Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During March, the following transactions/events were reported by Jerico Company that uses job-order costing for its product costing purpose: Depreciation on production machines and equipment,

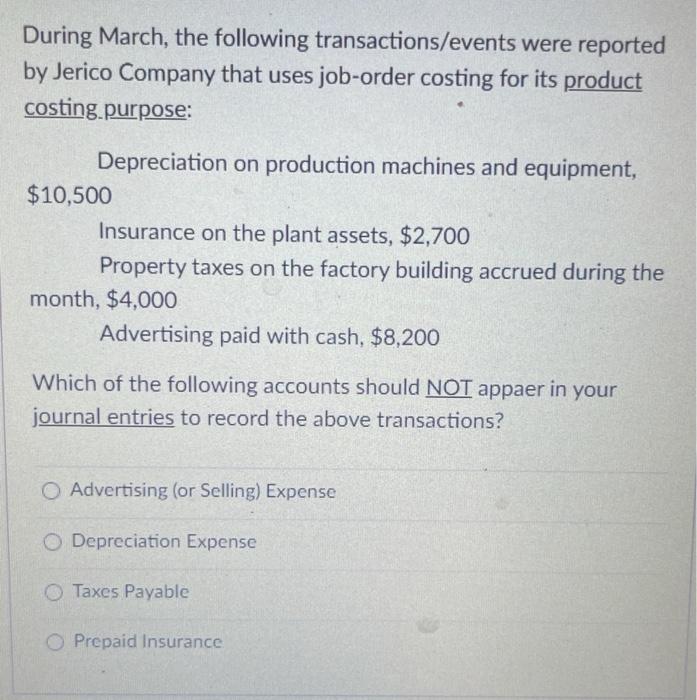

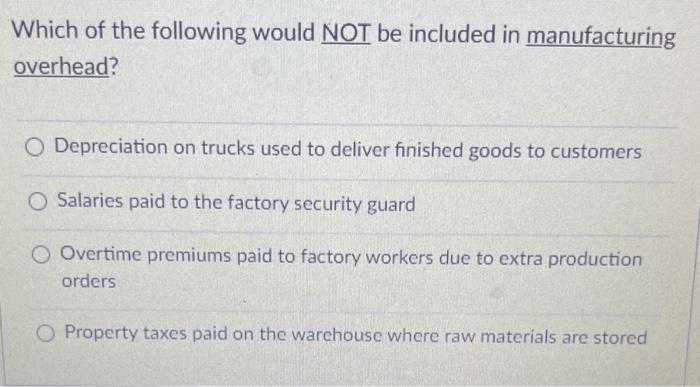

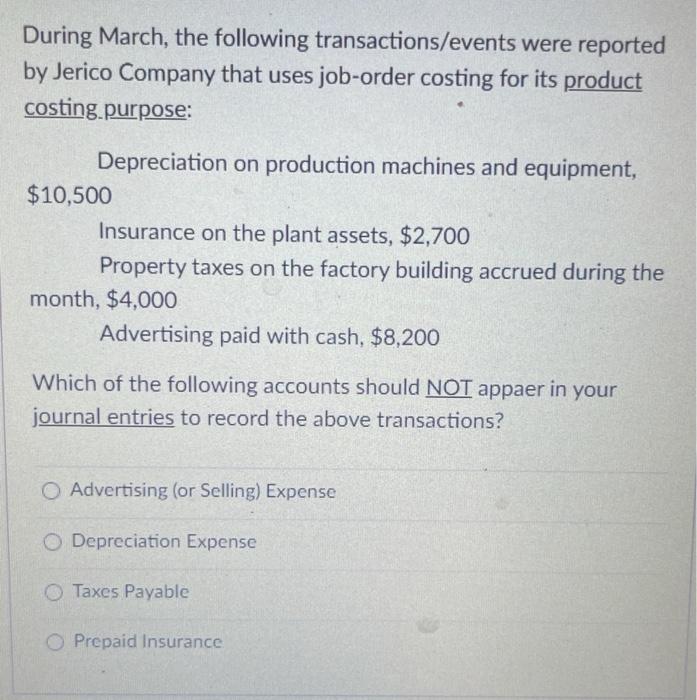

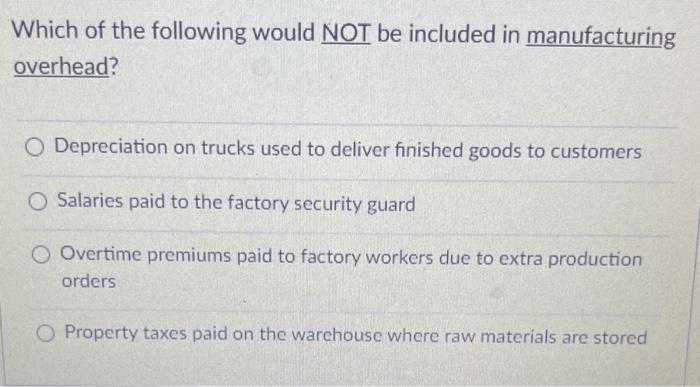

During March, the following transactions/events were reported by Jerico Company that uses job-order costing for its product costing purpose: Depreciation on production machines and equipment, $10,500 Insurance on the plant assets, $2,700 Property taxes on the factory building accrued during the month, $4,000 Advertising paid with cash, $8,200 Which of the following accounts should NOT appaer in your journal entries to record the above transactions? Advertising (or Selling) Expense Depreciation Expense Taxes Payable O Prepaid Insurance Which of the following would NOT be included in manufacturing overhead? O Depreciation on trucks used to deliver finished goods to customers Salaries paid to the factory security guard O Overtime premiums paid to factory workers due to extra production orders O Property taxes paid on the warehouse where raw materials are stored

During March, the following transactions/events were reported by Jerico Company that uses job-order costing for its product costing purpose: Depreciation on production machines and equipment, $10,500 Insurance on the plant assets, $2,700 Property taxes on the factory building accrued during the month, $4,000 Advertising paid with cash, $8,200 Which of the following accounts should NOT appaer in your journal entries to record the above transactions? Advertising (or Selling) Expense Depreciation Expense Taxes Payable O Prepaid Insurance Which of the following would NOT be included in manufacturing overhead? O Depreciation on trucks used to deliver finished goods to customers Salaries paid to the factory security guard O Overtime premiums paid to factory workers due to extra production orders O Property taxes paid on the warehouse where raw materials are stored

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started