Answered step by step

Verified Expert Solution

Question

1 Approved Answer

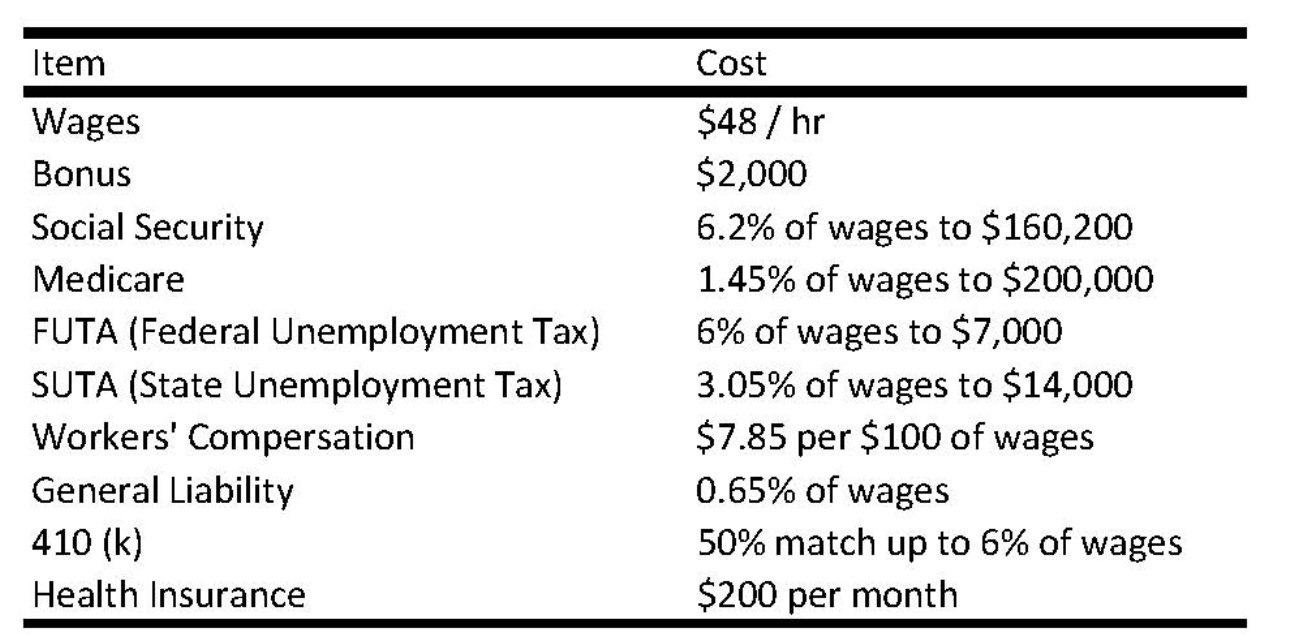

During last year, the average carpenter works 40 hours per week for 50 weeks (no overtime work hour) and receives 10 paid days off (based

During last year, the average carpenter works 40 hours per week for 50 weeks (no overtime work hour) and receives 10 paid days off (based on 2 weeks of regular work hours) for vacation. The employees health insurance is paid for entirely by the employer. Assuming that the employee takes full advantage of the 401(k) benefit, determine the total average hourly cost (including all burden markups shown in the table) for the carpenter:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started