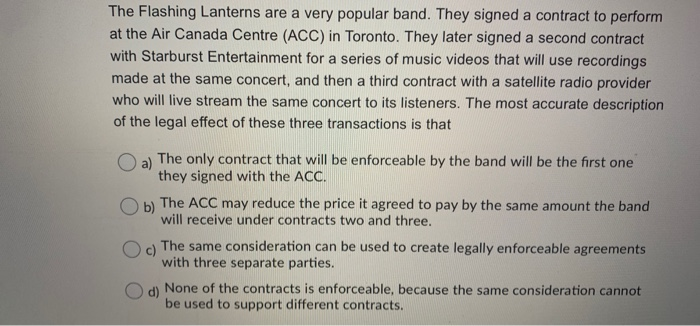

During negotiations to buy a business, the vendor tells you that the business has an excellent relationship with all of its suppliers. This is important to you and with this assurance you buy the business. It turns out that this statement was untrue. The false statement would best be described as a) Fraudulent misrepresentation. Ob) A contractual statement. c) Innocent misrepresentation. d) A pre-contractual representation. The postal or post-box rule applies to Oa) offers. b) acceptances. c) rejections. d) revocations. Sadly, Jasper, who had a substantial life insurance policy that named his spouse Becky as beneficiary, was killed in a car accident. After Jasper's death, the insurance company tried to deny paying the insurance to Becky, claiming that Jasper had misled them at the time he applied for life insurance by failing to disclose a pre-existing heart condition that only became evident when an autopsy was performed following Jasper's death. Becky knows that at the time Jasper applied for the insurance five years ago, he would not have been aware that he had a heart condition. In this situation, Becky will be considered a party to the contract because spouses always have the a) exact contractual rights and obligations as each other. will be able to sue the insurance company because provincial insurance b) statutes recognize the equitable interests of beneficiaries like Becky and grant them the right to sue. will not have any legal status to sue the insurance company because of privity of contract. d) will never win a lawsuit against a sophisticated business like an insurance company When you apply for insurance You have a common law duty of utmost good faith and a statutory duty to disclose risk situations to the insurance company. Ob) Getting the insurance agent to fill in the application form on your behalf will protect you from any claim that you have misrepresented the risks. c) There is a common law duty on the insurance company to check on the validity of your disclosures before accepting you as a customer, and once they have done so you are protected from a claim for misrepresentation. O d) It is legally acceptable for you not to disclose certain risks, if disclosure would result in a premium that is more than you can afford. The Flashing Lanterns are a very popular band. They signed a contract to perform at the Air Canada Centre (ACC) in Toronto. They later signed a second contract with Starburst Entertainment for a series of music videos that will use recordings made at the same concert, and then a third contract with a satellite radio provider who will live stream the same concert to its listeners. The most accurate description of the legal effect of these three transactions is that O a) The only contract that will be enforceable by the band will be the first one they signed with the ACC. b) The ACC may reduce the price it agreed to pay by the same amount the band will receive under contracts two and three. c) The same consideration can be used to create legally enforceable agreements with three separate parties. d) None of the contracts is enforceable, because the same consideration cannot be used to support different contracts