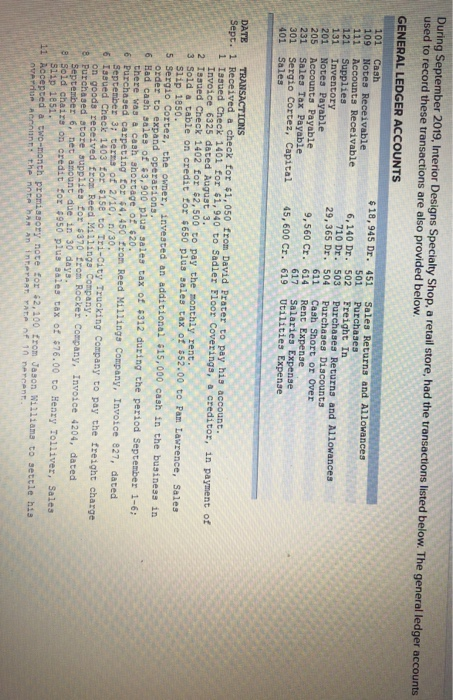

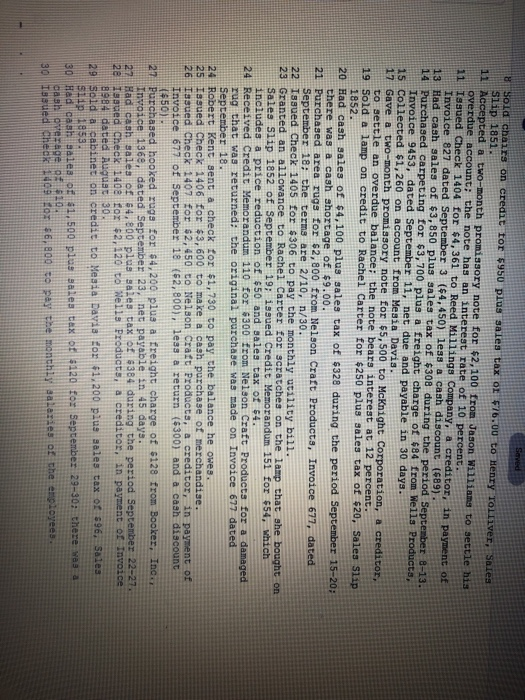

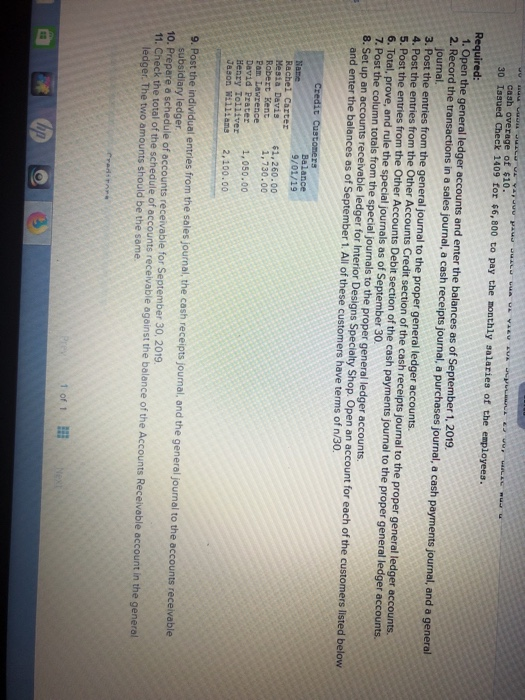

During September 2019, Interior Designs Specialty Shop, a retail store, had the transactions listed below. The general ledger accounts used to record these transactions are also provided below GENERAL LEDGER ACCOUNTS $18,945 Dr. 451 Sales Returns and Allowances 101 Cash 109 Notes Receivable 111 Accounts Receivable 121 Supplies 131 Inventory 201 Notes Payable 205 Accounts Payable 231 Sales Tax Payable 301 Sergio Cortez, Capital 45, 600 Cr. 619 Utilities Expense 401 Sales 501 Purchases 6,140 Dr. 502 Freight In 710 Dr. 503 Purchases Returns and Allowances 29, 365 Dr. 504 Purchases Discounts 611 Cash Short or Over 9,560 Cr. 614 Rent Expense 617 Salaries Expense DATE TRANSACTIONS Sept. 1 Received a check for $1,050 from David Prater to pay his account. 1 Issued Check 1401 for 61,940 to Sadler Floor Coverings, a creditor, in payment of Invoice 6325 dated August 3. 2 Issued Check 1402 for $2,500 to pay the monthly rent 3 Sold a table on credit for $650 plus sales tax o 52.00 to Pam Lawrence, Sales 5 Sergio Cortez, the owner, invested an additional 15, 000 cash in the business in 6 Had cash saies of 3,900 plus sales tax of 312 during the period Septenbez 1-6: 6 Purchased carpeting for 4,450 from Reed Millings Company, Invoice 827, dated 6 fasues Chesk 13 TO 215e t tri-Caty trucking Company to pay the treight charge 8. Purchased store supplies for 370 from Rocker Company, Invoice 4204, dated 8 Sold chaire on credit for 6950 plus sales tax of 76.00 to Henzy Tolliver, Sales Slip 1850 ozder to expand operations. chere was a cash shortage of 20. September 3; terms of 2/10, n/30. September , net amount due in 30 days. s1ip 1851. epted a two-month promissory note for 2,100 trom Jason Wi111ama to settle his 11 Accepted a two-month promissory note for $2,100 from Jason Wi11ians to settle his 1 Issued Check 1404 for $4,361 to Reed Miilings Company, a creditor, in payment of 13 Had cash sales of $3,850 plus sales tax of $308 during the period September 8-13 Slip 1851. overdue account: the note has an interest rate of 10 percent. Invoice 827 dated September 3 ($4,450) less a cash discount (89). Invoice 9453, dated September 11, net due and payable in 30 days. ged carpeting for 3,700 plus a freight charge of $84 from Wells Products, 15 Collected $1,260 on account from Mesia Davis. 17 Gave a two-month promissory not e for ss, 500 to Mcknight Corporation, a creditor, 19 Sold a lamp on credit to Rachel Carter for $250 plus sales tax of $20, Sales S 20 Had cash sales of $4,100 plus sales tax of $328 during the period September 15-20: 21 Purchased area rugs for $2,800 from Nelson Craft Products, Invoice 677, dated to settle an overdue balance: the note bears interest at 12 percent. 1852 there was a cash shortage of $9.00. September 18: the terms are 2/10, n/30. 1ip 22 Issued Check 1405 for $306 to pay the monthly utility bill 23 Granted an allowance to Rachel Carter for scratches on the lamp that she bought on Sales Slip 1852 of September 19: issued Credit Memorandum 151 for $54, which includes a price re tion of 450 and sales tax of 24 Received Credit Memorandum 110 for 300 from Nelson Craft Products for a damaged rug that was returned: the original purchase was made on Invoice 677 dated September 18. 24 Robert Kent sent a check for $1,730 to pay the balance he owes 25 Issued Check 1406 for 3,600 to make a cash purchase of merchandise 26 Tasued Check 1407 for $2,450 to Nelson Craft Products, a creditor, in payment of Invoice 677 of September 18 (2,800), less a return (300) and a cash discount (450) 27 Purchased hooked zugs for $4, 200 plus a freight charge of $128 from Booker, Inc 27 Had cash sales of s4, 800 plus sakes tax of 4384 during the period September 22-27 29 sold acabinet on credit to Mesia Daria for 41,200 plus sales tax Invoice 1368, dated September 23, net payable in 45 days 22 Isaued Check 1402 tox $2,120 to Nells Froducts, a creditor, in payment of Invoice f 96 Sales Hed cash aaiea oE 41. 500 plus salea cash overage 9 620 cash overage of $10. 30 Issued Check 1409 for $6,800 to pay the monthly salaries of the employees. 1. Open the general ledger accounts and enter the balances as of September 1, 2019. 2. Record the transactions in a sales journal, a cash receipts journal, a purchases journal, a cash payments journal, and a general journal. 3. Post the entries from the general journal to the proper general ledger accounts. 4. Post the entries from the Other Accounts Credit section of the cash receipts journal to the proper general ledger accounts. 5. Post the entries from the Other Accounts Debit section of the cash payments journal to the proper general ledger accounts. 6. Total, prove, and rule the special journals as of September 30 7. Post the column totals from the special journals to the proper general ledger accounts. 8. Set up an accounts receivable ledger for Interior Designs Specialty Shop. Open an account for each of the customers listed below and enter the balances as of September 1. All of these customers have terms of n/30 Robert tea:000 Mesia Davis 1,730.00 David Prater1,050.00 Jason W:114 ams 2,100.00 9. Post the individual entries from the sales journal, the cash receipts journal, and the general journal to the accounts receivable subsidlary ledger 10. Prepare a schedule of accounts receivable for September 30, 2019 11. Check the total of the schedule of accounts receivable against the balance of the Accounts Receivable account in the general ledger. The two amounts should be the same. 1 of 1 ll