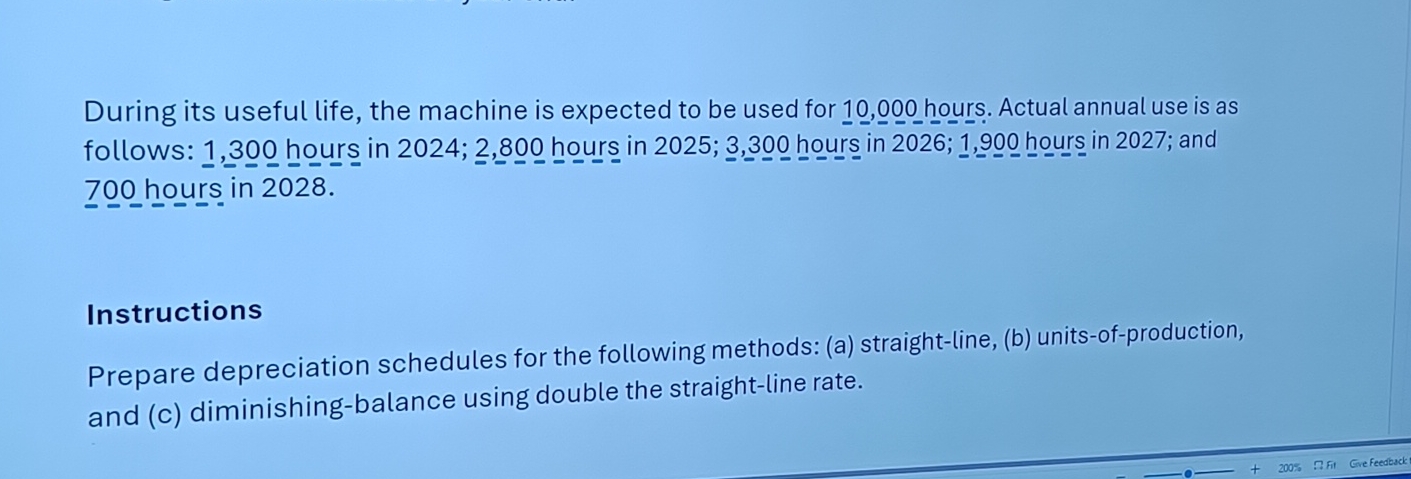

During its useful life, the machine is expected to be used for 10,000 hours. Actual annual use is as follows: 1,300 hours in 2024; 2,800 hours in 2025; 3,300 hours in 2026; 1,900 hours in 2027; and 700 hours in 2028. Instructions Prepare depreciation schedules for the following methods: (a) straight-line, (b) units-of-production, and (c) diminishing-balance using double the straight-line rate. 200% Fit Give Feedback

Step by Step Solution

There are 3 Steps involved in it

Step: 1

lets calculate depreciation schedules for the machine using the given methods a StraightLine Depreci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial And Managerial Accounting

Authors: Donald E. Kieso, Paul D. Kimmel, Jerry J. Weygandt

1st Edition

9781118004234, 111800423x

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App